Last Update 16 Aug 25

Fair value Decreased 8.58%The consensus price target for Envipco Holding has increased to €10.11, primarily driven by notable improvements in future earnings multiples and net profit margin expectations.

What's in the News

- Secured a frame agreement with Statiegeld Nederland in the Netherlands to deliver Quantum bulk collection RVMs for out of home locations, with an agreement running to end of 2026, including 8-year service contracts and first orders received.

- Signed a letter of intent in Portugal for delivery of approximately 250 RVMs to a leading retailer, with delivery and service agreement anticipated in the second half of 2025.

- Signed a letter of intent with a major Polish retail group, appointing Envipco as one of two RVM providers for about 1,000 supermarkets, including a 10-year service agreement and provision for expansion orders.

- Provided an update on strategic and financial ambitions at the company’s Analyst/Investor Day.

Valuation Changes

Summary of Valuation Changes for Envipco Holding

- The Consensus Analyst Price Target has risen from €9.38 to €10.11.

- The Future P/E for Envipco Holding has significantly risen from 10.06x to 12.55x.

- The Net Profit Margin for Envipco Holding has significantly risen from 20.09% to 25.06%.

Key Takeaways

- Regulatory momentum and growing ESG focus are fueling new demand for Envipco's recycling solutions, expanding its revenue pipeline and service opportunities.

- Strategic investments in capacity, innovation, and recurring services strengthen Envipco's market position and support margin improvement as existing installations mature.

- Ongoing regulatory delays, rising costs, weak operational cash flow, and overreliance on major launches jeopardize Envipco's growth, profitability, and financial stability.

Catalysts

About Envipco Holding- Develops, manufactures, assembles, leases, sells, markets, and services a line of reverse vending machines (RVMs) in the Netherlands, the United States, North America, and Europe.

- Pending regulatory implementation of new deposit return schemes (DRS) in key European markets such as Poland and Portugal, along with mandates like the EU Packaging Waste Regulation (requiring 90% recovery by 2029), are set to drive a significant, multi-year increase in reverse vending machine demand-creating a substantial pipeline of revenue growth as these markets move from pilot to full-scale rollout.

- Rising consumer and corporate focus on sustainability and ESG compliance is prompting major retailers and governments to accelerate the adoption of advanced recycling solutions, directly increasing the addressable market for Envipco's RVMs and supporting both higher unit sales and recurring services revenue in new and existing markets.

- Continued investment in localized production, expanded business development teams, and scalable manufacturing capacity positions Envipco to quickly fulfill large orders as they materialize, supporting top-line acceleration and potential operating margin improvement due to efficiency gains and supply chain flexibility.

- Envipco's expansion of high-margin recurring program services, digital platforms, and long-term service contracts-embedded early in customer relationships-provides a growing earnings base, which will gradually lift net profit margins as installed RVM bases mature beyond initial warranty periods.

- Ongoing innovation in high-speed, AI-integrated RVMs and partnerships for brownfield market entries (e.g., Quantum platform adoption in new regions) will differentiate Envipco's offering, enabling price premiums and market share gains, expected to support both revenue growth and long-term expansion of EBITDA margins.

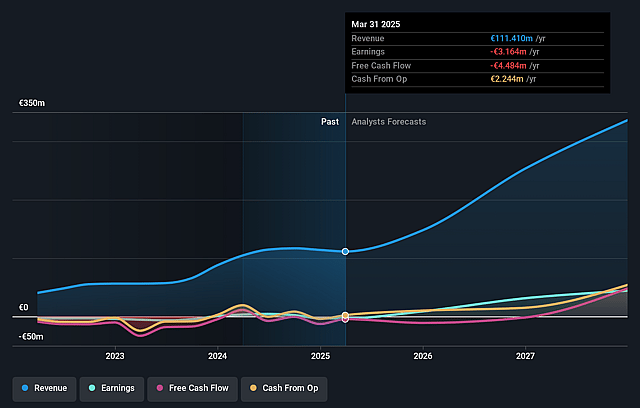

Envipco Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Envipco Holding's revenue will grow by 41.8% annually over the next 3 years.

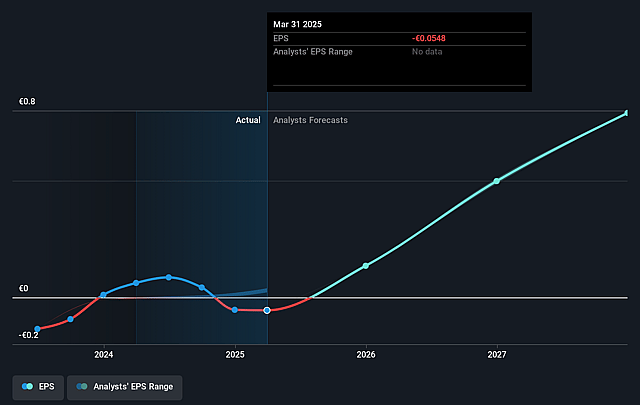

- Analysts assume that profit margins will increase from -6.9% today to 25.1% in 3 years time.

- Analysts expect earnings to reach €74.6 million (and earnings per share of €0.84) by about September 2028, up from €-7.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, up from -62.8x today. This future PE is lower than the current PE for the NL Machinery industry at 20.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.14%, as per the Simply Wall St company report.

Envipco Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays and uncertainty in the rollout of new deposit return schemes in key growth markets like Poland and Portugal are pushing customer purchasing decisions into late 2025 and possibly 2026, risking a protracted period of soft revenues and volatility in the company's projected topline growth.

- Heavy ongoing investments in headcount, business development, and R&D (with operating expenses up 17% year-on-year) are currently not matched by revenue growth, pressuring EBITDA and resulting in net losses, which, if prolonged, could erode net margins and threaten profitability.

- Despite stable gross margins, negative cash flow from operations (EUR -4.6 million in Q2) driven by working capital build (higher inventories and receivables) and a reliance on increased borrowings to maintain liquidity (total borrowings up €4.3 million sequentially) may strain the company's financial stability and increase balance sheet risk if soft market conditions persist.

- The decline in North American sales and limited underlying volume growth indicate that the region remains only moderately growing, exposing Envipco to regional demand fluctuations and limiting the company's global revenue diversification.

- Revenue remains heavily dependent on major market launches spurred by regulation, so any changes, delays, or uncertainties in policy implementation, deposit scheme specifications, or interoperability requirements could significantly impact Envipco's sales momentum and earnings visibility in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €8.571 for Envipco Holding based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €296.5 million, earnings will come to €74.6 million, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 6.1%.

- Given the current share price of €7.82, the analyst price target of €8.57 is 8.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.