Key Takeaways

- Shifting consumer preferences and stricter global regulations are threatening Becle's growth prospects, margins, and ability to effectively pursue premiumization.

- Reliance on tequila, volatile agave inputs, and the rise of low/no-alcohol beverages challenge Becle's market share, profitability, and long-term earnings strength.

- The company's premiumization, cost advantages, global diversification, innovation investments, and stronger financial flexibility are driving profitable growth and resilience across changing market conditions.

Catalysts

About Becle. de- Manufactures and distributes spirits and other distilled beverages in Mexico, the United States, Canada, and internationally.

- Heightening global health awareness and rising anti-alcohol attitudes, particularly among younger consumers, are poised to accelerate declines in spirits consumption in key growth markets, directly limiting Becle's potential for long-term revenue expansion and undermining the premiumization strategy.

- Intensifying regulatory actions on alcohol marketing, taxes, and labeling-especially as governments seek new revenue post-pandemic-will likely increase compliance and operating costs for Becle, erode net margins, and make international growth far costlier and more complex.

- Overdependence on core tequila markets and the flagship José Cuervo brand leaves Becle particularly exposed to market saturation and shifting consumer tastes, increasing the risk of market share erosion, volume stagnation, and downward pressure on company earnings.

- Volatile agave prices and cyclical supply imbalances-while currently beneficial-are likely to reverse, with impending shortages and input cost inflation poised to significantly compress gross margins and profitability in the medium to long term.

- The rapid expansion of the low/no-alcohol beverage segment is steadily reducing market share for traditional spirits, threatening Becle with declining sales volume, greater pricing pressure, and structurally weaker long-term earnings power amidst a changing global drinks landscape.

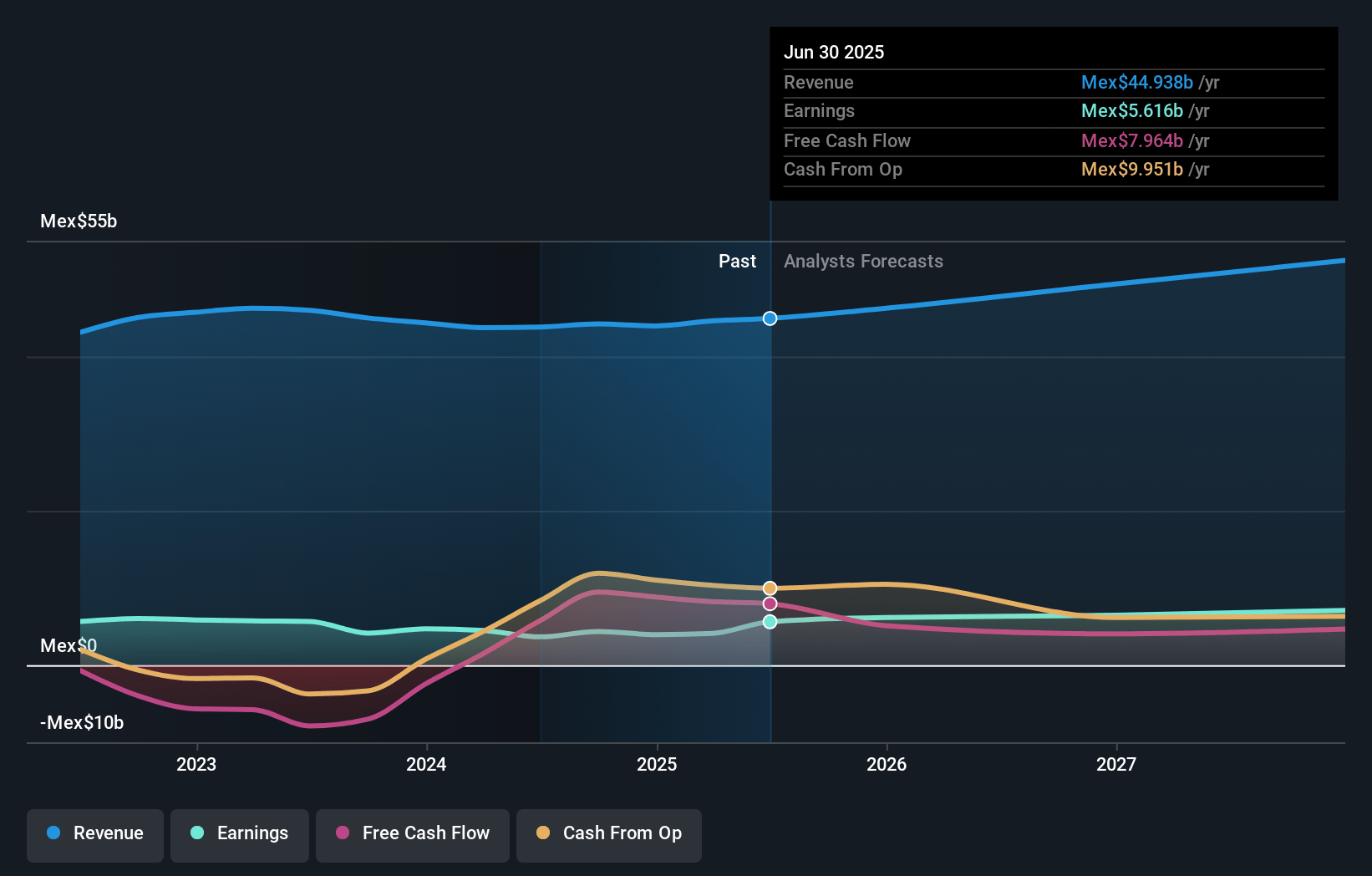

Becle. de Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Becle. de compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Becle. de's revenue will grow by 4.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 9.2% today to 13.3% in 3 years time.

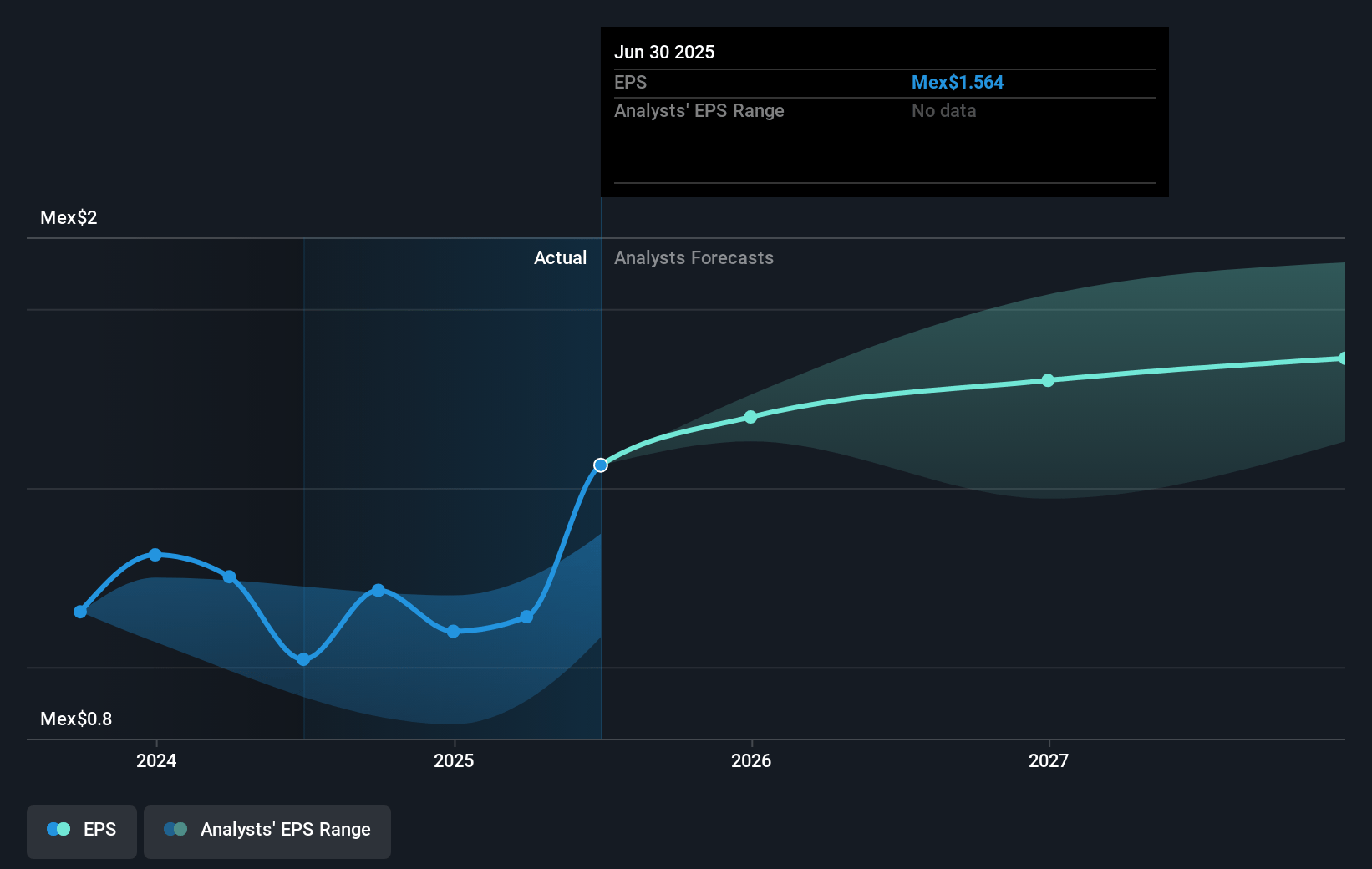

- The bearish analysts expect earnings to reach MX$6.7 billion (and earnings per share of MX$1.7) by about July 2028, up from MX$4.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, down from 20.1x today. This future PE is lower than the current PE for the MX Beverage industry at 18.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.87%, as per the Simply Wall St company report.

Becle. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing premiumization strategy, combined with enduring consumer demand for high-quality, authentic brands, is driving a favorable product mix and higher margins, providing resilient support for both revenue growth and long-term profitability.

- Becle is benefiting from a sustained period of low agave prices due to oversupply, and management expects this cost advantage to persist for several more years, leading to continued gross margin expansion and improved earnings.

- The company's robust international diversification, especially strong results and positive mix effects from the U.S. market, help offset regional volatility and support consolidated top-line and margin growth across economic cycles.

- Strategic investments in innovation, digital capabilities, and e-commerce, alongside targeted engagement with multicultural consumer segments, are positioning Becle to capitalize on powerful industry trends and expand its revenue base in emerging growth areas.

- Improved financial flexibility, demonstrated by growing cash flow generation, lower net debt, and a solid cash position, enhances Becle's ability to support dividends, pursue strategic opportunities, and invest in future growth without pressuring margins or earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Becle. de is MX$20.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Becle. de's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$37.0, and the most bearish reporting a price target of just MX$20.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be MX$50.7 billion, earnings will come to MX$6.7 billion, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 13.9%.

- Given the current share price of MX$23.04, the bearish analyst price target of MX$20.0 is 15.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.