Key Takeaways

- Strategic focus on AI infrastructure and B2B solutions aims to boost revenue and market expansion through partnerships and new contracts.

- Subscription-based models and LLM investments enhance customer experience and operational efficiency, supporting long-term earnings growth despite short-term losses.

- Decreased net income and competitive challenges in AI raise concerns about future dividends, market share, and strategic growth, amid execution risks from AI investments.

Catalysts

About SK Telecom- Provides wireless telecommunication services in South Korea.

- SK Telecom plans to become a leader in the global AI data center market by leveraging its extensive data center operational experience and partnerships with companies like Lambda, leading to potential increased revenues from AI infrastructure services.

- The company's focus on AI B2B and the expansion of enterprise AI solutions is expected to boost revenue growth by winning significant contracts and expanding into new markets.

- SK Telecom's strong subscription model, exemplified by T Universe, positions it to capitalize on the changing landscape of the AI B2C market, potentially enhancing revenue streams through new subscription-based services.

- Investments in AI-specific large language models (LLMs) and partnerships with global tech companies aim to enhance customer experience and operational efficiency, potentially improving net margins through cost reductions and higher operational efficiency.

- The company's commitment to maximizing shareholder returns, despite recent nonoperating losses, and its focus on long-term growth targets, such as a total revenue goal of ₩30 trillion by 2030 with a significant AI contribution, are likely to drive future earnings growth and increase EPS.

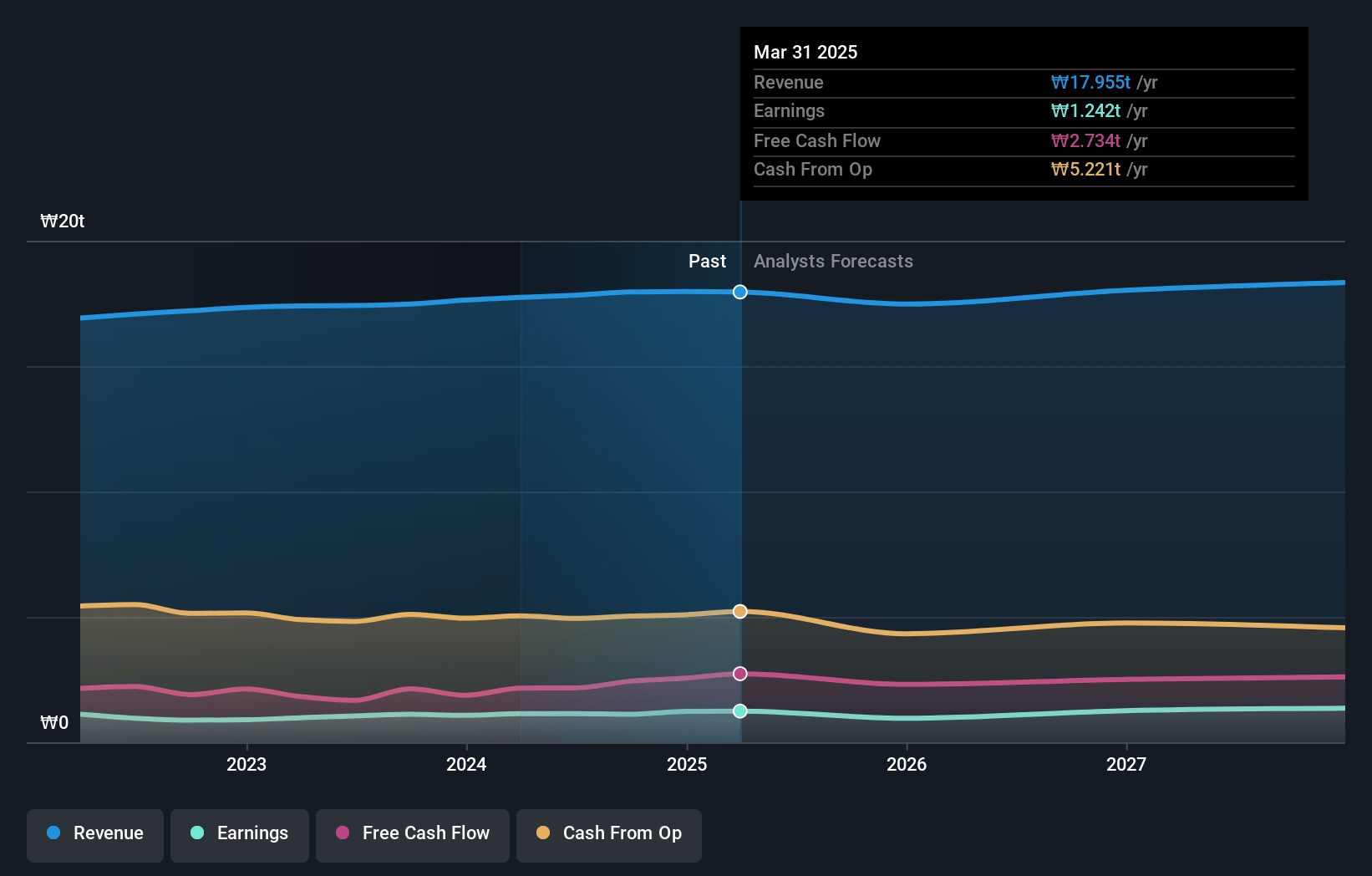

SK Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SK Telecom's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.2% today to 7.6% in 3 years time.

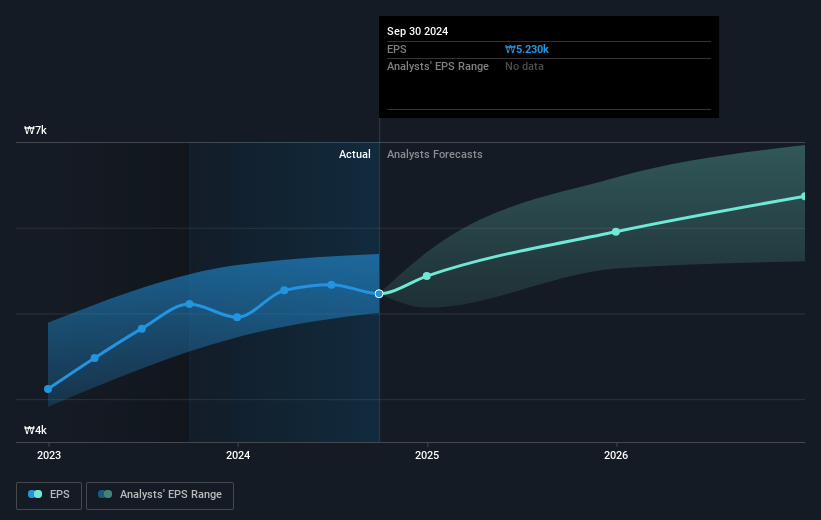

- Analysts expect earnings to reach ₩1446.8 billion (and earnings per share of ₩6911.6) by about January 2028, up from ₩1115.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₩1214.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, up from 10.5x today. This future PE is lower than the current PE for the GB Wireless Telecom industry at 16.4x.

- Analysts expect the number of shares outstanding to decline by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

SK Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recognition of nonoperating losses, caused by valuation losses from investment assets, has led to a decrease in net income by 9% year-over-year, which could potentially impact future dividend payouts and shareholder returns. This affects net margins and earnings.

- The lack of SK Telecom's inclusion in the Korea Value-up Index suggests a potential undervaluation by the market and may hinder its investor attractiveness, affecting shareholder perception and potentially stock price. This impacts corporate valuation and perceived market worth.

- Increased competition in the AI B2C market shift led by existing platform companies may challenge SK Telecom's ability to gain a significant market share, posing risk to their expected AI-derived revenue growth. This affects revenue from the AI B2C segment.

- Rapid expansion and investment in AI data centers and technologies entail significant capital expenditures and execution risks. Any delays or cost overruns could impact profitability. This affects cash flow and capital expenditures.

- Uncertainty around the pace of AI revenue growth relative to traditional telecommunications business raises questions on whether SK Telecom can achieve its ambitious target of making AI account for 35% of total revenue by 2030. This impacts long-term revenue projections and strategic growth outcomes.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩69086.96 for SK Telecom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩86000.0, and the most bearish reporting a price target of just ₩56000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩19029.5 billion, earnings will come to ₩1446.8 billion, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 6.4%.

- Given the current share price of ₩54800.0, the analyst's price target of ₩69086.96 is 20.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives