Key Takeaways

- Hyperscale data center expansion and deep tech partnerships could dramatically amplify SK Telecom's AI revenue and profit margins beyond current expectations.

- Modular AI data centers and 5G leadership position SK Telecom for new B2B revenue streams, persistent subscriber growth, and potential valuation re-rating via tech spin-offs.

- Intensifying competition, regulatory pressures, rising costs, and cybersecurity fallout threaten SK Telecom's subscriber base, margins, and growth, challenging both profitability and strategic flexibility.

Catalysts

About SK Telecom- Engages in the provision of wireless telecommunication services in South Korea.

- While analyst consensus acknowledges SK Telecom's AI and cloud business as a growth driver, they may be significantly underestimating the multiplier effect of hyperscale data center expansion-with construction pipelines open through 2030 and deep partnerships with global tech leaders positioning SK Telecom to capture outsize share of Korea and regional AI infrastructure demand, this could more than double AI-related revenues and dramatically boost consolidated EBITDA margins in coming years.

- Analysts broadly agree AI-driven operational efficiencies will support higher profitability, but they may overlook how full enterprise digitization and automation (enabled by advanced internal AI, agentic AI services, and rapid data center scale) could structurally reduce SK Telecom's cost base and drive a step-change increase in long-term net margins and free cash flow.

- The ongoing proliferation of connected devices and edge computing requirements-spanning IoT, telehealth, and video/gaming-directly aligns with SK Telecom's nationwide 5G and eventual 6G leadership, giving the company enduring ARPU uplift opportunities and stickier high-value subscriber growth that supports long-term top-line expansion.

- SK Telecom's modular and tailored AI data center business model-offering turnkey and customized AI infrastructure solutions for enterprises-creates first-mover advantage in Korea's digital transformation wave, unlocking entirely new recurring B2B revenue streams that are not yet factored into consensus projections for earnings.

- Structural changes in the market, including potential spin-offs and value-unlocking transactions of its tech and data center businesses, could rapidly drive a re-rating in SK Telecom's valuation multiples, as pure-play tech infrastructure units command premium valuations and boost overall ROE and EPS for shareholders.

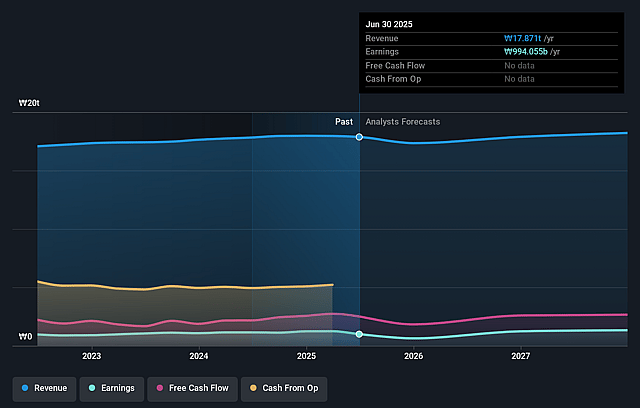

SK Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SK Telecom compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SK Telecom's revenue will grow by 4.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.9% today to 8.1% in 3 years time.

- The bullish analysts expect earnings to reach ₩1666.0 billion (and earnings per share of ₩7734.79) by about July 2028, up from ₩1241.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, up from 9.6x today. This future PE is lower than the current PE for the GB Wireless Telecom industry at 18.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

SK Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent cybersecurity incident has triggered an increase in customer churn, with more subscribers switching to rival mobile network providers; combined with South Korea's demographic decline and ongoing competition from MVNOs, this could shrink SK Telecom's core subscriber base over time and negatively impact both revenue and profit generation.

- The mandated suspension of new subscriber sign-ups following the cybersecurity breach leads to immediate pauses in customer acquisition, creating direct downside risk to revenue growth, especially as regulatory scrutiny and stricter privacy enforcement may impose longer-term limitations on new customer onboarding and digital service expansion.

- Mounting costs from large-scale USIM replacements, potential administrative penalties, and necessary investments in customer protection raise the company's operating expenses; if high compliance burdens and data privacy regulations accelerate in coming years, SK Telecom's net margins and overall profitability could face structural pressure.

- Ambitious long-term capital expenditures on hyperscale data centers and AI infrastructure could expose SK Telecom to risks if industry-wide adoption of next-generation digital services does not keep pace, as commoditization of connectivity services erodes ARPU while non-core technology bets may dilute management focus and weigh on returns from invested capital, impairing free cash flow and dampening earnings growth.

- Intensified regulatory oversight on pricing, together with pressure to maintain stable dividends despite uncertain earnings, may constrain SK Telecom's strategic flexibility and its ability to reinvest in growth areas, threatening both sustained revenue expansion and the reliability of shareholder returns in a slow-growing, increasingly commoditized telecommunications sector.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SK Telecom is ₩78000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SK Telecom's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩78000.0, and the most bearish reporting a price target of just ₩42000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩20591.9 billion, earnings will come to ₩1666.0 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of ₩56100.0, the bullish analyst price target of ₩78000.0 is 28.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.