Key Takeaways

- Redevelopment of prime assets and focus on top urban hubs enhances portfolio quality, tenant appeal, and supports long-term rent and asset value growth.

- Strong sustainability credentials, active asset recycling, and digital innovation drive tenant retention, green financing access, and stable earnings.

- Prolonged hybrid work trends, rising finance costs, limited market liquidity, and sector concentration heighten pressure on NSI's rental income, margins, balance sheet, and future growth.

Catalysts

About NSI- We are Amsterdam real estate specialists bringing together local market knowledge, experience and capital.

- The upcoming redevelopment and repositioning of Vitrum, coupled with the delivery of the Paris Proof HNK Rotterdam Alexander, will add modern, sustainable, high-quality assets to the portfolio. These appeal strongly to tenants seeking flexible and energy-efficient space, likely boosting occupancy, driving higher rental rates, and growing revenue and EPS over time.

- NSI's clear focus on core urban hubs-particularly Amsterdam and to a lesser extent Utrecht-capitalizes on the persistent urbanization and strong office demand in these cities, supporting long-term occupancy, rent growth, and asset values, all of which bolster revenue and net asset value.

- The company's leadership in sustainability, evidenced by the high share of A/A+ EPC labels and energy intensity well below Paris targets, enhances tenant appeal and provides access to green financing. This should support tenant retention, lower cost of capital, and strengthen net margins.

- Active asset recycling, with imminent disposals in secondary markets (Hoofddorp and Eindhoven), is expected to release over €40 million of capital for reinvestment in accretive projects or acquisitions in top locations, improving portfolio quality, raising rental income, and aiding earnings stability.

- Continued investment in digital tenant services and operational flexibility (such as the in-house flex office HNK platform) positions NSI to capture demand from evolving workplace needs in the digital economy, supporting sustained rental growth, improved occupancy, and stable cash flows.

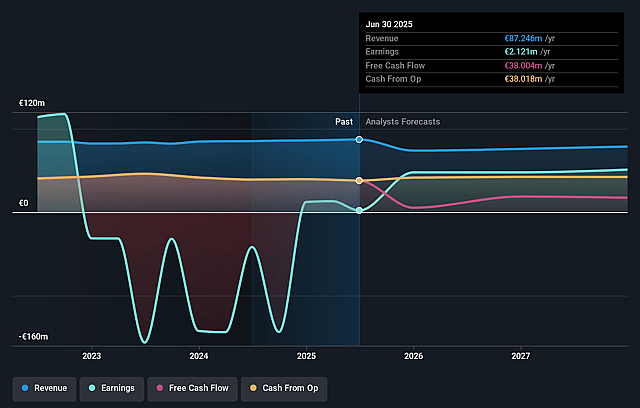

NSI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NSI's revenue will decrease by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.4% today to 92.4% in 3 years time.

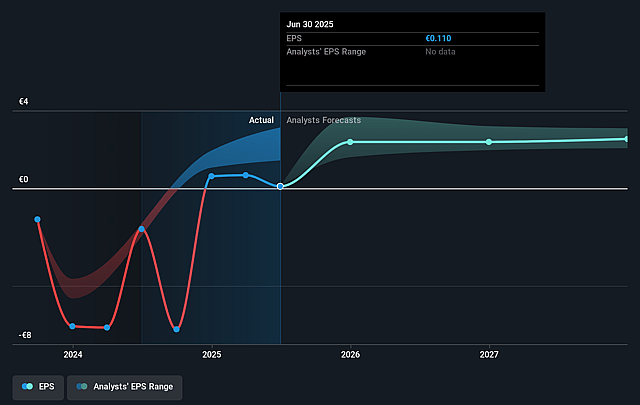

- Analysts expect earnings to reach €69.6 million (and earnings per share of €2.54) by about September 2028, up from €2.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, down from 196.9x today. This future PE is lower than the current PE for the GB Office REITs industry at 196.9x.

- Analysts expect the number of shares outstanding to grow by 2.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.41%, as per the Simply Wall St company report.

NSI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent hybrid and remote work trends are leading to physical occupancy levels that remain below pre-COVID norms, which may drive tenant rightsizing and put downward pressure on future occupancy rates, thus impacting long-term rental income and revenue growth.

- Limited market liquidity and recently negative portfolio revaluations (–2.7%) suggest continued uncertainty around the true market value and demand for office assets, potentially resulting in further negative revaluations and compressed net asset value, ultimately weighing on share price and earnings.

- Rising interest rates, alongside nearing refinancing of a €40 million private placement initially secured during negative rate periods, are set to increase NSI's average finance costs, pressuring net margins and reducing capacity for dividend growth or accretive reinvestment.

- Significant CapEx commitments to value-add projects (e.g., Vitrum redevelopment, HNK Rotterdam Alexander refurbishment, and future assets in the pipeline) risk stretching balance sheet flexibility, particularly if leasing up new or renovated space is delayed or market demand softens, increasing the likelihood of lower earnings or higher leverage over time.

- Dependency on single-sector exposure (office assets in prime Dutch cities) and long lead times for strategic redevelopments (such as office-to-residential conversions or major refurbishments) exposes NSI to secular shifts in office demand and sector-specific risks, increasing the vulnerability of revenues and net operating income should structural oversupply or further tenant demand shifts occur in the office market.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €23.625 for NSI based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €75.3 million, earnings will come to €69.6 million, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of €21.4, the analyst price target of €23.62 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on NSI?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.