Last Update01 May 25Fair value Increased 0.39%

Key Takeaways

- Increased public investment and major projects in Kuwait are expected to boost NBK's loan growth and revenue.

- Digital innovation and international expansion are projected to improve operational efficiency, stabilize returns, and diversify NBK's revenue streams.

- Increased tax rates, asset yield pressures, geopolitical uncertainties, and rising costs are expected to hinder revenue growth and net margins for National Bank of Kuwait.

Catalysts

About National Bank of KuwaitK.P- Provides financial and investment services and solutions to individual, corporate, and institutional clients in Kuwait, the Middle East, North Africa, Europe, the United Kingdom, and internationally.

- The anticipated unwinding of OPEC production cuts and increased public investment in Kuwait are expected to drive a recovery in GDP growth to 3% in 2025, which can positively affect NBK's revenue growth.

- A substantial pipeline of projects valued at over KWD 10 billion in Kuwait is likely to accelerate, supported by the government's development plans, potentially boosting loan growth and, consequently, NBK's revenue.

- Ongoing investments in digital technology and innovation are expected to enhance operational efficiencies and service offerings, potentially leading to improved net margins.

- The issuance of NBK's first green bond reflects a commitment to sustainable finance, attracting investor interest and potentially diversifying its revenue streams and supporting long-term earnings.

- International expansion and leveraging regional operations, particularly through NBK Wealth and the Islamic banking arm, are expected to stabilize returns and optimize operational costs, potentially enhancing earnings.

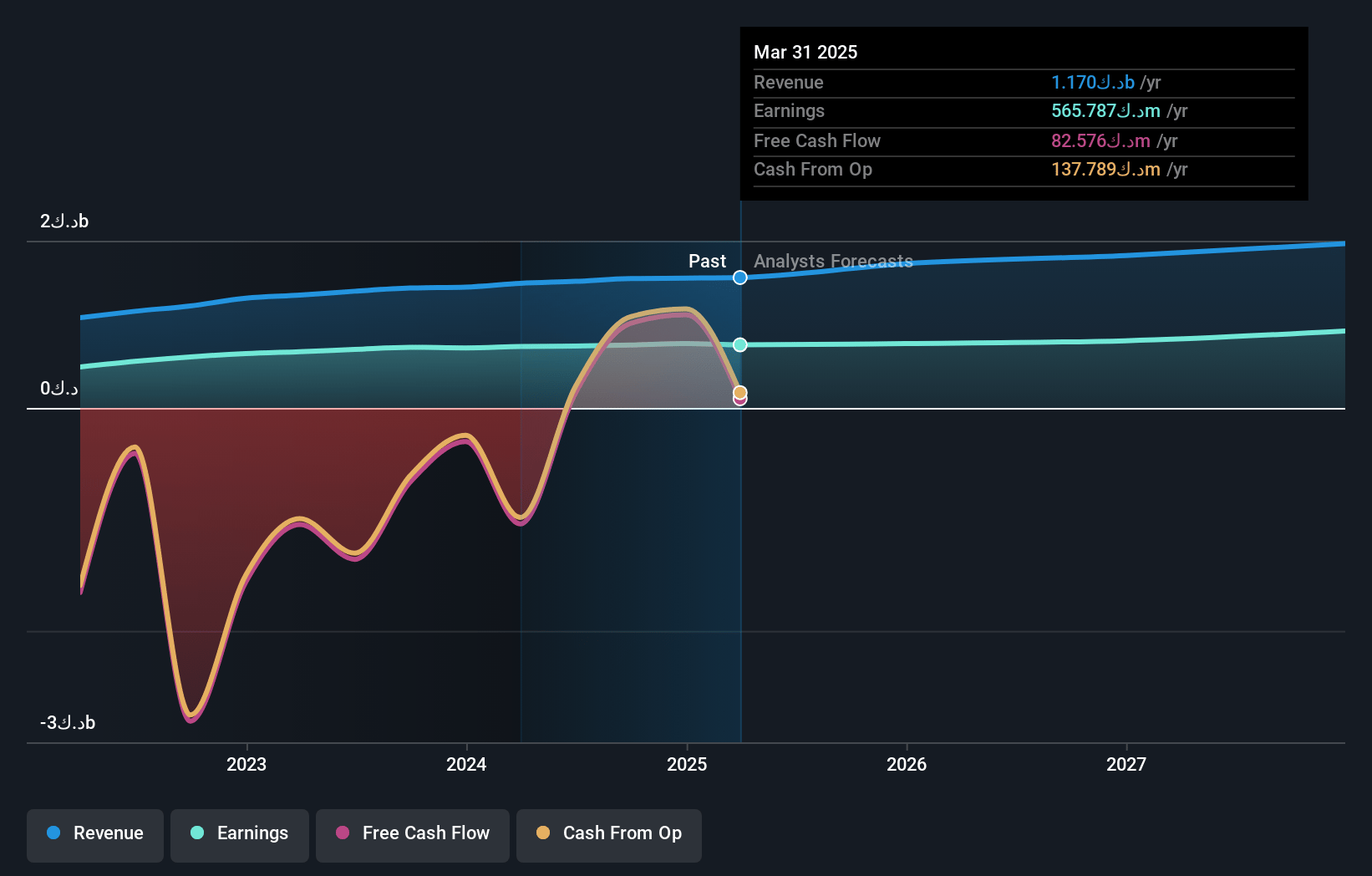

National Bank of KuwaitK.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming National Bank of KuwaitK.P's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 48.3% today to 45.8% in 3 years time.

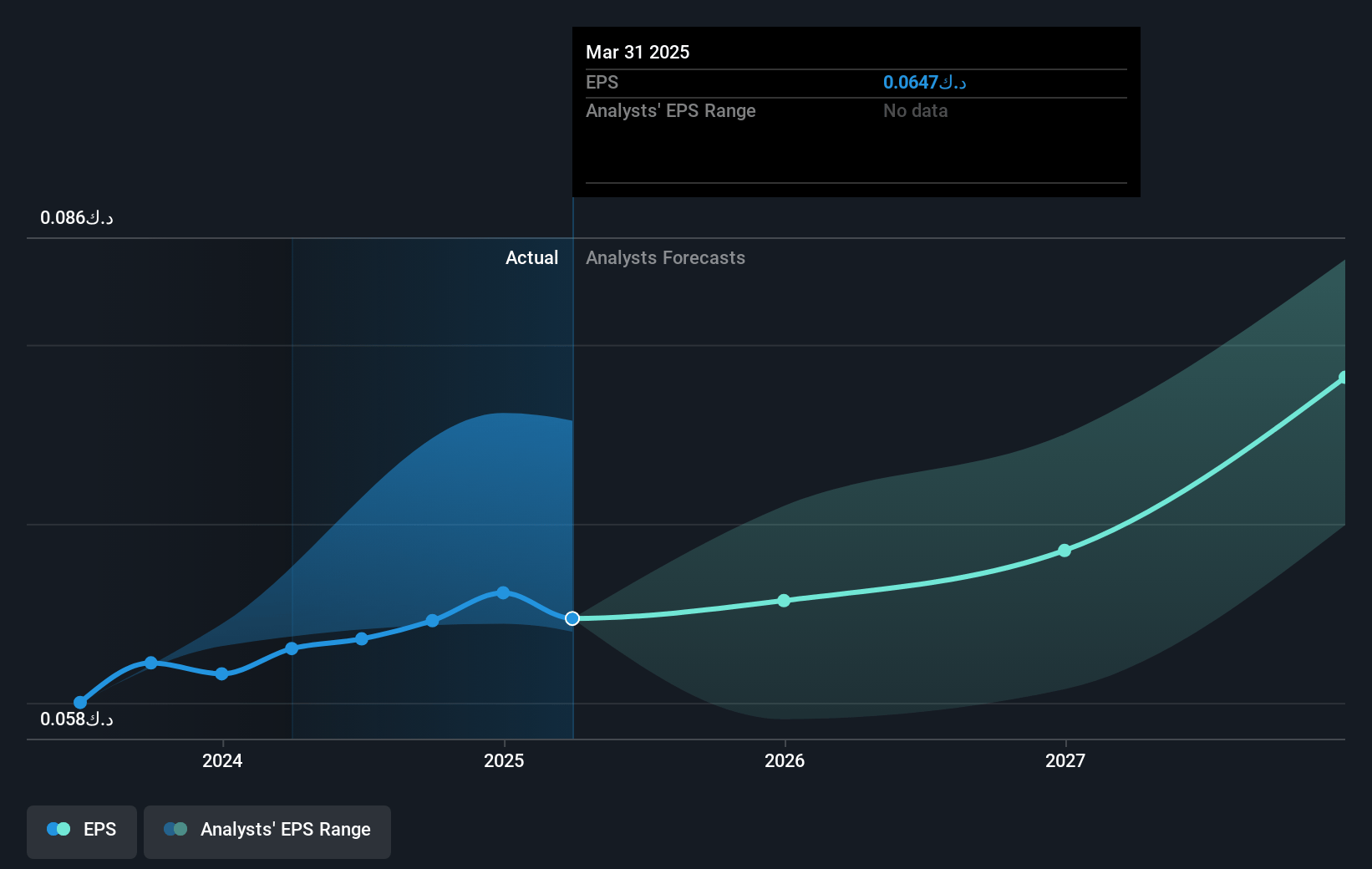

- Analysts expect earnings to reach KWD 704.8 million (and earnings per share of KWD 0.08) by about May 2028, up from KWD 565.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as KWD626 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.8x on those 2028 earnings, up from 14.7x today. This future PE is lower than the current PE for the KW Banks industry at 21.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.4%, as per the Simply Wall St company report.

National Bank of KuwaitK.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The imposition of a new domestic minimum top-up tax (DMTT) from 9% to 15% has significantly increased the effective tax rate, reducing the bank's net profits by 8.5% year-on-year. This higher tax burden directly impacts net margins and earnings.

- The National Bank of Kuwait faces pressure on net interest margins (NIM) due to an unfavorable change in the mix of assets at the Central Bank of Kuwait and lower benchmark interest rates, combined with the effects of the Egyptian pound devaluation. This impacts revenue negatively by reducing the yield on interest-earning assets.

- Global and regional geopolitical instabilities, along with potential repercussions from a trade war and tariff impositions, create a macroeconomic environment full of uncertainties leading to possible slowdowns in business activities and lending, which could adversely affect revenue growth.

- The expected guidance of mid-single-digit loan growth for 2025, resulting from macroeconomic uncertainties and competitive pressures, reflects a cautious outlook that might impede stronger topline revenue gains.

- The cost-to-income ratio is expected to rise to the high 30s, driven by anticipated cost growth of circa 10% as the bank continues to invest in technology and human resources. This could place additional pressure on net margins unless offset by corresponding revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of KWD0.984 for National Bank of KuwaitK.P based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KWD1.19, and the most bearish reporting a price target of just KWD0.72.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be KWD1.5 billion, earnings will come to KWD704.8 million, and it would be trading on a PE ratio of 20.8x, assuming you use a discount rate of 19.4%.

- Given the current share price of KWD0.95, the analyst price target of KWD0.98 is 3.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.