Key Takeaways

- Strategic investments in specialized growth segments and digital talent solutions are anticipated to enhance revenue via high-demand, high-value areas.

- Cost discipline paired with strategic growth investments aims to protect profitability, leveraging early cyclical growth in key regions.

- Challenging macroeconomic conditions and sector-specific issues could hinder Randstad's revenue growth and profitability due to subdued hiring, declining margins, and elevated operational costs.

Catalysts

About Randstad- Provides solutions in the field of work and human resources (HR) services.

- Randstad's investment in specialization, such as increasing capacity in growth segments like skilled trades, healthcare, and digital talent solutions, is expected to drive revenue growth as these specialized areas have higher demand and added value.

- The acquisition of Zorgwerk and its focus in the growing healthcare segment in the Netherlands offers opportunities to capture a larger market share in a high-demand sector, potentially improving margins and revenue.

- The implementation of digital marketplaces in regions like the U.S. is expected to enhance productivity and client adoption, likely boosting both earnings and operational efficiency.

- Randstad's focus on cost discipline and indirect cost reduction aims to protect net margins while strategically investing in growth segments, creating a balance that can improve profitability as market conditions stabilize.

- Randstad's commitment to leveraging its operational talent solutions in regions showing early cyclical growth, like the U.S., Spain, and Japan, is likely to accelerate revenue recovery even as the broader market remains challenged.

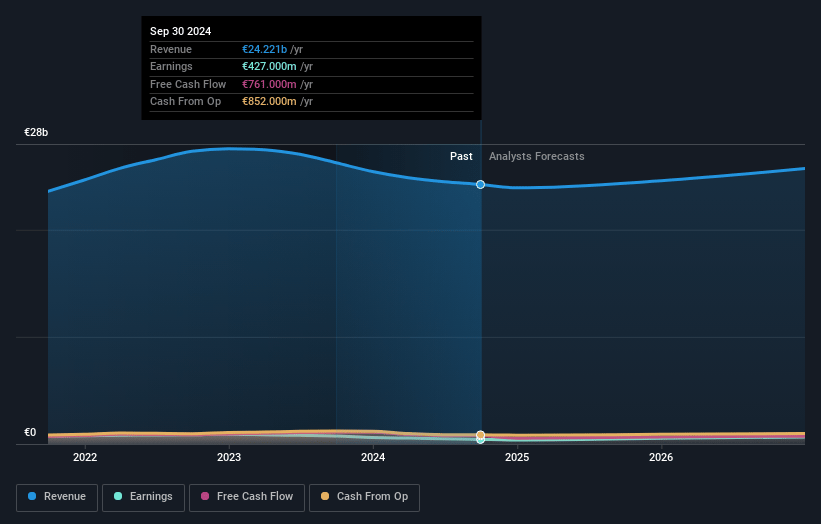

Randstad Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Randstad's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.8% today to 2.6% in 3 years time.

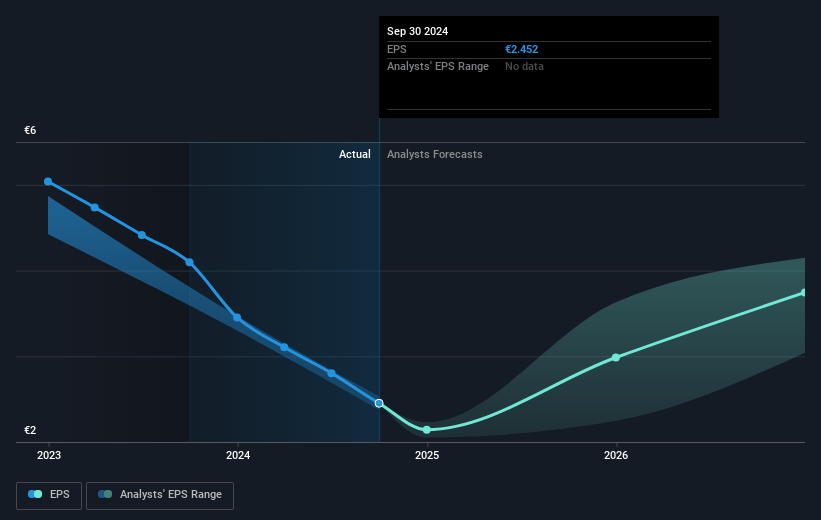

- Analysts expect earnings to reach €693.9 million (and earnings per share of €3.78) by about January 2028, up from €427.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €466.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.5x on those 2028 earnings, down from 17.3x today. This future PE is lower than the current PE for the GB Professional Services industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 1.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.25%, as per the Simply Wall St company report.

Randstad Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenging macroeconomic environment, especially in the manufacturing and automotive industries, could adversely impact Randstad’s revenue growth if this trend continues.

- Persistent subdued client and candidate confidence leading to muted hiring activity may result in lower revenues than anticipated.

- The declining trend in gross margin due to geographic and service mix changes and sector-specific headwinds could pressure net margins if not managed effectively.

- Elevated idle time, sickness rates, and related costs in certain markets, such as Northern Europe, could negatively impact net earnings if these issues persist.

- The mix of Randstad's revenue sources, particularly the lower temp margins in some sectors like logistics, may result in increased operational costs, thereby impacting operating margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €43.8 for Randstad based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €60.0, and the most bearish reporting a price target of just €30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €26.4 billion, earnings will come to €693.9 million, and it would be trading on a PE ratio of 13.5x, assuming you use a discount rate of 5.2%.

- Given the current share price of €42.27, the analyst's price target of €43.8 is 3.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

TH

The_Prince

Community Contributor

Randstad: A Value Caution in a Shifting Landscape

Randstad NV (AEX: RAND) currently trades around €41.55 with a market cap of approximately €7.62 billion. While many investors may be drawn to its strong dividend history and solid reputation in staffing, a closer look at the fundamentals and macroeconomic outlook suggests that the market may be overestimating its near‐term growth prospects.

View narrative€30.00

FV

27.1% overvalued intrinsic discount-0.35%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

4users have followed this narrative

9 days ago author updated this narrative