Key Takeaways

- Broadband and mobile service growth across Latin America, along with digital ecosystem expansion, are driving higher margins and supporting long-term revenue gains.

- Operational efficiencies and resilience to economic slowdowns enable sustained profitability and position the company for improved future earnings.

- Stricter regulation, intensifying competition, economic headwinds, reduced investment, and currency volatility threaten América Móvil's growth prospects and financial stability in core markets.

Catalysts

About América Móvil. de- Provides telecommunications services in Latin America and internationally.

- The ongoing expansion and accelerated adoption of broadband and fiber-to-the-home services in Latin America, with strong performance in Mexico, Brazil, and Central America, position América Móvil to capture increasing household penetration and rising ARPU as digitalization deepens—supporting sustained revenue and long-term margin expansion.

- The proliferation of connected devices and higher mobile data consumption, seen in the sustained growth in postpaid subscriber numbers and ARPU, support uplifts in wireless service revenue and are likely to drive further top-line gains as economies digitize and demand for always-connected solutions intensifies.

- Executing on synergies and operational efficiencies, particularly in newly integrated markets like Chile, has led to significant improvements in EBITDA margin; further synergy capture and cost discipline will enable higher EBITDA and enhanced net margins over time.

- The company's proven ability to weather short-term economic headwinds—such as recent slowdowns in Mexican and broader Latin American consumption—combined with expectations of an economic rebound in the second half of the year, suggests cyclical earnings momentum is likely to recover, bolstering both revenue and net income.

- Expansion into financial technology and digital ecosystems, leveraging mobile connectivity for banking and payments, positions América Móvil to benefit from new high-margin revenue streams and increased customer stickiness, supporting future earnings growth.

América Móvil. de Future Earnings and Revenue Growth

Assumptions

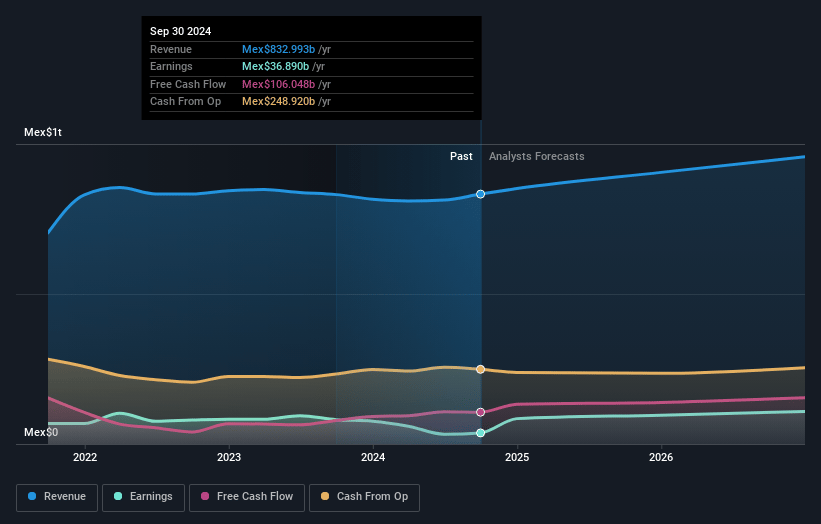

How have these above catalysts been quantified?- Analysts are assuming América Móvil. de's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 11.3% in 3 years time.

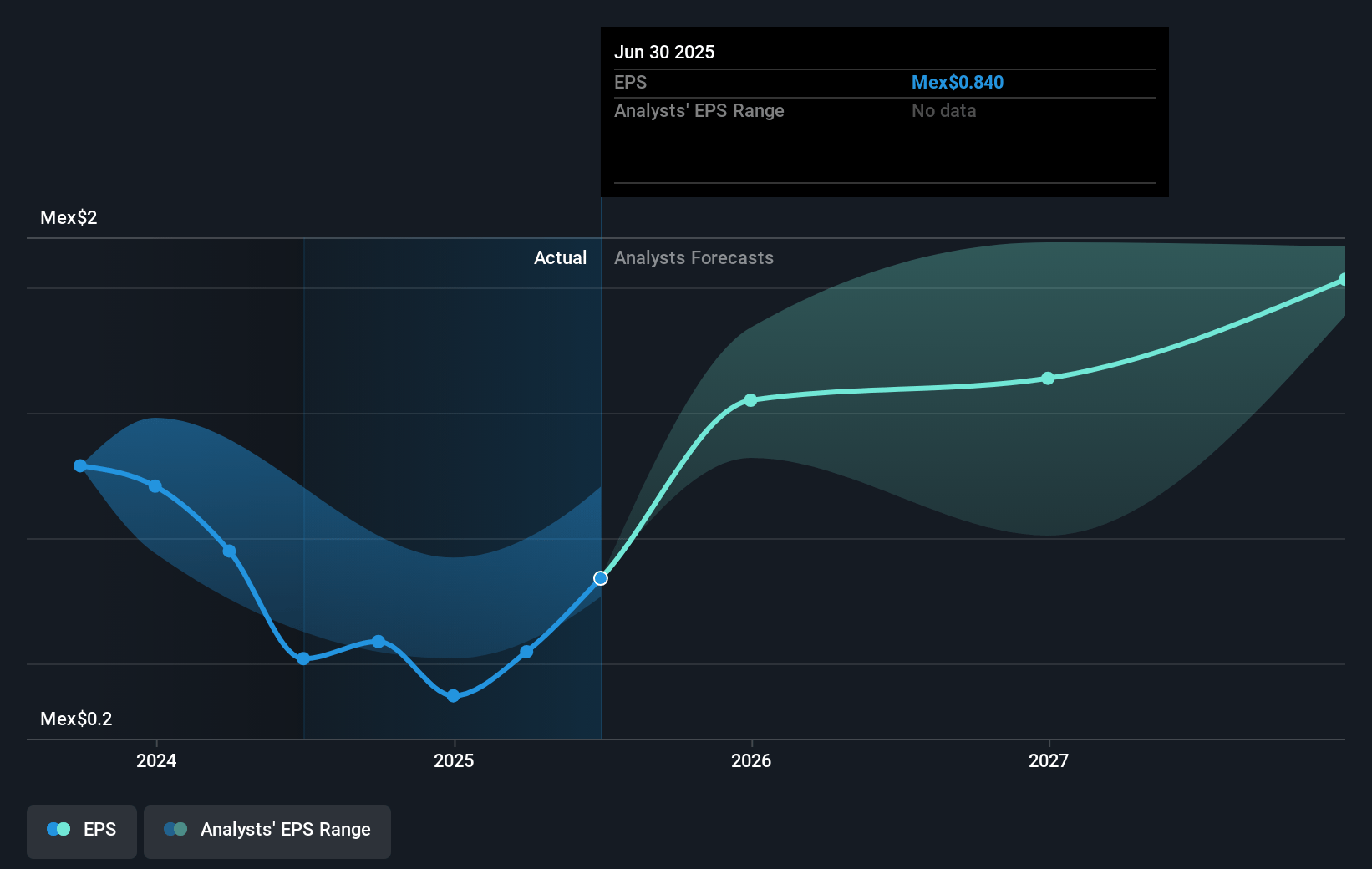

- Analysts expect earnings to reach MX$114.5 billion (and earnings per share of MX$2.11) by about July 2028, up from MX$33.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting MX$126.5 billion in earnings, and the most bearish expecting MX$82.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, down from 29.4x today. This future PE is lower than the current PE for the US Wireless Telecom industry at 29.4x.

- Analysts expect the number of shares outstanding to decline by 1.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.87%, as per the Simply Wall St company report.

América Móvil. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising regulatory pressures in Mexico, including potential new telecommunications and competition laws under discussion, could restrict América Móvil’s market share or impose stricter controls on pricing and spectrum allocation, impacting revenue growth and margins.

- Increasingly aggressive competition in the Mexican prepaid smartphone segment—particularly from MVNOs offering deep discounts and promotional pricing—may erode América Móvil’s market share, depress ARPU, and compress EBITDA margins in its largest market.

- Weakening consumer demand, especially in Mexico, due to macroeconomic slowdown, declining private consumption, high real interest rates, and fiscal tightening, could result in slower subscriber growth and lower service revenue across key segments.

- Persistent high capital expenditures (CapEx) requirements to maintain and expand 5G, fiber, and IT infrastructure, alongside management's recent move to reduce CapEx (in response to slower economic growth), may constrain revenue-driving investments and limit long-term earnings growth potential.

- Currency volatility in América Móvil’s core Latin American markets—particularly ongoing depreciation risks—could negatively affect the company’s reported earnings and cash flows when translated into Mexican pesos or U.S. dollars, and introduce unpredictability into financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MX$19.475 for América Móvil. de based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$22.0, and the most bearish reporting a price target of just MX$15.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$1016.6 billion, earnings will come to MX$114.5 billion, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 13.9%.

- Given the current share price of MX$16.31, the analyst price target of MX$19.47 is 16.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.