Key Takeaways

- Regulatory and input cost pressures, market concentration, and sector competition risk compressing Corbion's margins, increasing volatility, and limiting revenue growth opportunities.

- Shifting consumer preferences and aggressive competitor expansion may weaken demand for legacy products and challenge Corbion's pricing power and innovation leadership.

- Growth in sustainable solutions, regulatory support, operational improvements, and long-term contracts enhance Corbion's resilience and earnings potential amid rising global demand for natural, bio-based products.

Catalysts

About Corbion- Provides lactic acid and lactic acid derivatives, food preservation solutions, functional blends, and algae ingredients in the Netherlands, the United States, Asia, rest of North Americas, the rest of Europe, the Middle East, and Africa.

- Intensifying regulation and taxation targeting single-use plastics-despite appearing favorable for bioplastics-may expose Corbion to significantly higher compliance costs, volatile policy risks, and abrupt market disruptions. This scenario could limit the expected addressable market for PLA, erode margins in the joint venture, and dampen top-line revenue growth as the cost to serve sustainable segments rises unevenly across regions.

- Shifts in consumer preferences toward clean-label, minimally processed products and skepticism of additives threaten the long-term demand for some of Corbion's legacy food ingredients, especially if reformulation momentum accelerates in major end markets. This may ultimately constrain revenue and cause mix deterioration, weakening both the volume and margin profile across the company's food and preservation businesses.

- Overreliance on large-volume contracts and a concentrated customer base in high-growth segments such as lactic acid, PLA, and health & nutrition leaves Corbion highly vulnerable to sharp revenue loss and margin compression. Any downturn, contract renegotiation, or demand shock could quickly cascade through earnings, increasing business volatility and complicating long-term financial planning.

- Ongoing sector consolidation and aggressive expansion by larger, well-capitalized competitors in biobased ingredients and specialty chemicals threaten Corbion's ability to maintain pricing power, negotiate favorable contracts, or retain innovation leadership. This trend could steadily erode both gross margins and overall competitive position, pushing earnings growth below investor expectations.

- Persistent input cost inflation and supply chain volatility in raw materials such as sugar or corn pose a structural risk to Corbion's profitability. Sustained or sudden increases in feedstock or logistics costs-especially amid geopolitical or climate-related disruptions-could rapidly compress margins and undermine cash flow generation, even as the company attempts to pass along costs or seeks operational efficiencies.

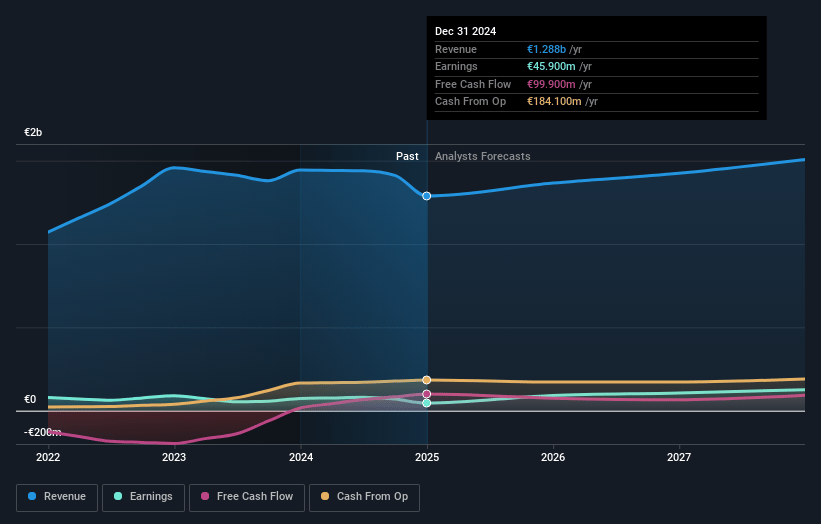

Corbion Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Corbion compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Corbion's revenue will decrease by 0.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.6% today to 7.6% in 3 years time.

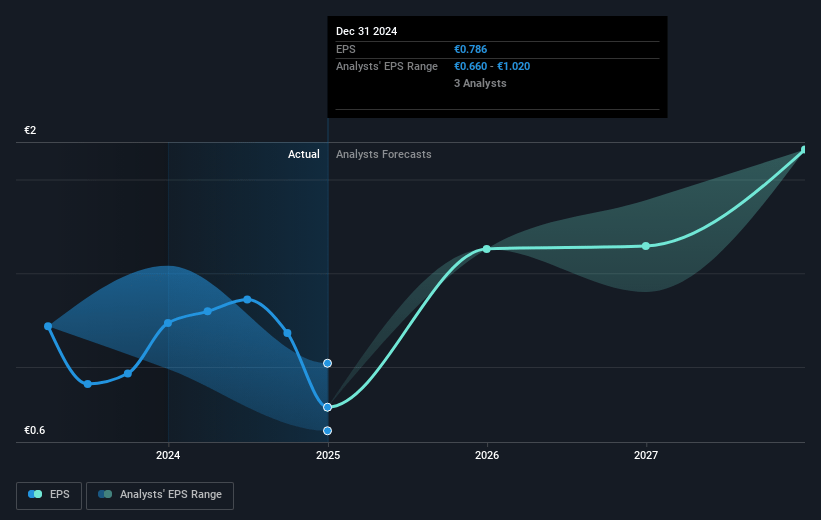

- The bearish analysts expect earnings to reach €98.0 million (and earnings per share of €1.03) by about July 2028, up from €45.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, down from 23.2x today. This future PE is lower than the current PE for the GB Chemicals industry at 21.0x.

- Analysts expect the number of shares outstanding to decline by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

Corbion Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Corbion's strong leadership and established production footprint in lactic acid, bioplastics, and natural preservation position it to benefit from accelerating global demand for sustainable food systems and bio-based materials, which can drive sustained revenue growth even amid market headwinds.

- Ongoing regulatory incentives and upcoming Chinese government directives to increase PLA (bioplastic) usage in food service and packaging are expected to significantly expand Corbion's addressable market from 2026, delivering new volume growth and supporting both top-line revenue and margin expansion.

- Continuous innovation and disciplined investment in efficiency measures, restructuring, and portfolio optimization have already led to notable improvements in adjusted EBITDA margin and free cash flow, indicating strong execution capabilities and a potential for further earnings and margin improvement over the long term.

- Corbion's ability to secure long-term contracts, particularly in its algae and omega-3 businesses, alongside a strategy of global manufacturing flexibility and strong local footprints, increases resilience to supply chain disruptions and input cost volatility, helping to stabilize both revenues and profit margins.

- Secular trends such as the global shift toward circular economy models, increasing demand for natural food preservation, and growing consumer and regulatory preference for sustainable, functional ingredients all provide long-term tailwinds that could override near-term cyclical pressures, supporting both future sales and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Corbion is €14.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Corbion's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €31.9, and the most bearish reporting a price target of just €14.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €1.3 billion, earnings will come to €98.0 million, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 6.3%.

- Given the current share price of €18.32, the bearish analyst price target of €14.0 is 30.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.