Key Takeaways

- Kakao's focus on user engagement and AI-driven services could enhance revenue streams and profit potential through targeted advertising and differentiated offerings.

- Strategic divestment and concentration on key markets aim to stabilize revenues, while healthcare innovations promise new growth opportunities in the coming years.

- Kakao faces challenges with declining revenue, underperforming content and ad segments, market uncertainties, and commerce payment delays, impacting growth and earnings stability.

Catalysts

About Kakao- Operates mobile and online platforms in South Korea.

- Kakao is focusing on increasing user engagement within KakaoTalk by introducing new services that encourage exploration and entertainment, potentially boosting future advertising and commerce revenues.

- By divesting non-core operations and concentrating on key markets such as Japan and Korea, Kakao aims to reaccelerate growth in its core content businesses, which should improve revenue stability and potential profitability.

- The development and integration of personalized AI services like Kanana aim to open new business models and revenue streams, enhancing user engagement and service differentiation, which could positively impact future earnings.

- Kakao Healthcare is poised to expand its market presence, especially with its diabetes management app, PASTA, and the CGM technology, potentially establishing a new revenue base with Komodo’s healthcare data platform business expected to contribute to sales growth by 2025.

- Despite macroeconomic challenges, Kakao plans to win a larger share of advertisers' budgets by leveraging new ad products and strategies, like full-screen ads and personalized shopping curation, aiming for revenue growth and potentially higher net margins.

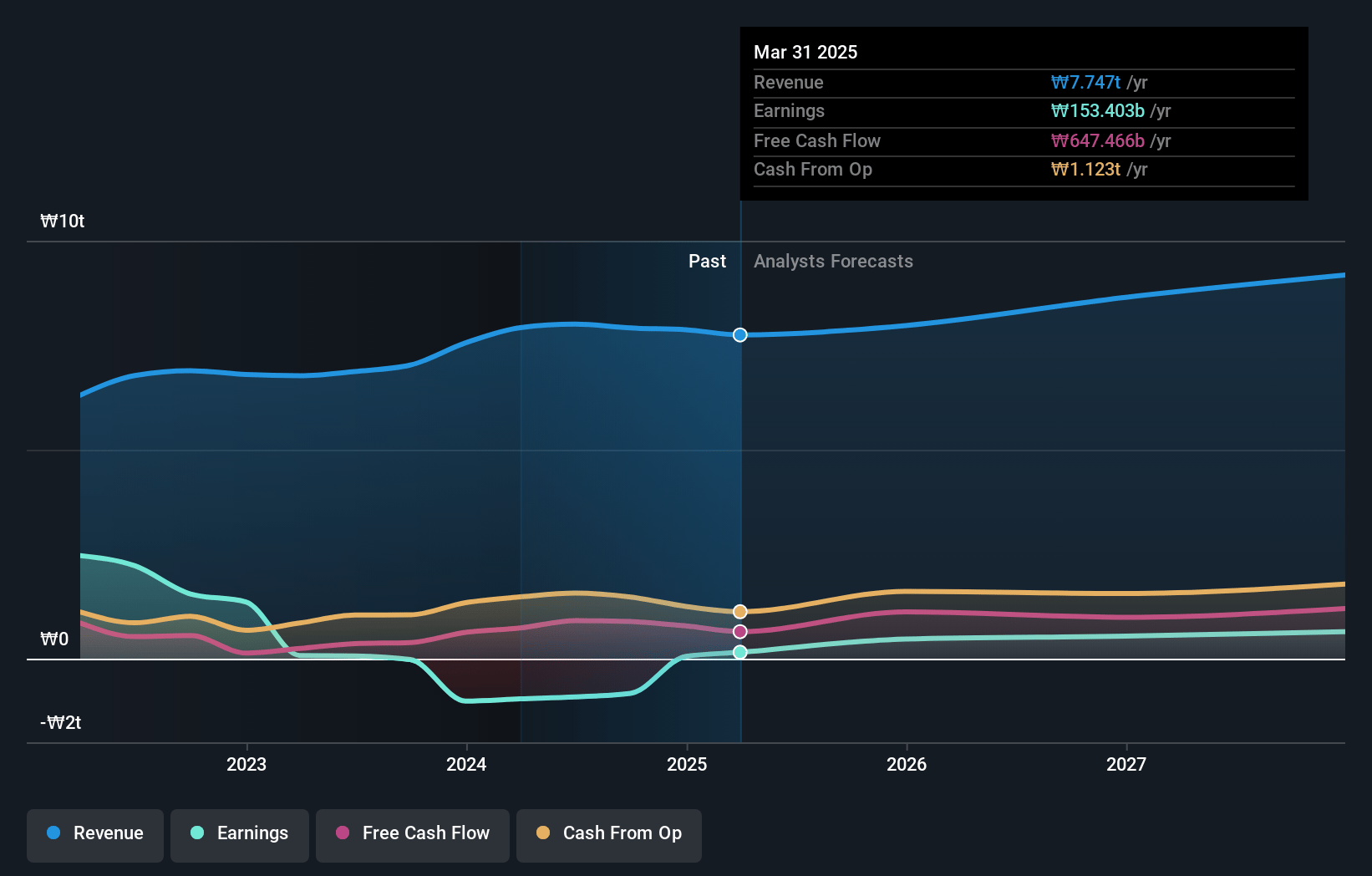

Kakao Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kakao's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -10.5% today to 7.4% in 3 years time.

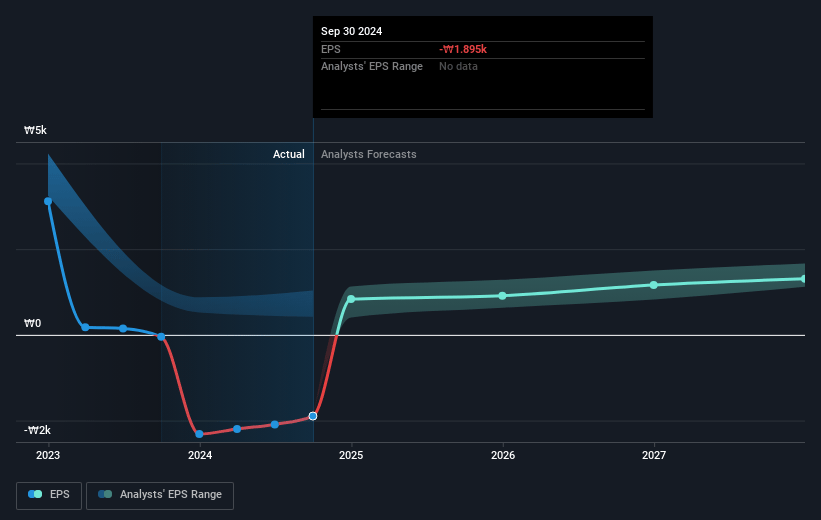

- Analysts expect earnings to reach ₩733.6 billion (and earnings per share of ₩1661.12) by about January 2028, up from ₩-830.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩811.3 billion in earnings, and the most bearish expecting ₩399.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.9x on those 2028 earnings, up from -18.9x today. This future PE is greater than the current PE for the KR Interactive Media and Services industry at 19.7x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.18%, as per the Simply Wall St company report.

Kakao Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kakao's revenue declined by 4% year-on-year, which could indicate underlying challenges in sustaining growth, potentially impacting the company's ability to improve its net margins and overall earnings.

- The Content segment, including Kakao Games and story business, showed disappointing results, with a decrease in content revenue by 14% year-on-year, raising concerns about future contributions to revenue and earnings from this segment.

- The delay in the overall recovery of the advertising market and price competition from new entrants like Chinese e-commerce players negatively impacted ad revenue, which can suppress revenue growth and net profit margins.

- The company is facing external market challenges and uncertainties, particularly in the advertisement and content sectors, which could prolong financial recovery and affect future earnings.

- Large-scale payment delays in the commerce industry affected smaller partners, reflecting potential risks in supply chain and commerce operations, which may hinder revenue stability and growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩47228.57 for Kakao based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩60000.0, and the most bearish reporting a price target of just ₩33000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩9884.2 billion, earnings will come to ₩733.6 billion, and it would be trading on a PE ratio of 35.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of ₩35750.0, the analyst's price target of ₩47228.57 is 24.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives