Narratives are currently in beta

Key Takeaways

- The merger with AUB-Kuwait enhances growth potential and solidifies KFH's presence in Islamic finance, expanding access to new client segments.

- Digital transformation and fintech partnerships aim to improve efficiency and costs, while high borrowing costs in Turkey could affect earnings adversely.

- Recent merger and digital transformation could enhance market position and profitability for KFH, while economic stabilization may bolster revenue and investor confidence.

Catalysts

About Kuwait Finance House K.S.C.P- Provides Islamic banking services in the Middle East, Europe, and other countries.

- The successful merger of KFH and AUB-Kuwait has positioned the company for increased growth, potentially enhancing future revenue streams and solidifying their market presence in the Islamic finance sector.

- KFH's commitment to digital transformation, including the development of AI-powered systems and partnerships with fintech companies, indicates a potential for increased operational efficiency and cost savings, potentially improving net margins.

- The completion of the conversion of AUB-Egypt and AUB-UK to Sharia-compliant banks suggests an expansion in the Islamic finance market, likely to lead to enhanced earnings potential through access to new client segments.

- Increased borrowing costs associated with financing operations in Turkey, amidst a high interest rate environment, are likely to impact net margins and earnings adversely.

- The anticipated introduction of the mortgage law in Kuwait could significantly boost loan growth for KFH, potentially increasing revenue from lending operations.

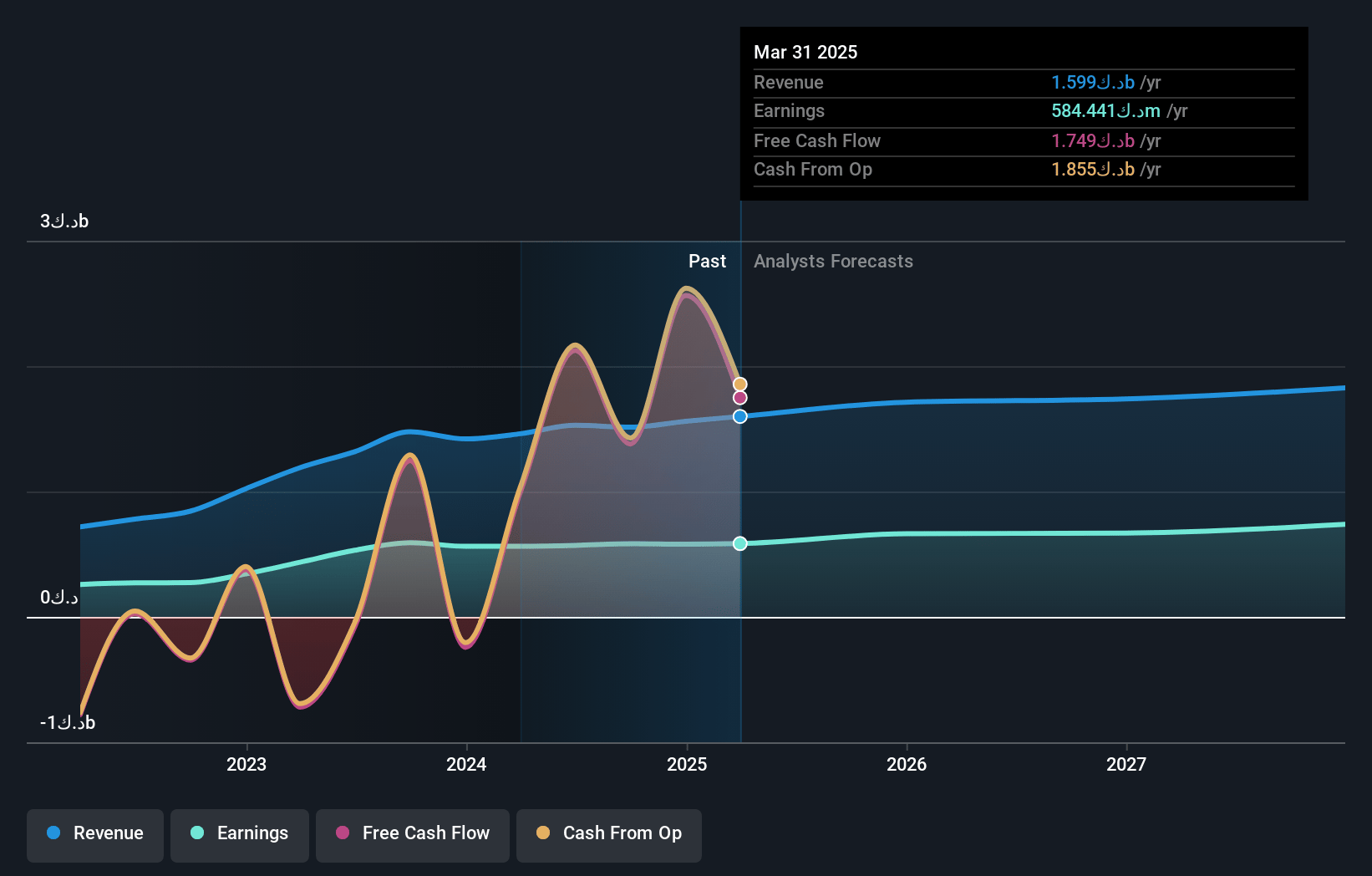

Kuwait Finance House K.S.C.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kuwait Finance House K.S.C.P's revenue will grow by 2.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 38.3% today to 46.8% in 3 years time.

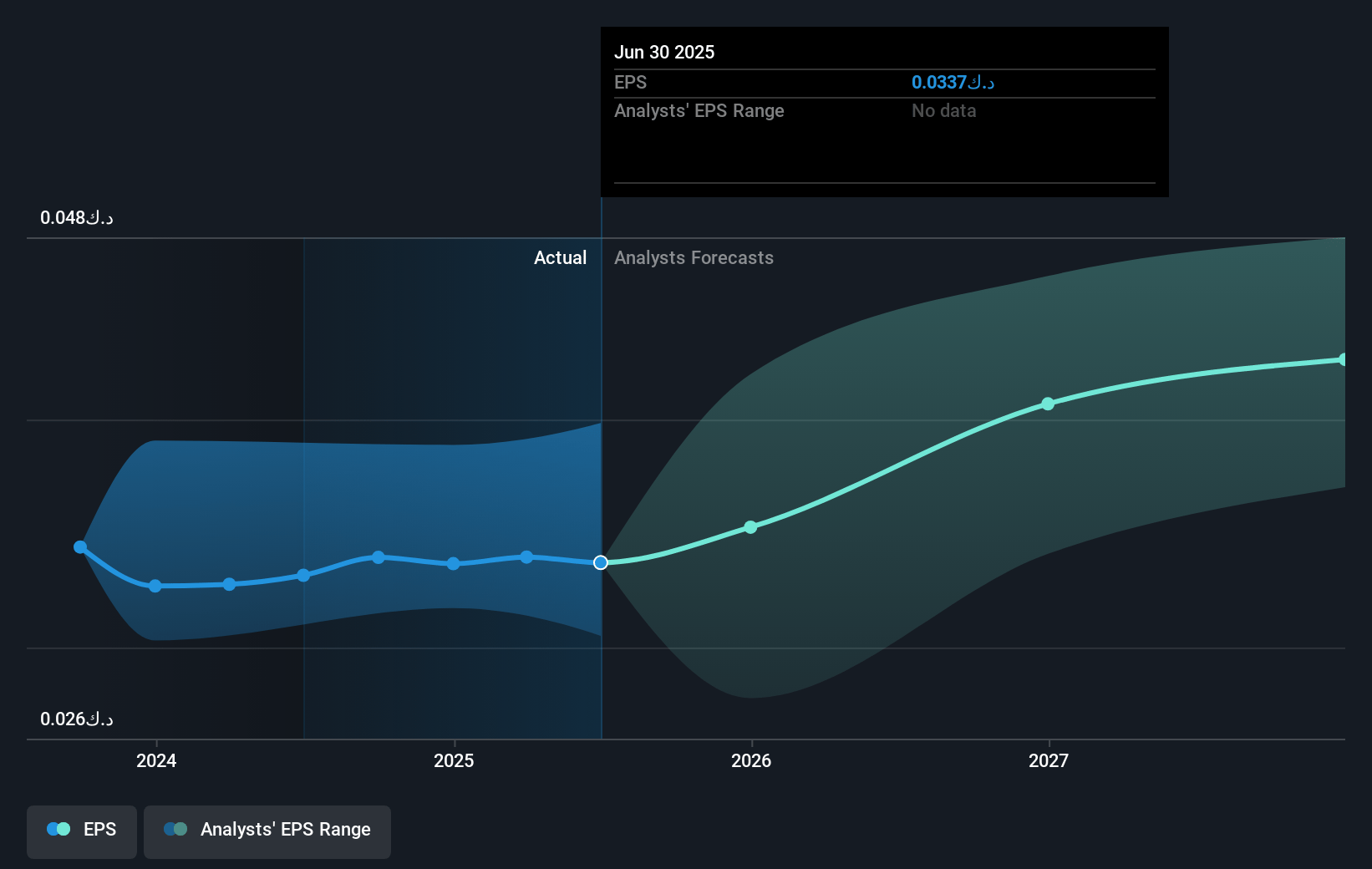

- Analysts expect earnings to reach KWD 789.0 million (and earnings per share of KWD 0.04) by about January 2028, up from KWD 601.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting KWD899 million in earnings, and the most bearish expecting KWD679 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.9x on those 2028 earnings, up from 21.7x today. This future PE is greater than the current PE for the KW Banks industry at 20.0x.

- Analysts expect the number of shares outstanding to grow by 7.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.52%, as per the Simply Wall St company report.

Kuwait Finance House K.S.C.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The easing of the headline inflation rate in Kuwait, alongside reductions in housing and transportation costs, suggests potential economic recovery and stabilization, which could lead to stronger revenue growth and financial performance for KFH.

- KFH's recent successful merger with AUB-Kuwait has created a major financial entity in the Islamic finance industry, potentially enhancing market position and contributing positively to earnings.

- The improved economic outlook for Kuwait, with expected GDP growth of 3.8% in 2025, combined with a strong national credit rating, could bolster investor confidence and positively impact KFH’s net margins and revenue streams.

- KFH's focus on sustainability, as demonstrated by its high ESG ratings, may attract more conscientious investors and clients, potentially strengthening revenue and profitability.

- Digital transformation efforts, including the development of AI-driven processes and the success of its Sharia-compliant digital bank, may lead to efficiency gains and cost reductions, improving overall profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of KWD0.6 for Kuwait Finance House K.S.C.P based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KWD0.8, and the most bearish reporting a price target of just KWD0.22.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be KWD1.7 billion, earnings will come to KWD789.0 million, and it would be trading on a PE ratio of 26.9x, assuming you use a discount rate of 19.5%.

- Given the current share price of KWD0.79, the analyst's price target of KWD0.6 is 30.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives