Key Takeaways

- Rapid merger integration, market repair, and digital expansion position Axiata for accelerated revenue and margin growth ahead of analyst expectations.

- Strong cash generation and balance sheet support strategic investments, M&A, and higher returns to shareholders, unlocking further value.

- Persistent revenue stagnation, heavy reliance on cost cuts, and challenging market conditions expose Axiata to margin compression, earnings risk, and declining long-term financial stability.

Catalysts

About Axiata Group Berhad- An investment holding company, provides telecommunications services.

- While analyst consensus expects only incremental gains from Indonesia's market consolidation, Axiata's dominant emerging position in a rationalized three-player market-combined with significant ARPU upside and rapid post-merger integration-could trigger a step-change in revenue growth and EBIT margin expansion much sooner than anticipated as market repair unfolds.

- Analysts broadly agree the Airtel-Dialog merger will deliver synergies by 2025, but management execution already outpaces targets, signaling that accelerated realization of merger benefits and cross-sell opportunities can drive double-digit net margin and profit growth in Sri Lanka ahead of consensus timelines.

- Axiata's ongoing push into digital payments, fintech, and enterprise cloud through subsidiaries like Boost and ADA strongly positions the group to capture outsized revenue growth and higher-margin earnings as digital adoption and e-commerce boom across Southeast and South Asia.

- Aggressive network modernization including 5G and fiber deployment puts Axiata at the forefront of the region's data revolution, enabling premium pricing, ARPU upside, and first-mover advantage as demand for high-speed connectivity and digital infrastructure accelerates well above current projections.

- Axiata's strengthened balance sheet and sustained free cash flow generation provide ample firepower for opportunistic M&A, digital asset monetization, and increased dividends or buybacks, all of which could unlock further value and drive accelerated growth in earnings per share.

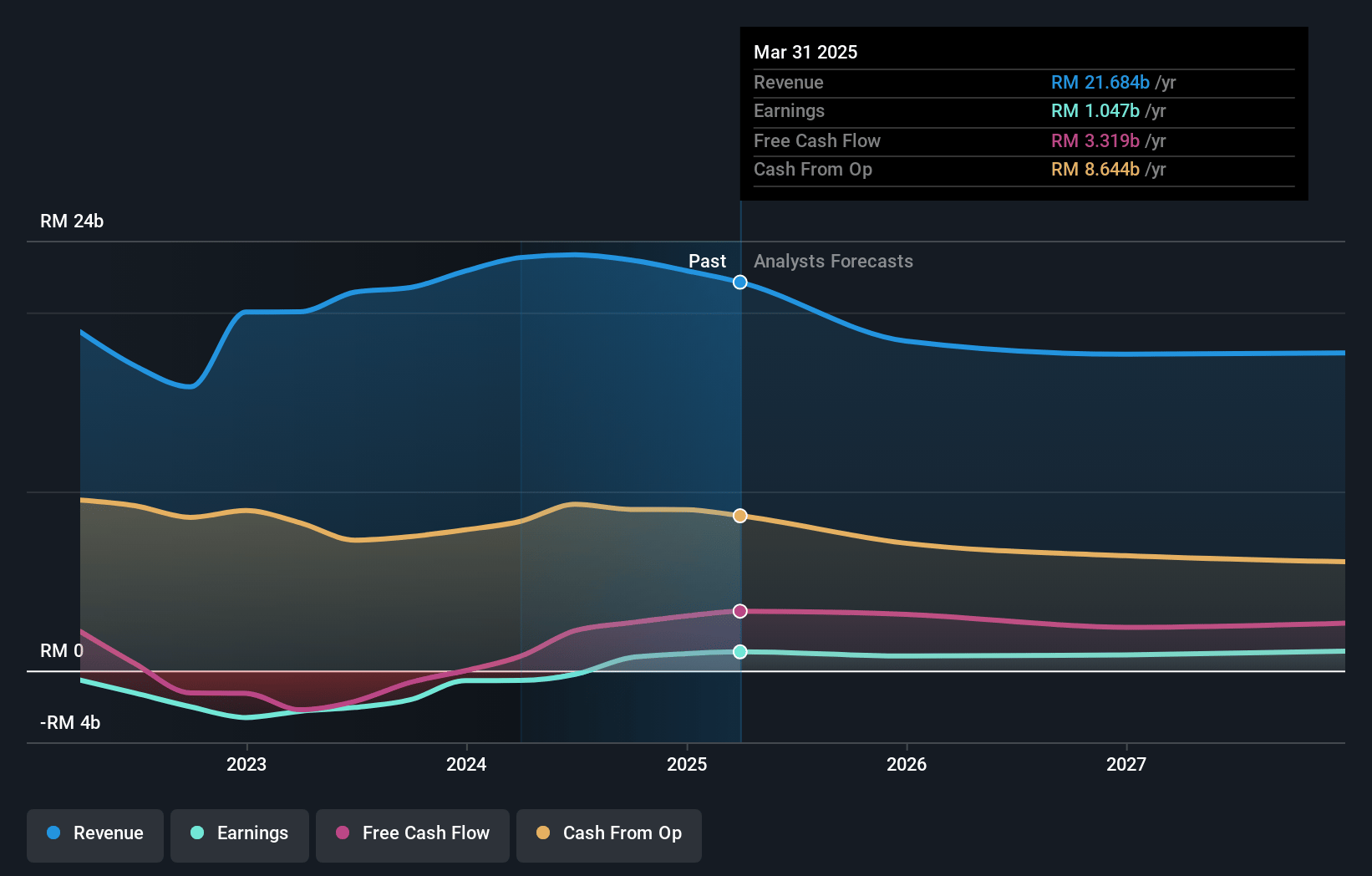

Axiata Group Berhad Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Axiata Group Berhad compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Axiata Group Berhad's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.8% today to 6.4% in 3 years time.

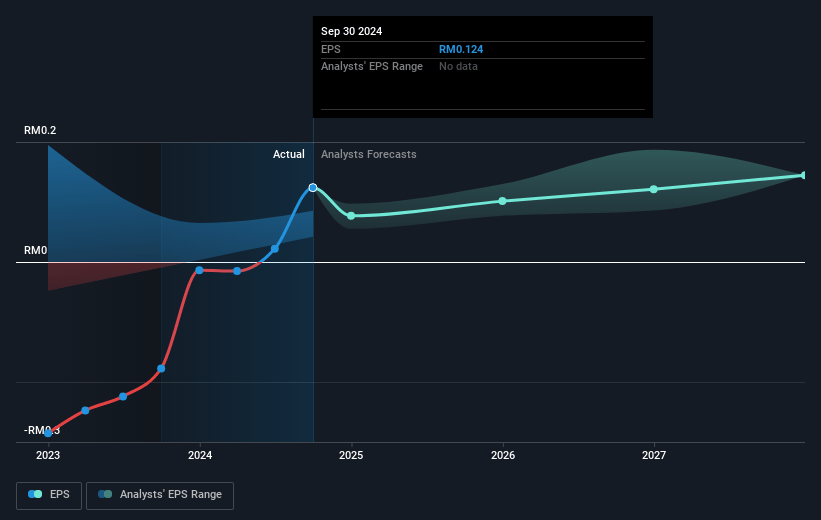

- The bullish analysts expect earnings to reach MYR 1.6 billion (and earnings per share of MYR 0.14) by about July 2028, up from MYR 1.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.6x on those 2028 earnings, up from 22.5x today. This future PE is greater than the current PE for the MY Wireless Telecom industry at 22.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.2%, as per the Simply Wall St company report.

Axiata Group Berhad Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The group repeatedly highlighted sluggish revenue growth in major markets such as Indonesia, Bangladesh, and Malaysia, with 2024 revenue growth missing mid-single digit targets and guidance for 2025 only set at low single digit, signaling limited top-line expansion due to persistent competitive pressures and digital disruption, likely impacting long-term revenue and earnings growth.

- Axiata emphasized that profitability improvements were mainly driven by cost optimization and lower CapEx rather than sustainable revenue gains, suggesting that ongoing commoditization and price wars could continue to compress margins over time and limit the company's ability to grow net margins and earnings.

- Subsidiaries in key regions, particularly Robi (Bangladesh) and Dialog (Sri Lanka), have faced ongoing economic instability, regulatory interventions like mandated network shutdowns, and foreign exchange losses, exposing Axiata to recurring risks of currency devaluation and local macro shocks that threaten group revenues, trigger possible impairment charges, and reduce returns.

- The company's continued exposure to fragmented and emerging markets, combined with high and rising capital expenditures needed for 5G and network upgrades against uncertain and slow monetization, poses a structural risk of negative free cash flow, greater debt burden, and declining net margins, making Axiata vulnerable to rising interest expenses and reduced profitability.

- Industry-wide secular trends such as regulatory uncertainty (forced network sharing, price controls, and data privacy scrutiny), the ongoing decline of traditional SMS and voice revenues due to OTT competition, and the entry of powerful non-traditional tech players threaten to erode Axiata's pricing power, lower average revenue per user, and undermine revenue visibility and long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Axiata Group Berhad is MYR3.84, which represents two standard deviations above the consensus price target of MYR2.59. This valuation is based on what can be assumed as the expectations of Axiata Group Berhad's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MYR4.5, and the most bearish reporting a price target of just MYR1.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be MYR25.2 billion, earnings will come to MYR1.6 billion, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 9.2%.

- Given the current share price of MYR2.56, the bullish analyst price target of MYR3.84 is 33.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.