Key Takeaways

- Accelerated digital transformation and targeted SME strategies are driving operational efficiency, higher customer engagement, and sustainable revenue growth.

- Loan book diversification and superior asset quality management support margin resilience and limit credit losses, positioning the bank for stable long-term earnings.

- Ongoing interest rate declines, costly deposit competition, regional loan concentration, and lagging digital adoption are pressuring margins, increasing risk, and threatening profitability.

Catalysts

About Banco del Bajío Institución de Banca Múltiple- Provides banking products and services in Mexico.

- Accelerating digital adoption and innovation-including a 21% CAGR in digital transactions over five years and over 80% of volumes now routed through digital channels-is driving operational efficiency, expanding customer engagement, and supporting strong non-interest income growth (likely boosting fee-based revenues and margins).

- Consistent double-digit growth in company loans and deposits, along with the robust addition of nearly 1,000 new commercial borrowers in a challenging macroeconomic environment, points to the bank's successful targeting of the expanding SME sector and growing middle class; this bodes well for future loan growth and market share gains, supporting sustainable revenue and net income increases.

- Strategic efforts to diversify the loan book-particularly with high-quality, rapidly growing consumer loans-are aligning with rising financial inclusion and formalization in Mexico, reducing concentration risk and supporting margin resilience through multiple economic cycles (positively impacting risk-adjusted earnings).

- Ongoing disciplined asset quality management, evidenced by below-industry NPL ratios, proactive client visits, and strong coverage ratios, should limit future credit losses and stabilize provisioning needs, helping to defend bottom-line earnings against downside scenarios.

- Continued investments in digitalization, branch expansion across high-growth regions, and product innovation position the bank to capitalize on nearshoring and manufacturing sector momentum, supporting both growth in commercial lending and enhanced operational leverage (supporting future revenue scalability and cost-to-income improvements).

Banco del Bajío Institución de Banca Múltiple Future Earnings and Revenue Growth

Assumptions

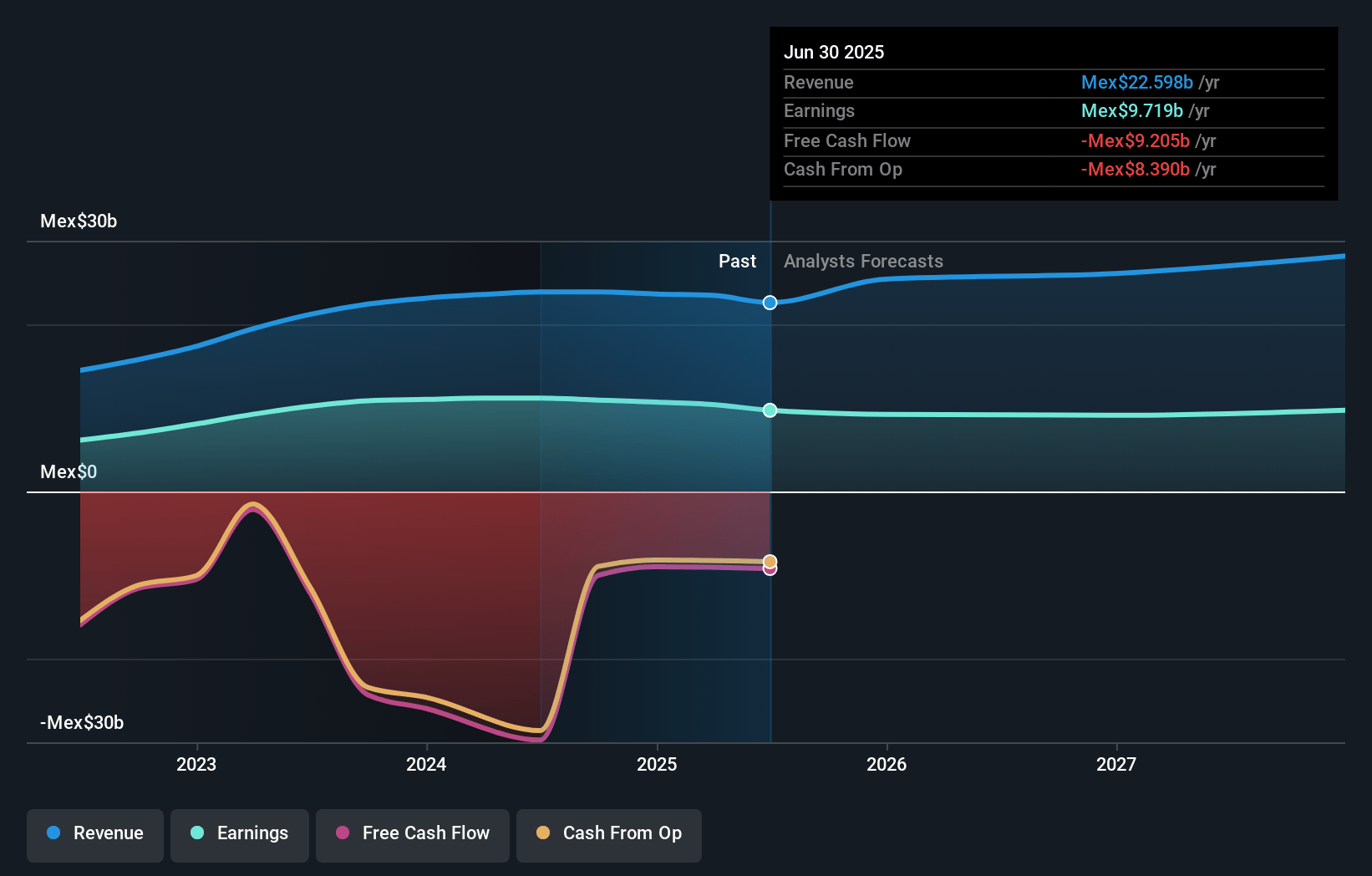

How have these above catalysts been quantified?- Analysts are assuming Banco del Bajío Institución de Banca Múltiple's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 44.3% today to 32.2% in 3 years time.

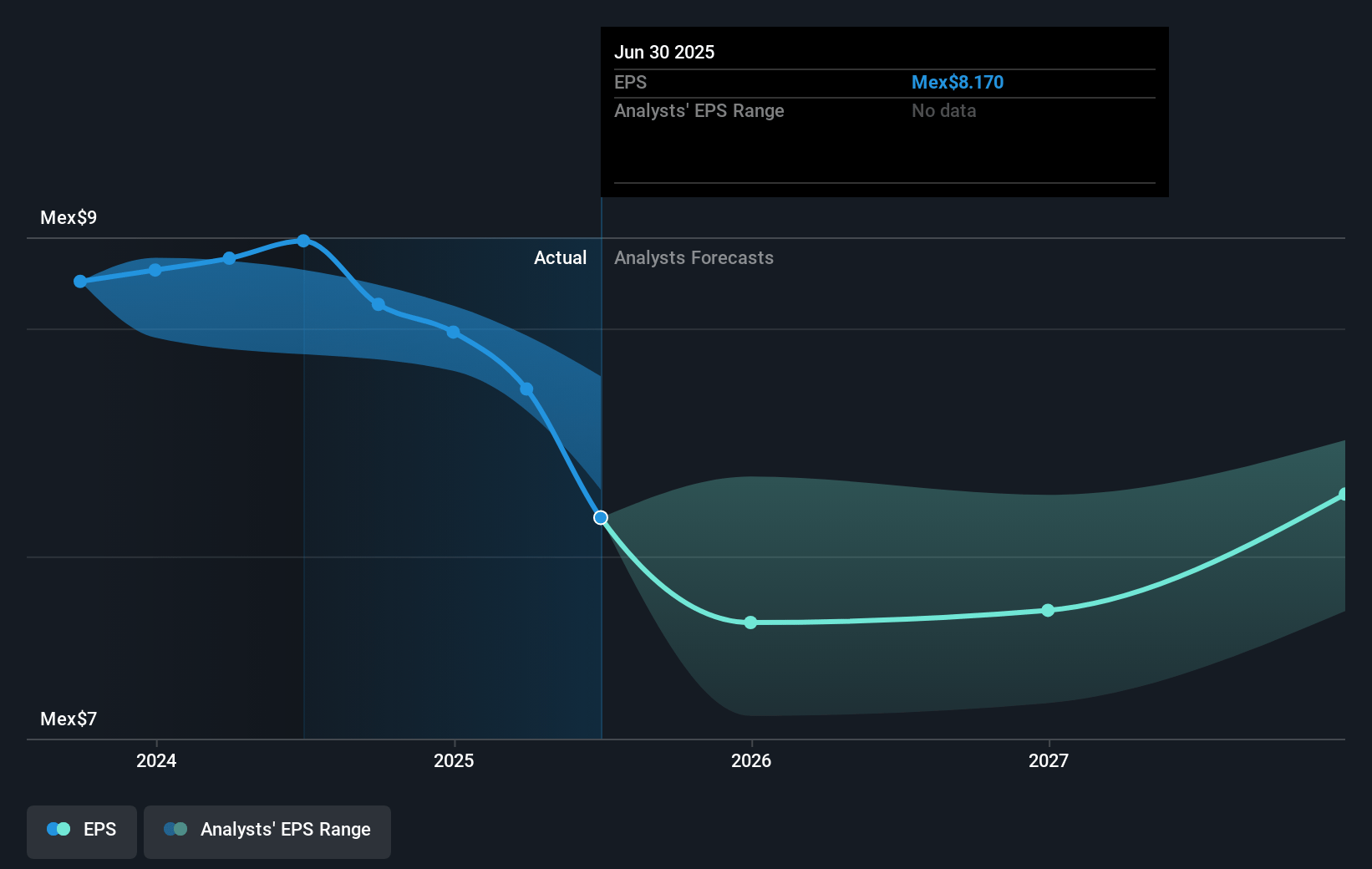

- Analysts expect earnings to reach MX$9.3 billion (and earnings per share of MX$8.24) by about July 2028, down from MX$10.4 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as MX$10.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, up from 4.9x today. This future PE is greater than the current PE for the MX Banks industry at 7.4x.

- Analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.78%, as per the Simply Wall St company report.

Banco del Bajío Institución de Banca Múltiple Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained declines in benchmark interest rates in Mexico are compressing net interest margins (NIM), as reflected in a 68 basis point contraction year-over-year, and management guidance anticipates further pressure if rates fall to 7% or below by the end of 2026, negatively impacting core lending revenues and net income.

- Growing competition for deposits, especially demand deposits with cost, is shifting Banco del Bajío's funding mix toward more expensive sources, which may lead to increased interest expenses and further margin compression, risking overall profitability.

- The bank's concentrated focus on regional (Bajío, Mexico City, Nuevo León) and SME/commercial lending creates exposure to local economic downturns or adverse sector shifts, heightening credit risks and increasing the likelihood of non-performing loans, thus affecting asset quality and future earnings stability.

- While digital channel adoption is increasing, there is acknowledgment of the need for continued investment in branches and technology; lagging in digital transformation relative to emerging fintech competitors could erode customer acquisition, reduce fee-based revenue growth, and raise operating costs, affecting net margins.

- Despite maintaining current asset quality guidance, the management notes higher normalized cost of risk versus historical levels and cites uncertainty around Mexican economic growth, global trade, and tariffs, which could escalate loan losses and require higher provisioning, directly impacting earnings and capital adequacy.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MX$58.407 for Banco del Bajío Institución de Banca Múltiple based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$66.0, and the most bearish reporting a price target of just MX$46.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$28.7 billion, earnings will come to MX$9.3 billion, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 15.8%.

- Given the current share price of MX$42.49, the analyst price target of MX$58.41 is 27.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.