Key Takeaways

- Structural decline in LNG demand, regulatory pressures, and limited capital access threaten Cool's revenues, margins, and long-term growth prospects.

- Vessel oversupply and uncertain Asian demand risk lower fleet utilization, pressuring charter rates and future profitability.

- Higher LNG supply and outdated vessel retirements will tighten shipping markets, boosting Cool's charter rates, margin expansion, and long-term revenue stability amid global energy shifts.

Catalysts

About Cool- Acquires, owns, operates, and charters liquefied natural gas carriers (LNGCs).

- The relentless global shift towards renewable energy sources and increasing decarbonization efforts is poised to structurally erode long-term demand for LNG and related shipping services, which will severely pressure Cool's revenues and justify a potential contraction in their multi-year contract backlog as fewer countries commit to LNG as a bridge fuel.

- Intensifying regulatory burdens-such as carbon taxes, more stringent emissions caps, and ambiguous future tariffs on Chinese-leased vessels-will escalate Cool's compliance and operating costs over time, leading to persistent margin compression even as the fleet is modernized.

- Institutional capital is expected to become scarcer for hydrocarbon-centric companies due to harsher ESG criteria, raising the cost of debt refinancing and hampering Cool's ability to undertake newbuild acquisitions or fleet renewals, thus lowering future earnings power.

- A surge in vessel orders during the last cycle has resulted in ongoing vessel oversupply, while the absorption of these assets depends heavily on an uncertain demand pivot from Europe to Asia; if Asian demand does not materialize as expected or if efficiency improvements elsewhere reduce ton-mile demand, Cool's utilization rates and daily charter revenues may deteriorate for years.

- Long-term LNG demand forecasts are at major risk from rising electric vehicle penetration and efficiency gains in major economies, which will likely reduce underlying LNG shipping demand compared to current projections, significantly threatening Cool's top-line growth and the sustainability of their high EBITDA margins.

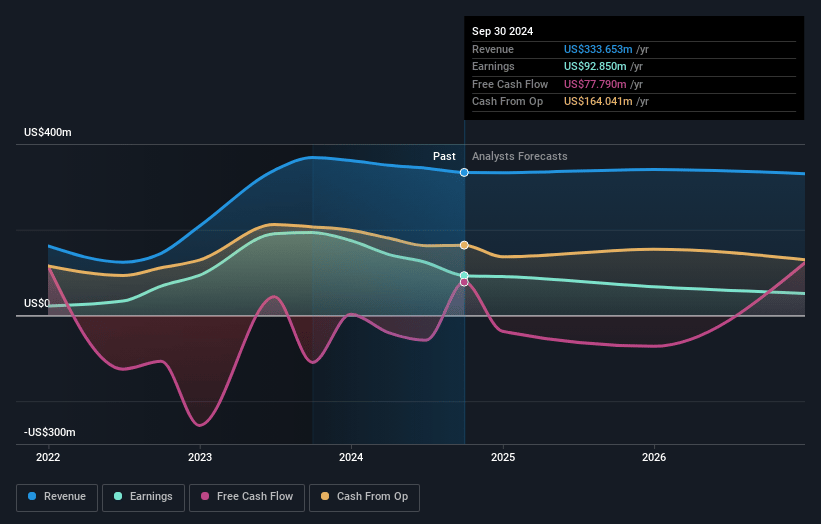

Cool Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cool compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cool's revenue will decrease by 4.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 22.0% today to 9.6% in 3 years time.

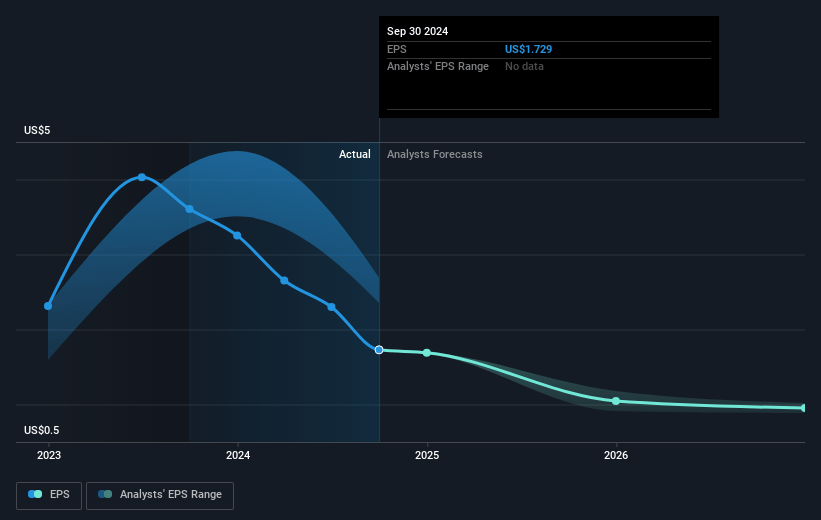

- The bearish analysts expect earnings to reach $27.4 million (and earnings per share of $0.53) by about July 2028, down from $70.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from 5.0x today. This future PE is greater than the current PE for the NO Oil and Gas industry at 7.3x.

- Analysts expect the number of shares outstanding to decline by 1.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.92%, as per the Simply Wall St company report.

Cool Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The projected wave of new LNG supply, with over 20 percent more capacity expected by end of 2026 and further substantial growth through 2028, will require significant shipping capacity, supporting sustained demand for Cool's fleet and potentially boosting revenue, vessel utilization, and charter rates.

- Cool benefits from a large and visible revenue backlog of approximately $1.6 billion, covering up to four and a half years per vessel, which provides resilient revenue streams and reduces earnings volatility through market cycles.

- The ongoing scrapping and retirement of older, less efficient LNG ships, combined with the very limited new LNG carrier ordering in 2025, is set to tighten vessel supply and improve charter market fundamentals, which could increase average charter rates and improve net margins.

- The company's modernization of its fleet, operational efficiencies from recent dry docks, and investment in environmentally upgraded vessels have led to declining vessel operating expenses, providing a continued pathway for margin expansion and stronger EBITDA.

- Structural shifts in global LNG trade, such as longer shipping routes to Asia and the broader role of LNG as a bridge fuel in the energy transition, may drive higher ton-mile demand and longer-term contracts, directly supporting Cool's long-term revenue growth and operating income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cool is NOK60.12, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cool's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK116.85, and the most bearish reporting a price target of just NOK60.12.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $284.1 million, earnings will come to $27.4 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 12.9%.

- Given the current share price of NOK67.9, the bearish analyst price target of NOK60.12 is 12.9% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.