Key Takeaways

- Significant CapEx investments and infrastructure projects are expected to increase capacity and enhance passenger services, driving future revenue and profitability.

- Diversification into non-aeronautical revenues and implementation of new tariff regulations could boost overall net margins and mitigate passenger traffic declines.

- Declines in passenger traffic and delayed tariff implementation could hinder revenue growth, while rising operational costs threaten profitability and revenue stability.

Catalysts

About Grupo Aeroportuario del Pacífico. de- Grupo Aeroportuario del Pacífico, S.A.B. de C.V., together with its subsidiaries, holds concessions to develop, operate, and manage airports in Mexico and Jamaica.

- The approval of the 2025-2029 Master Development Plan involves a total CapEx commitment of MX$43.2 billion, indicating significant future investments in infrastructure, particularly in terminal buildings. This is expected to increase capacity and enhance passenger services, potentially boosting future revenues and earnings.

- The strategic expansion of commercial revenue streams is evident with a 39% increase in non-aeronautical revenues during the third quarter, driven by ventures in car rentals, retail, and food and beverage. This diversification is expected to offset declines in passenger traffic, positively impacting net margins.

- Ongoing infrastructure projects such as a new terminal in Guadalajara and expansion in Los Cabos are poised to improve the operational efficiency and capacity of key airports, contributing to future revenue growth and potentially higher net margins.

- Implementation of new tariff regulations, gradually introduced over the next 15 months, is likely to enhance aeronautical revenues once fully adopted, improving overall revenue and operating margins.

- With a strong balance sheet and strategic refinancing, GAP is well-positioned financially to capitalize on growth opportunities and expand its service offering, which can lead to increased earnings and profitability in the future.

Grupo Aeroportuario del Pacífico. de Future Earnings and Revenue Growth

Assumptions

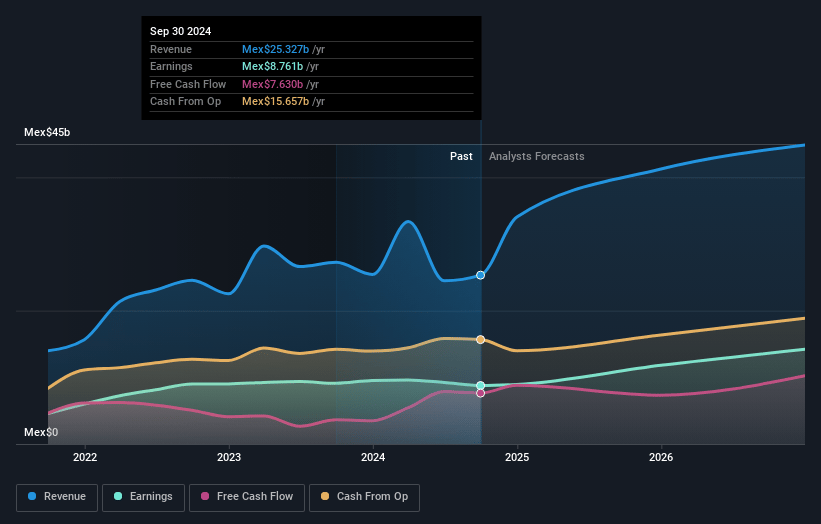

How have these above catalysts been quantified?- Analysts are assuming Grupo Aeroportuario del Pacífico. de's revenue will grow by 21.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 34.6% today to 30.1% in 3 years time.

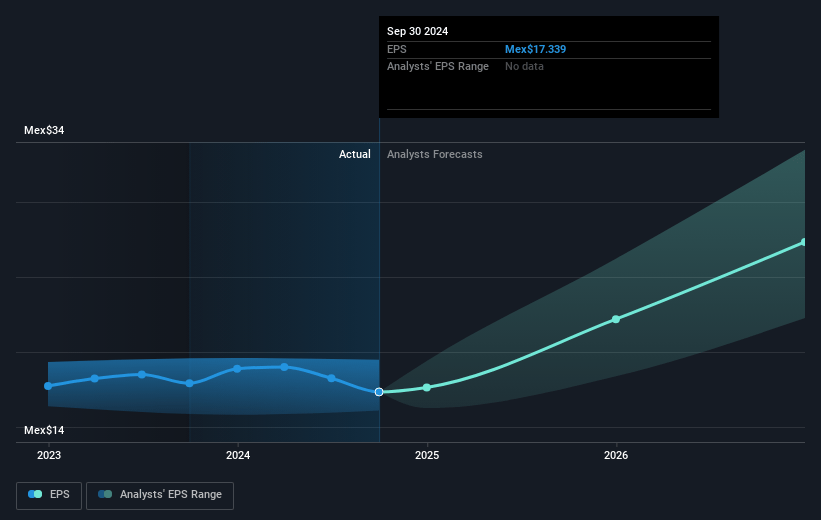

- Analysts expect earnings to reach MX$13.7 billion (and earnings per share of MX$28.61) by about January 2028, up from MX$8.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting MX$16.8 billion in earnings, and the most bearish expecting MX$11.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.0x on those 2028 earnings, down from 22.1x today. This future PE is greater than the current PE for the US Infrastructure industry at 15.6x.

- Analysts expect the number of shares outstanding to decline by 1.82% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.94%, as per the Simply Wall St company report.

Grupo Aeroportuario del Pacífico. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The 5.7% decline in passenger traffic due to ongoing inspections of Pratt & Whitney's engines could negatively impact aeronautical revenue, as fewer passengers translate directly to decreased revenue from flight operations.

- The inability to reach the maximum tariff, with the company achieving only around 94%, alongside gradual tariff implementations, could constrain potential revenue growth from aeronautical services in the short to medium term.

- Increasing operational expenses, which rose by 21% due to the consolidation of the cargo and freight flight facility and inflationary pressures, could compress net margins and impact overall profitability if not effectively controlled.

- The delay in full implementation of the new tariff until January 2026 could hold back revenue growth anticipated from the revised pricing structure, placing a drag on earning potentials until complete execution.

- The reported decrease in aeronautical revenue by 3.8%, attributed to lower passenger traffic amidst a challenging market environment, could signal potential vulnerabilities in capturing enough passenger volume, thereby impacting revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MX$393.55 for Grupo Aeroportuario del Pacífico. de based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$465.0, and the most bearish reporting a price target of just MX$303.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$45.5 billion, earnings will come to MX$13.7 billion, and it would be trading on a PE ratio of 22.0x, assuming you use a discount rate of 16.9%.

- Given the current share price of MX$382.51, the analyst's price target of MX$393.55 is 2.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives