Key Takeaways

- Geographical diversification and innovative remerchandising in flagship stores are expected to boost foot traffic and sales, driving revenue growth.

- Sustainability efforts and strategic financial management, including hedging and refinancing, likely result in reduced financing costs, supporting earnings growth.

- Reliance on indexation and increased vacancy rates, along with rising interest expenses, pose challenges to revenue growth and net margins amid cautious outlooks.

Catalysts

About Eurocommercial Properties- A Euronext-quoted property investment company and one of Europe’s shopping centre specialists.

- Geographical diversification and strategic remerchandising projects, especially in flagship stores, are expected to enhance foot traffic and sales, contributing to revenue growth.

- The expansion of high-performing sectors such as health, beauty, and sports, along with the introduction of new international brands, is anticipated to drive revenue through higher turnover rents and increased rental income per square meter.

- Continuation of low vacancy rates across properties, including timely re-letting of vacated spaces, is likely to maintain stable net margins and property income.

- The company's commitment to sustainability, including securing green loans and enhancing ESG credentials, could lead to favorable financing terms and reduced interest expenses, positively impacting earnings.

- Strategic use of interest rate hedges and refinancing plans to extend loan maturities, combined with expected declines in interest rates, may lower financing costs, supporting net margins and earnings growth.

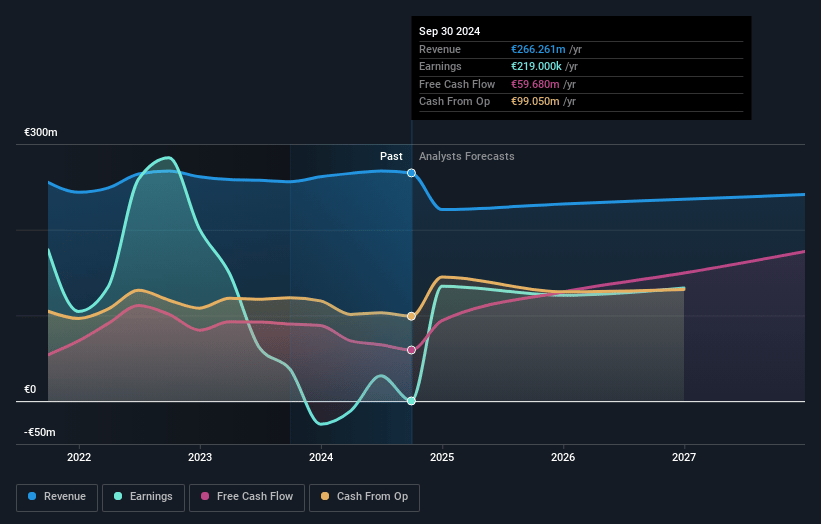

Eurocommercial Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eurocommercial Properties's revenue will decrease by 3.4% annually over the next 3 years.

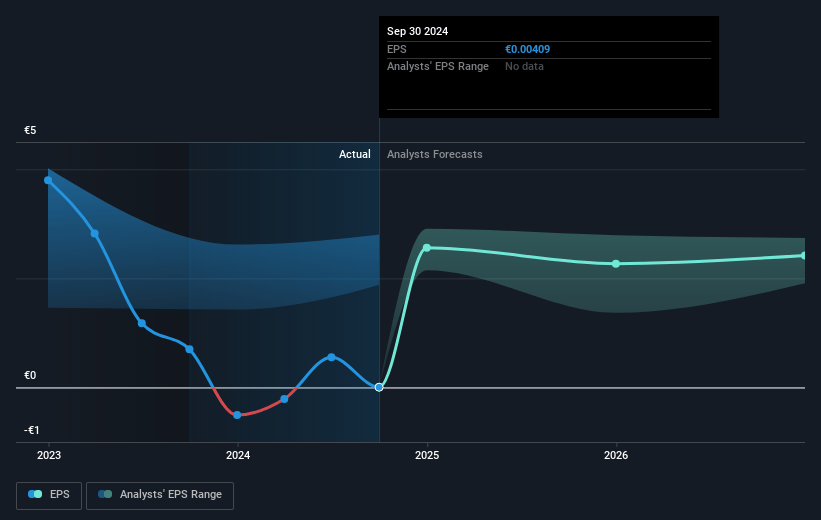

- Analysts assume that profit margins will increase from 0.1% today to 76.8% in 3 years time.

- Analysts expect earnings to reach €183.9 million (and earnings per share of €3.33) by about February 2028, up from €219.0 thousand today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, down from 5892.1x today. This future PE is lower than the current PE for the GB Retail REITs industry at 2955.1x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

Eurocommercial Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on indexation for rental growth means that lower inflation in 2024 could lead to slower rental income increases compared to previous years, potentially impacting revenue growth negatively.

- Increased vacancy rates in Sweden due to the hypermarket relocation indicate potential risks in tenant stability, leading to lost revenue if spaces remain unlet, impacting overall earnings.

- Rising interest expenses, even with some refinancing efforts, could result in higher financing costs that may erode net margins, particularly if hedging strategies do not fully mitigate interest rate increases.

- The potential for tenant insolvencies due to competition and macroeconomic pressures may result in increased bad debts, lowering rental income and potentially impacting net profit margins.

- The company's cautious guidance and flat retail sales suggest a conservative revenue outlook, indicating potential headwinds in achieving significant net earnings growth for 2024.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €27.344 for Eurocommercial Properties based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €239.7 million, earnings will come to €183.9 million, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 8.2%.

- Given the current share price of €24.15, the analyst price target of €27.34 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives