Key Takeaways

- Expanded digital offerings and network investments strengthen market share, technological leadership, and revenue growth across Latin America.

- Cross-industry partnerships and market consolidation support margin stability, reduced churn, and a more diversified revenue base.

- Regulatory challenges, currency volatility, high capital needs, rising competition, and telecom service commoditization threaten América Móvil's growth, margins, and long-term profitability.

Catalysts

About América Móvil. de- Provides telecommunications services in Latin America and internationally.

- Robust growth in postpaid mobile and fixed broadband subscribers-fueled by ongoing improvements in network quality, expanded coverage, and digital service offerings-positions América Móvil to benefit from rising data consumption and digital adoption across Latin America, supporting future revenue and ARPU growth.

- Continued investments in fiber-optic and 5G infrastructure have enabled accelerated expansion in high-value markets (notably Brazil and Mexico), which is likely to reinforce technological leadership, capture greater market share, and drive improved net margins as operating leverage increases.

- Integration of digital partnerships (e.g., with Nubank) and bundled value-added services, including streaming platforms and IoT offerings, expands cross-sell opportunities and diversifies the revenue mix, supporting higher earnings and reduced churn over the medium to long term.

- Market consolidation in key countries (such as Brazil, Colombia, and Argentina) is creating more rational competitive environments, reducing promotional intensity and paving the way for more sustained ARPU levels and margin stability going forward.

- Positive macroeconomic trends-including urbanization, middle-class growth, and rebounding private consumption in core countries such as Mexico-should broaden the addressable market for wireless and broadband, underpinning long-term revenue and earnings growth.

América Móvil. de Future Earnings and Revenue Growth

Assumptions

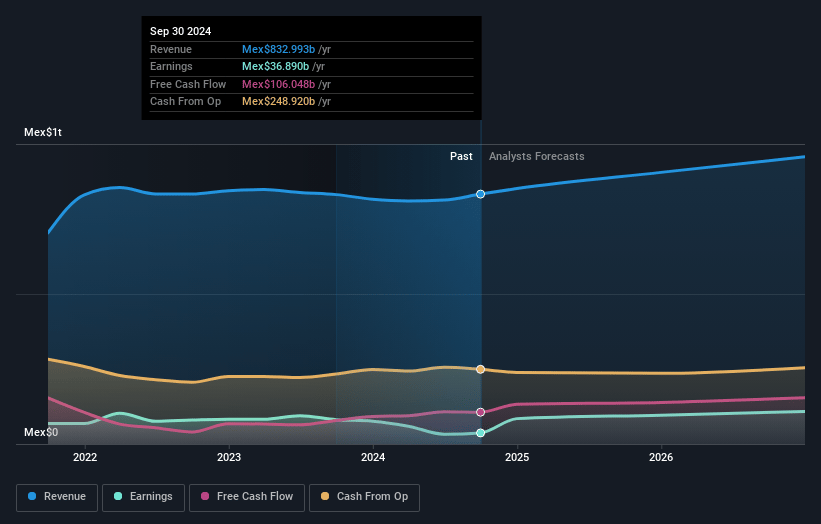

How have these above catalysts been quantified?- Analysts are assuming América Móvil. de's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 11.3% in 3 years time.

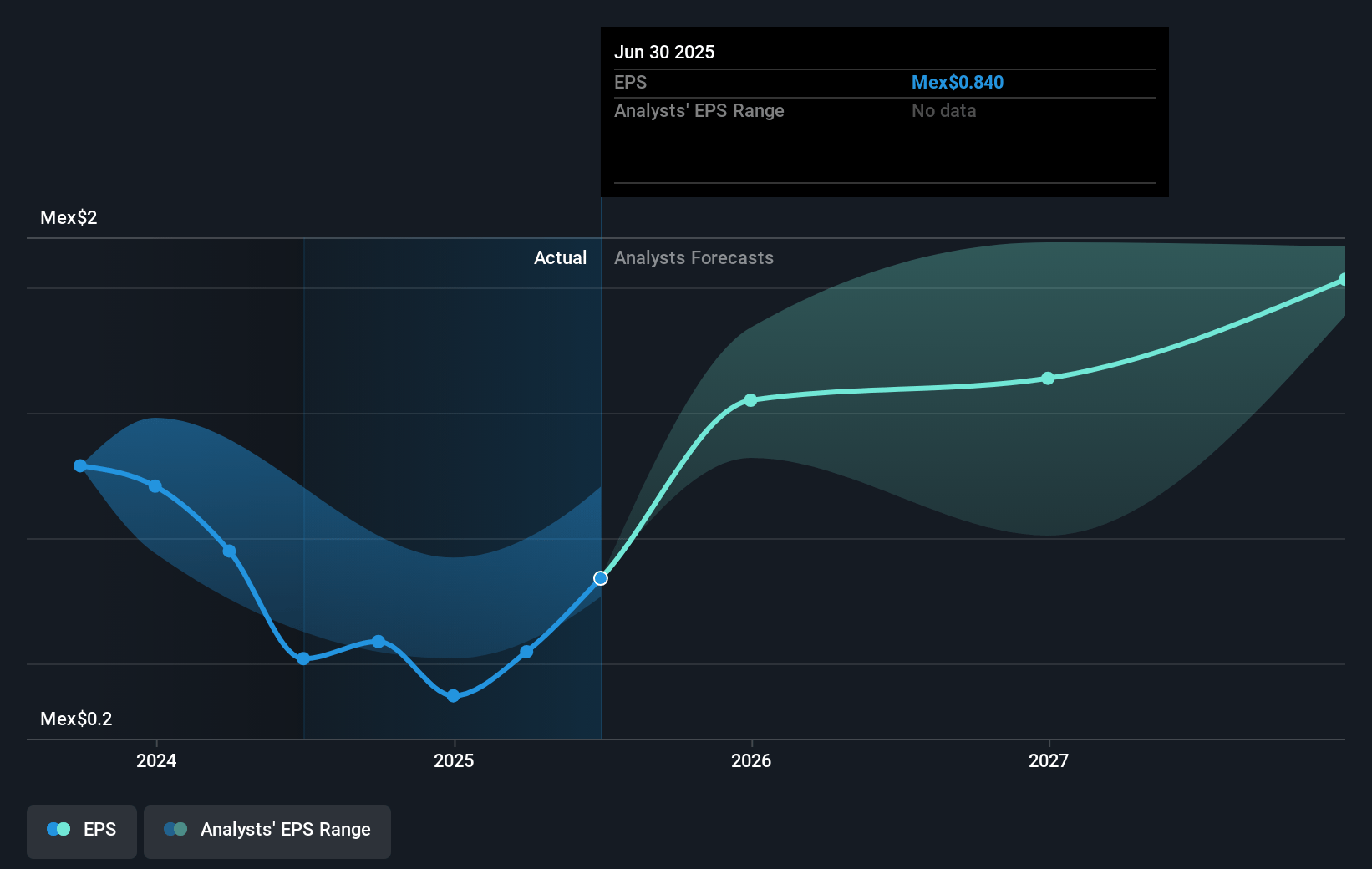

- Analysts expect earnings to reach MX$114.5 billion (and earnings per share of MX$2.11) by about July 2028, up from MX$33.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting MX$126.5 billion in earnings, and the most bearish expecting MX$82.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, down from 28.6x today. This future PE is lower than the current PE for the US Wireless Telecom industry at 28.6x.

- Analysts expect the number of shares outstanding to decline by 1.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.88%, as per the Simply Wall St company report.

América Móvil. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent regulatory uncertainty and the introduction of a new antitrust body in Mexico-with increased fines and potential spectrum changes-could limit América Móvil's market share expansion, heighten compliance costs, and restrain overall revenue growth and margins.

- Exposure to significant foreign currency volatility-given that much of América Móvil's revenues and costs are in local Latin American currencies-creates ongoing risks to earnings stability and can negatively affect reported sales, margins, and net profit due to translation effects.

- Ongoing high capital expenditure requirements for network upgrades (including fiber deployment and 5G rollout) may not be matched by equivalent ARPU or revenue growth, potentially pressuring free cash flow and return on invested capital (ROIC), while lease expense growth could further compress margins.

- Intensifying competitive pressures in key markets-both from aggressive incumbents and new entrants like Bait and potential fintech disruptors-could inhibit América Móvil's ability to grow its subscriber base and ARPU, putting pressure on revenue and profit growth over time.

- ARPU and margin compression risk remains due to secular trends, such as substitution of traditional telco services with internet-based/OTT communication platforms (e.g., WhatsApp, Zoom), coupled with the commoditization of mobile data and evolving consumer expectations, potentially undermining long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MX$19.475 for América Móvil. de based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$22.0, and the most bearish reporting a price target of just MX$15.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$1016.6 billion, earnings will come to MX$114.5 billion, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 13.9%.

- Given the current share price of MX$15.88, the analyst price target of MX$19.47 is 18.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.