Last Update 11 Sep 25

Fair value Increased 4.72%The analyst price target for Sats has been raised from NOK42.33 to NOK44.33, primarily driven by EchoStar’s major spectrum sales unlocking significant shareholder value, enhancing balance sheet strength, and elevating the market valuation of remaining spectrum assets while also raising competitive risks for industry peers.

Analyst Commentary

- EchoStar’s significant spectrum sales to AT&T and SpaceX/Starlink for $17–23B have unlocked substantial shareholder value, cleared debt, and increased the recognized value of remaining spectrum assets.

- Bullish analysts raised price targets on EchoStar, citing transformative spectrum monetization, enhanced balance sheet strength, after-tax gains, and improved private-market value framework for unsold licenses.

- The SpaceX/Starlink spectrum purchase is seen as a direct threat to Iridium and AST SpaceMobile, heightening execution risks for competitors due to Starlink's aggressive pricing and regulatory ambitions.

- The spectrum sale strengthens AT&T’s mid- and low-band portfolio at a premium price, viewed as a necessary strategic move to maintain network competitiveness.

- The transaction highlights the growing value of spectrum holdings across the sector, prompting re-evaluation of similar assets for peers like ViaSat, but poses headwinds for the tower sector as EchoStar decommissions network elements, increasing churn risk.

What's in the News

- The FCC ended its probe into EchoStar (SATS) following the company’s agreement to sell $17B in wireless spectrum to SpaceX and a separate spectrum deal with AT&T, ceasing scrutiny over network buildout milestones (Bloomberg).

- Starlink (SpaceX) is in discussions to acquire spectrum assets from EchoStar, signaling further partnership or asset sales in the satellite and wireless markets (Bloomberg).

- Disney (DIS) has sued Dish Network (SATS) over new Sling TV packages that allow short-term subscriptions, alleging these offerings breach existing programming distribution agreements and demanding removal of Disney content from non-compliant packages (Variety).

- Prior to the resolution, federal regulators pressured EchoStar to sell portions of its unused AWS-4 wireless spectrum, with the FCC chairman delivering a “best and final” offer to EchoStar management (Bloomberg).

- EchoStar had previously sought debt relief from creditors after halting $326M in bond coupon payments due to FCC investigations that severely restricted corporate financial flexibility; the company holds $25B in debt and $5B in cash, with creditors showing resistance to the requested reprieve (Bloomberg).

Valuation Changes

Summary of Valuation Changes for Sats

- The Consensus Analyst Price Target has risen slightly from NOK42.33 to NOK44.33.

- The Future P/E for Sats has risen slightly from 13.18x to 13.76x.

- The Consensus Revenue Growth forecasts for Sats has risen slightly from 7.1% per annum to 7.3% per annum.

Key Takeaways

- Expansion of premium offerings and scalable group training models supports higher revenue per member and consistency in earnings across diverse markets.

- Effective cost controls and resilient capital return strategies bolster margin stability and long-term shareholder value amid ongoing macroeconomic pressures.

- Rising operating and labor costs, shifting consumer trends, uneven international recovery, and seasonal volatility threaten SATS' margin stability and consistent long-term growth.

Catalysts

About Sats- Provides fitness and training services in Norway, Sweden, Denmark, and Finland.

- Strong growth in total group visits (up 9% YoY) and increased engagement in group training across all markets signals rising demand for high-quality fitness experiences, aligning with global trends of urbanization and a growing middle class in developed and developing regions; this is likely to drive sustained topline revenue growth and improved customer retention.

- Ongoing expansion of premium group training offerings and successful upselling to higher-tier memberships, particularly visible in Sweden's improving yield, should support higher average revenue per member and improved net margins.

- The shift towards systematic investments in group training and new product launches, first proven in Norway and now being rolled out internationally, creates a scalable model for volume and yield growth across the portfolio, likely accelerating EBITDA and earnings consistency over the medium and long term.

- Disciplined cost management and ongoing energy hedging strategies help contain operational cost volatility amid rising input prices (notably labor and energy), supporting stability and gradual expansion of net margins despite macroeconomic pressures.

- Consistent capital returns via dividends and active share buybacks show management confidence in long-term cash flow generation and earnings growth, acting as a support for EPS and total shareholder return in the future.

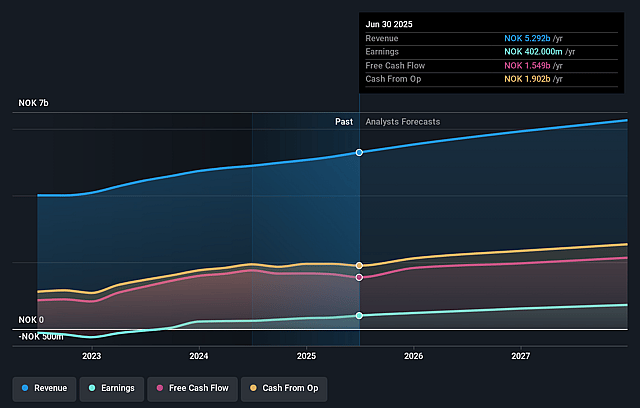

Sats Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sats's revenue will grow by 7.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.6% today to 12.6% in 3 years time.

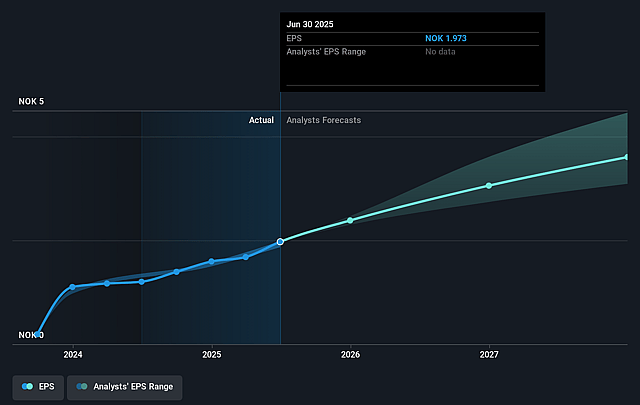

- Analysts expect earnings to reach NOK 821.3 million (and earnings per share of NOK 3.6) by about September 2028, up from NOK 402.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as NOK620 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, down from 18.3x today. This future PE is lower than the current PE for the NO Hospitality industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 1.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.01%, as per the Simply Wall St company report.

Sats Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising labor costs, particularly salary increases outpacing inflation for overhead and operational staff (e.g. developers), could erode SATS' profitability and net margins, given that labor represents a significant portion of the cost base.

- Persistent upward pressure on input costs (such as rent and other operating expenses) beyond normal inflation, combined with necessary strategic investments in group training and product development, may squeeze margins and limit bottom-line growth.

- Reliance on growth from group exercise and upselling premium memberships may face challenges if consumer preferences or market saturation shift, potentially capping revenue growth and impacting longer-term earnings momentum.

- Slow or uneven recovery and earnings development in international markets (e.g. Sweden) highlight the risk that anticipated top-line or margin improvements may be gradual or less pronounced than in the home market, affecting consolidated revenue and profit contributions.

- Weather sensitivity and seasonality in club activity levels introduce volatility and unpredictability in visit growth and revenue, posing a risk to achieving steady long-term earnings targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK42.333 for Sats based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK48.0, and the most bearish reporting a price target of just NOK37.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK6.5 billion, earnings will come to NOK821.3 million, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 10.0%.

- Given the current share price of NOK36.55, the analyst price target of NOK42.33 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.