Narratives are currently in beta

Key Takeaways

- Strategic hires, product innovation, and secular growth drivers are set to enhance AutoStore's market strategy and boost revenue.

- Strong customer retention and a scalable model with high margins support long-term growth and improved earnings potential.

- Challenging market conditions and rising expenses may hinder revenue growth, with regional disparities and delayed payments adding to financial pressures.

Catalysts

About AutoStore Holdings- A robotic and software technology company, provides warehouse automation solutions in Norway, Germany, rest of Europe, the United States, Asia, and internationally.

- The appointment of Keith White as Chief Commercial Officer, with his extensive experience in driving growth at major companies, is expected to enhance AutoStore's go-to-market strategy and bolster revenue growth.

- Product innovation, including new storage solutions and efficiency-enhancing Cube control software, is anticipated to improve customer value propositions, potentially increasing revenue through enhanced sales of advanced systems.

- Secular growth drivers, such as the rise of e-commerce and increasing labor costs, position AutoStore in an expanding market, potentially boosting revenue as these trends continue to unfold.

- A strong existing customer base and data indicating repeat purchases could lead to revenue growth through the successful execution of a land-and-expand strategy, as evidenced by 70% of customers returning for additional orders.

- An efficient go-to-market model with global partners, coupled with high gross margins and sustainable scalability, may lead to improved net margins and earnings as the company capitalizes on market opportunities.

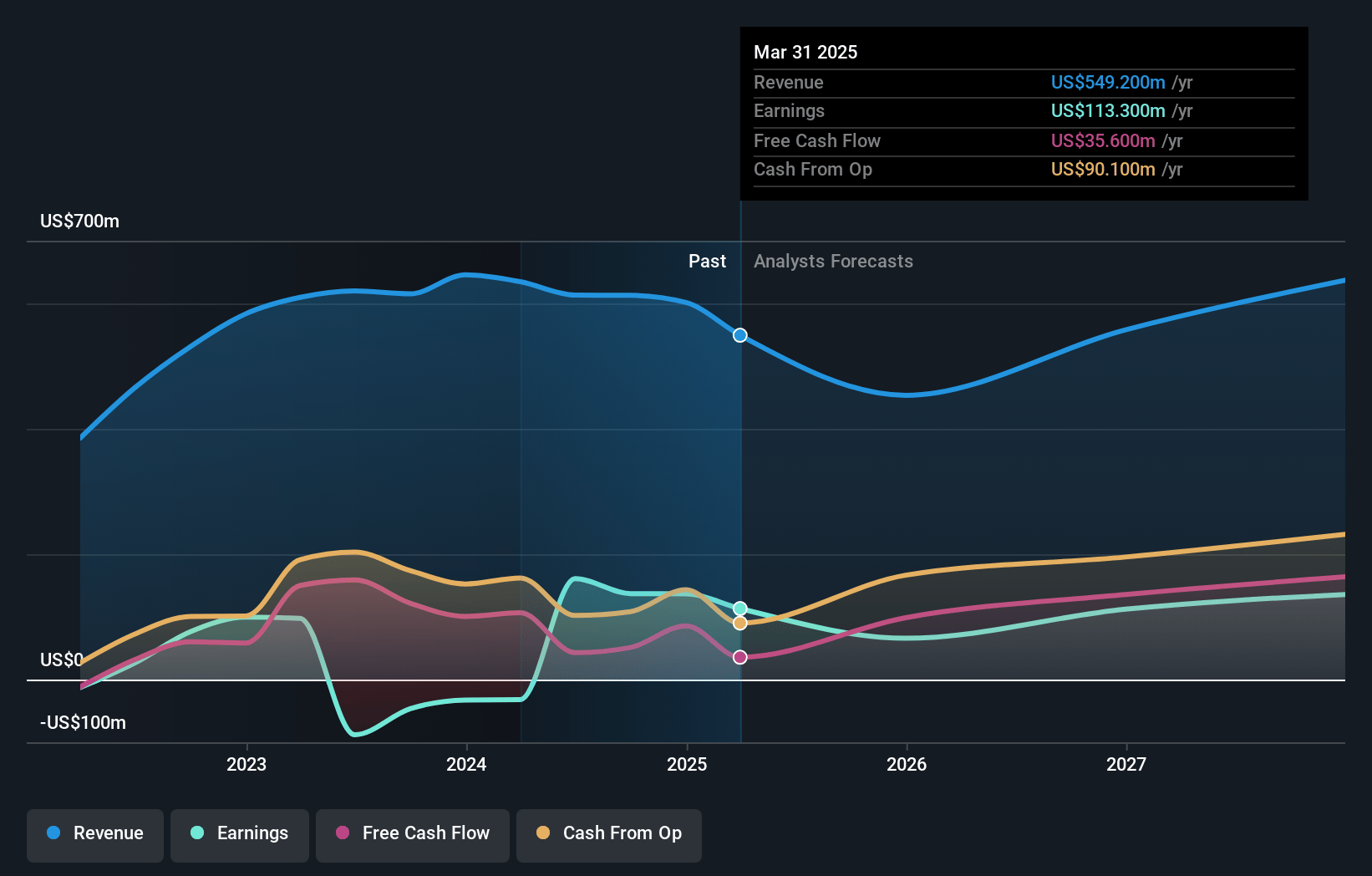

AutoStore Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AutoStore Holdings's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 22.4% today to 23.8% in 3 years time.

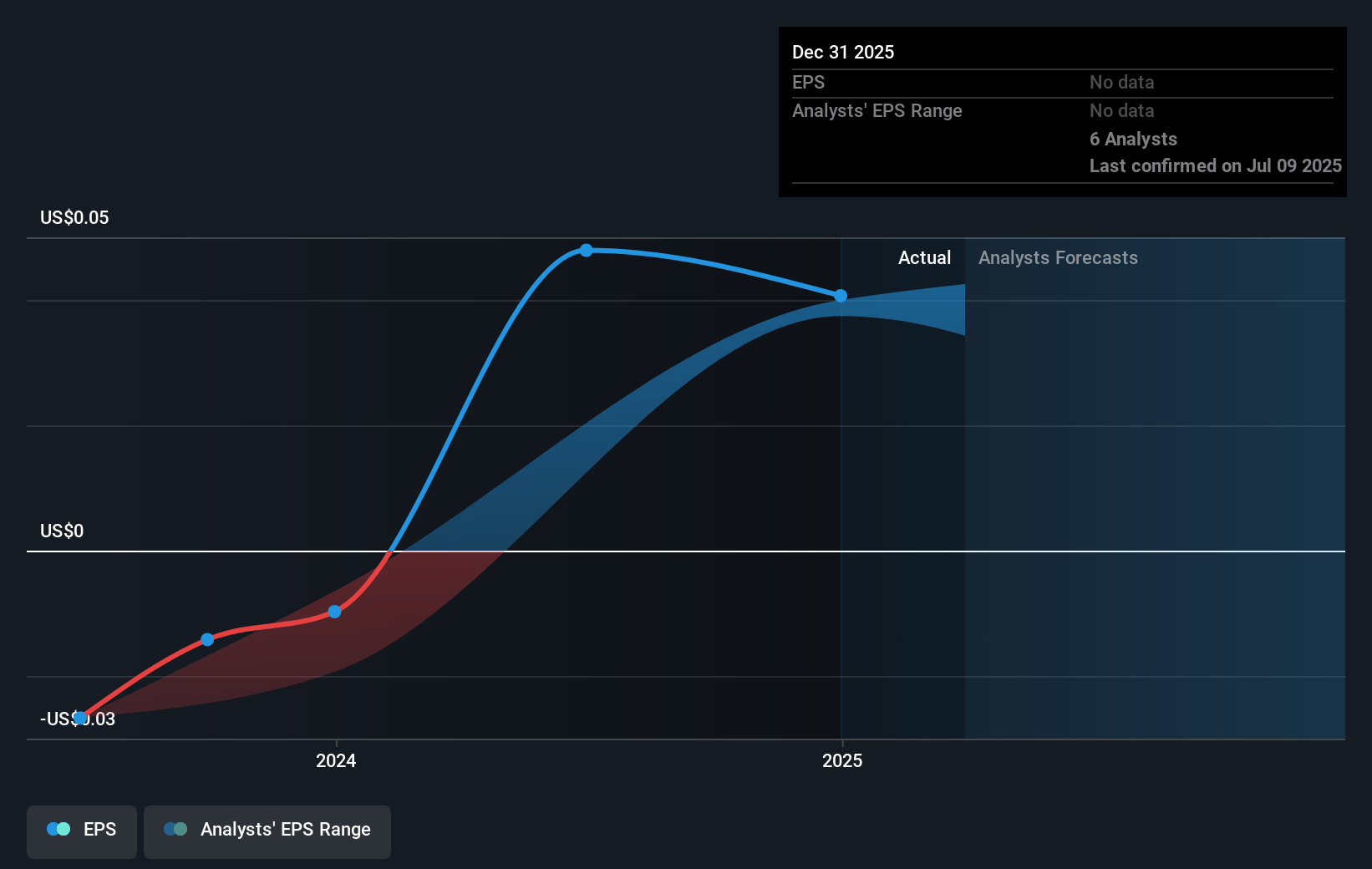

- Analysts expect earnings to reach $174.0 million (and earnings per share of $0.04) by about January 2028, up from $137.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $209 million in earnings, and the most bearish expecting $131.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.8x on those 2028 earnings, up from 22.7x today. This future PE is greater than the current PE for the NO Machinery industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 6.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

AutoStore Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenging market conditions and reduction in order intake year-over-year suggest that the company might face difficulties in achieving its ambitious growth targets. This uncertainty could negatively impact revenue projections.

- Despite the strong financial profile, the current macroeconomic environment and prolonged customer decision-making processes could slow down sales growth, ultimately affecting overall earnings.

- The increase in Days Sales Outstanding (DSO) indicates potential delays in customer payments, which could strain cash flow and impact net margins if not managed efficiently.

- Regional disparities in revenue performance, with stronger results in EMEA and weaker results in North America and APAC, suggest that market dynamics and customer hesitancy may pose risks to consistent revenue growth across all regions.

- Significant growth in operating expenses, up nearly 30% year-over-year due to investment in the business, could pressure margins if revenue growth does not meet expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK13.93 for AutoStore Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK17.43, and the most bearish reporting a price target of just NOK9.57.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $730.9 million, earnings will come to $174.0 million, and it would be trading on a PE ratio of 34.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of NOK10.57, the analyst's price target of NOK13.93 is 24.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives