Narratives are currently in beta

Key Takeaways

- Strong demand for AI memory and high-performance products is expected to drive revenue growth and improve profit margins.

- Technological advancements and focus on higher-margin products position SK hynix for sustainable growth and competitive advantage.

- Delayed demand recovery, increased competition, inventory issues, and aggressive expansion create risks for revenue growth and profitability in DRAM and HBM markets.

Catalysts

About SK hynix- Engages in the manufacture, distribution, and sale of semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

- Continued strong demand for AI memory products, such as HBM and enterprise SSDs, is expected to drive revenue growth and improve profitability due to higher ASPs and margins compared to traditional DRAM and NAND products.

- Expansion of sales in value-added products like HBM3E and the anticipated shift to HBM3E 12Hi products are set to grow DRAM revenue by increasing ASPs, as these high-performance products gain a larger share of total sales.

- Increasing demand for AI-enhanced PCs and smartphones is projected to boost DRAM content per device, driving higher revenue and potentially improving profit margins as SK hynix strengthens its position in high-performance memory markets.

- Strategic shift to higher-margin enterprise SSDs in the NAND segment is expected to increase revenue and operating profit margins, driven by robust demand from data centers and cloud providers seeking high-capacity solutions.

- Continuous technological advancements and production capacity expansions in cutting-edge memory technologies, such as the industry's first 16-gigabit DDR5 using 1c nanometer node and HBM4 development, are poised to maintain competitiveness and support sustainable earnings growth.

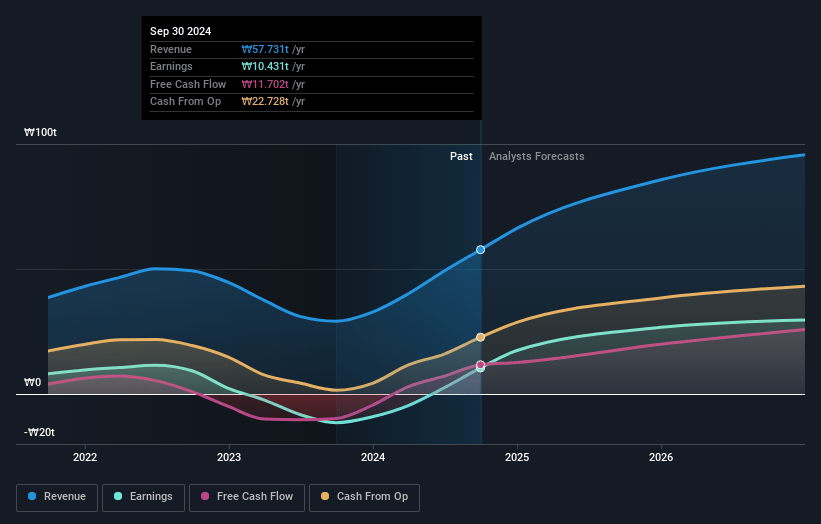

SK hynix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SK hynix's revenue will grow by 12.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.1% today to 21.7% in 3 years time.

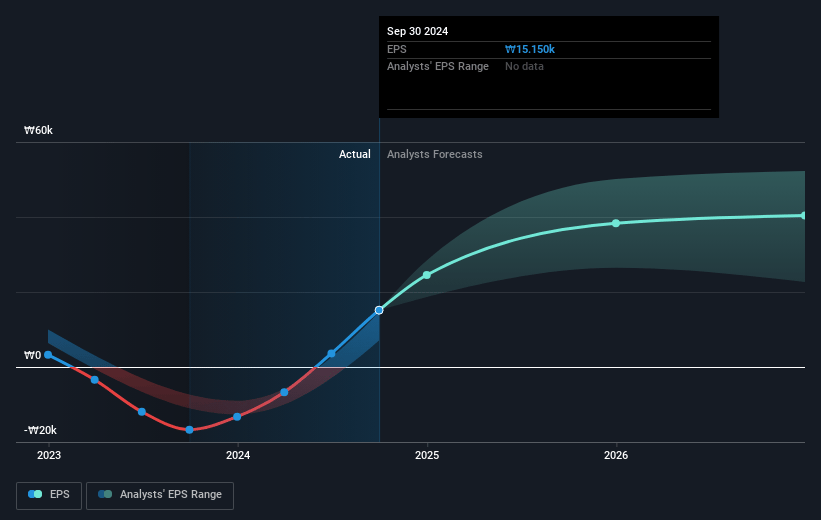

- Analysts expect earnings to reach ₩17714.0 billion (and earnings per share of ₩25074.1) by about January 2028, up from ₩10431.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, up from 11.5x today. This future PE is lower than the current PE for the KR Semiconductor industry at 30.0x.

- Analysts expect the number of shares outstanding to grow by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.42%, as per the Simply Wall St company report.

SK hynix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delayed recovery in demand for conventional applications such as PCs and smartphones, coupled with weak procurement demand, could negatively impact overall revenue growth.

- Increased competition from Chinese suppliers entering the legacy DRAM market may lead to a further fall in prices for general purpose DRAM like DDR4 and LPDDR4, potentially affecting net margins.

- The inventory issues due to a slower-than-expected recovery in mobile and PC demand might necessitate inventory corrections, impacting both earnings and profitability in the short term.

- Concerns about potential oversupply in the HBM market due to aggressive capacity expansion, especially with Chinese suppliers, might pressure pricing and revenue if demand does not meet expectations.

- Increased capital investment needed for developments in advanced products like HBM and infrastructure projects may strain financial resources and potentially impact net earnings if not met with proportional demand growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩257190.49 for SK hynix based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩350000.0, and the most bearish reporting a price target of just ₩135000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩81703.6 billion, earnings will come to ₩17714.0 billion, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 9.4%.

- Given the current share price of ₩173900.0, the analyst's price target of ₩257190.49 is 32.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives