Narratives are currently in beta

Key Takeaways

- Transition to NXE:3800E and High-NA EUV systems could drive future revenue and earnings through performance benefits and cost reductions.

- Global fab construction and normalized China sales may stabilize revenue, support growth, and reduce geopolitical risks.

- High inventory and low order intake could pressure cash flow, impacting earnings amid reduced growth expectations and a normalized China sales contribution.

Catalysts

About ASML Holding- Develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers.

- The transition of customers to the new NXE:3800E system with higher performance leads to potential revenue growth from higher sales and upgrades. Expected performance improvements and throughput increases will likely boost system sales. This shift can positively impact ASML's future revenue.

- Progress in High-NA EUV technology, demonstrating major performance benefits, offers significant cost reductions for customers. This could drive increased demand for High-NA systems, impacting future earnings, as customers recognize the benefits and increase purchases.

- The AI-driven market recovery presents potential upside in sectors like data centers, supporting future growth in earnings as more advanced semiconductor products are utilized in AI applications.

- The expectation of new fab constructions globally, even amid slower traditional market recovery, presents opportunities for increased sales and revenue as these fabs begin operations and order ASML's equipment in the future.

- The movement towards normalization of China sales and return to historical levels potentially stabilizes revenue streams, reducing geopolitical risks while maintaining a substantial percentage of total revenue, hence impacting net margins due to more predictable sales flows.

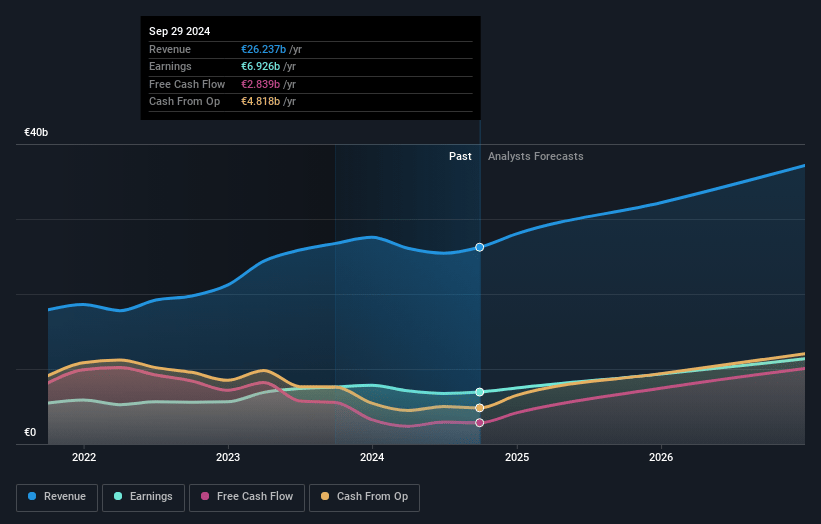

ASML Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ASML Holding's revenue will grow by 15.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.4% today to 34.2% in 3 years time.

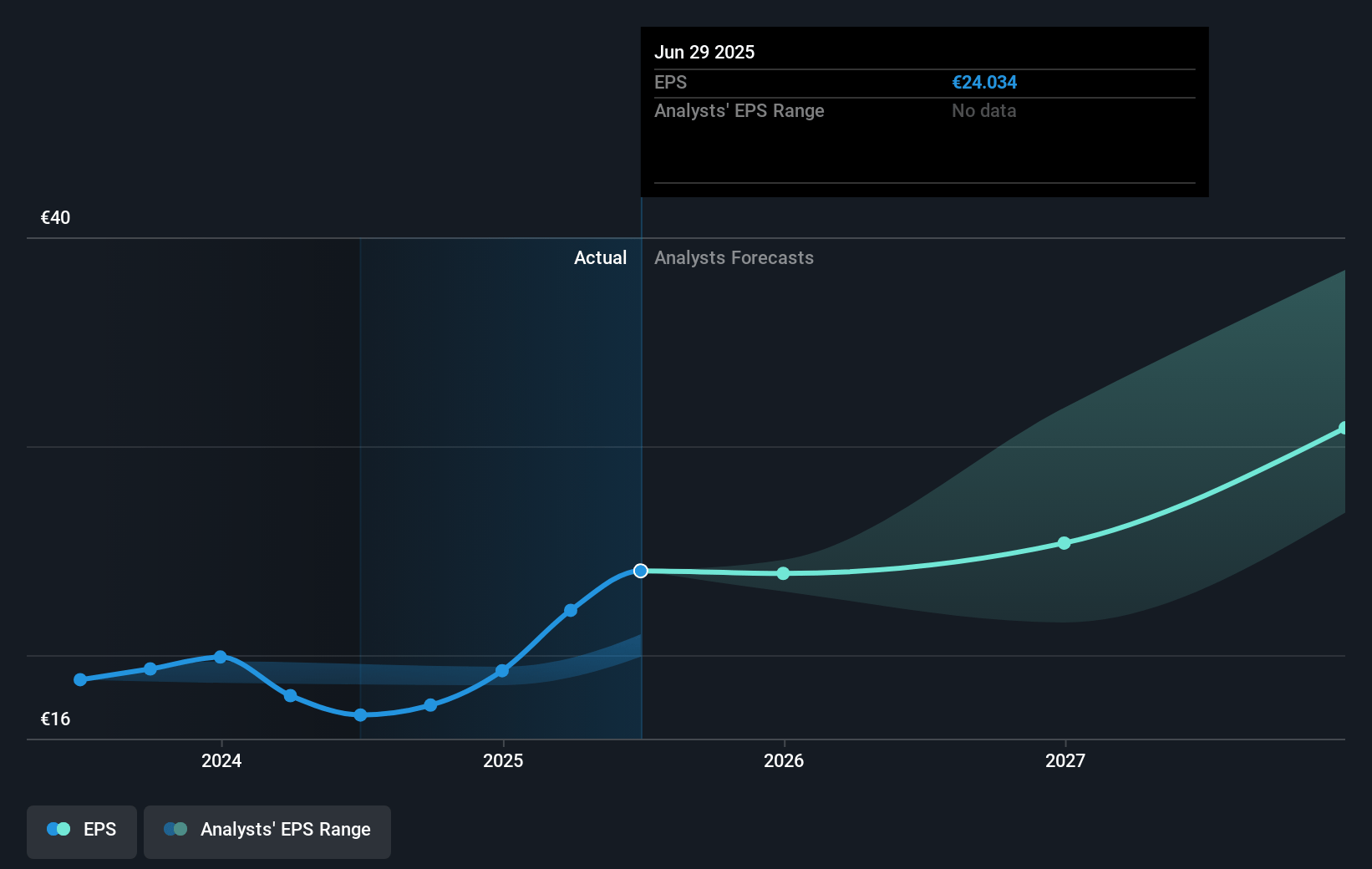

- Analysts expect earnings to reach €13.7 billion (and earnings per share of €36.23) by about January 2028, up from €6.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €9.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.3x on those 2028 earnings, down from 38.5x today. This future PE is lower than the current PE for the GB Semiconductor industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 1.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.54%, as per the Simply Wall St company report.

ASML Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The relatively low level of order intake, as well as high inventory levels, could pressure ASML's free cash flow, impacting earnings and cash flow forecasts.

- The slowdown in recovery of traditional end markets like mobile and PC, coupled with specific competitive foundry dynamics, has resulted in a slower ramp of new nodes, reducing revenue growth expectations.

- The projection for China sales is expected to normalize at around 20% of total revenue for 2025, which is a significant decrease and could result in a lower revenue contribution from this region.

- The large reduction in expected Low-NA shipments and a less favorable product mix have led to a downward revision in ASML's gross margin expectations for 2025, which could lower profitability.

- Continued cautiousness and investment pushouts among customers, particularly in Logic and Memory segments, have prompted a reduced growth curve into 2025, potentially impacting revenue and future market expansion plans.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €847.1 for ASML Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €1057.0, and the most bearish reporting a price target of just €675.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €40.2 billion, earnings will come to €13.7 billion, and it would be trading on a PE ratio of 28.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of €678.7, the analyst's price target of €847.1 is 19.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives