Key Takeaways

- Strategic investments in manufacturing and digitalization enhance efficiency, potentially improving revenue, net margins, and reversing declining EBITDA trends.

- Expansion into digital channels and growing bebbia service drive new revenue streams, positively impacting sales and profitability.

- Economic challenges and digital investment pressures hindered revenue growth and profitability, with workforce restructuring and cost management posing risks to operational stability.

Catalysts

About Grupo Rotoplas. de- Manufactures, purchases, sells, and installs plastic containers and accessories for water storage, conduction, and improvement solutions in Mexico, Argentina, the United States and internationally.

- The investment in upgrading manufacturing processes in Mexico, specifically for storage solutions, is likely to enhance production efficiency and product quality, which should have positive effects on revenue and net margins as customer satisfaction and demand increase.

- The broad technological revamp, including migrating to Google Cloud and implementing advanced digital analytics and AI tools, is expected to improve operational efficiency and decision-making, potentially enhancing net margins and earnings by reducing costs and increasing productivity.

- Expansion of digital channels through the launch of B2B and B2B2C e-commerce platforms in Mexico can open new revenue streams, increase market reach and potentially drive growth in sales, positively impacting the revenue aspect of financials.

- The company's efforts to streamline operations by reducing headcount and optimizing expenses alongside continuing investments in digitalization are likely to help reverse declining EBITDA trends, maintaining or potentially increasing earnings through cost management.

- The steady growth trajectory of their bebbia service, driven by increased subscriber rates, could contribute significantly to revenue growth, and as the service division becomes profitable, it will also positively impact net margins and earnings.

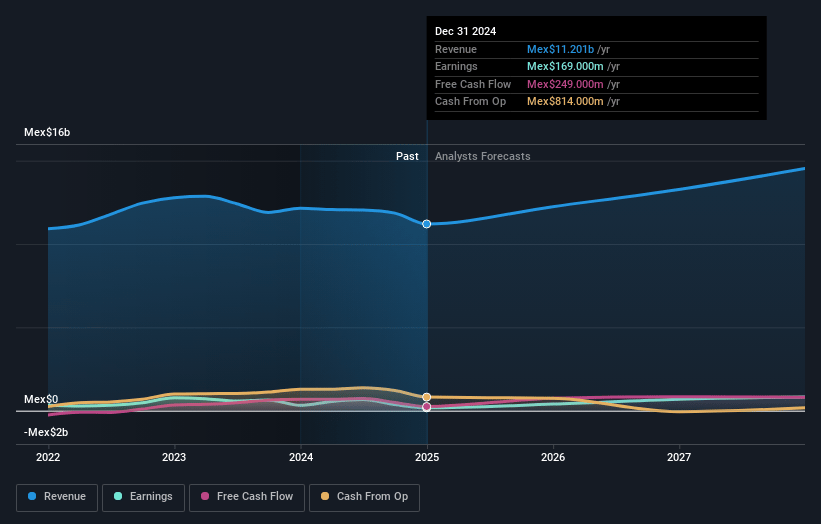

Grupo Rotoplas. de Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Grupo Rotoplas. de's revenue will grow by 11.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.5% today to 3.6% in 3 years time.

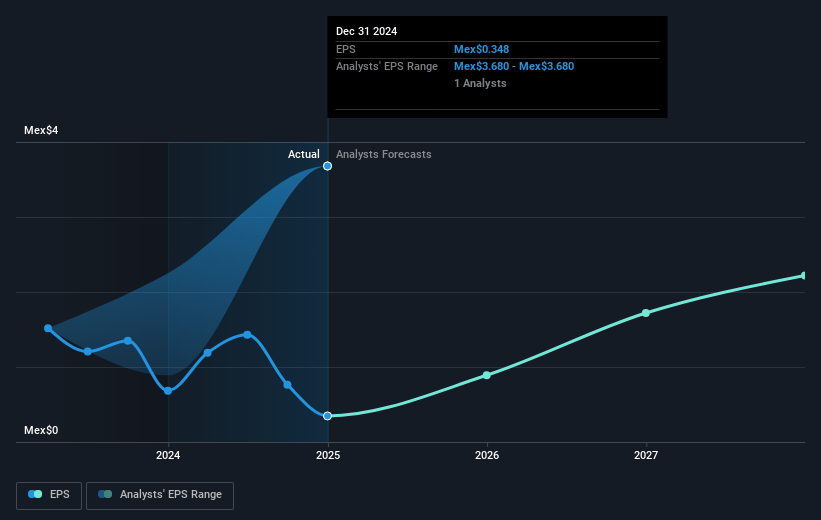

- Analysts expect earnings to reach MX$552.0 million (and earnings per share of MX$8.42) by about February 2028, up from MX$169.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 51.1x on those 2028 earnings, up from 47.0x today. This future PE is lower than the current PE for the MX Building industry at 58.0x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.28%, as per the Simply Wall St company report.

Grupo Rotoplas. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recession in Argentina significantly impacted Grupo Rotoplas' overall results, leading to a decline in top-line revenue and profitability, with net income falling by 46% for the year. This exposes risks related to revenue generation and net margins.

- Planned investments in digital initiatives added further pressure on margins, limiting full-year results, highlighting risks to EBITDA and earnings due to increased capital expenditures and associated costs.

- The company's workforce restructuring involved severance payments that impacted EBITDA margins, revealing operational risks related to cost management and profitability.

- Economic conditions in key markets like Argentina and the United States presented challenges such as declining net sales and negative EBITDA, which pose risks to revenue stability and profitability in these regions.

- The increased focus on cost reduction and free cash flow generation may limit growth-focused investments, risking potential long-term revenue growth and strategic market expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MX$36.225 for Grupo Rotoplas. de based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$50.0, and the most bearish reporting a price target of just MX$24.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$15.4 billion, earnings will come to MX$552.0 million, and it would be trading on a PE ratio of 51.1x, assuming you use a discount rate of 17.3%.

- Given the current share price of MX$16.4, the analyst price target of MX$36.22 is 54.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives