Key Takeaways

- Prolonged industry oversupply and uncertain market conditions are likely to constrain LG Chem's revenue growth and keep pressure on margins and earnings recovery.

- Expansion into sustainable technologies and specialty chemicals may enhance future competitiveness, but high investment needs and cautious market development could limit short-term gains.

- Persistent weak demand, competition, and high investment needs create sustained margin pressure, cash flow risk, and volatility in LG Chem's earnings and competitive position.

Catalysts

About LG Chem- Engages in the petrochemicals, energy, advanced materials, and life science businesses in Korea, China, Asia/Oceania, the United States, Europe, and internationally.

- While LG Chem's battery materials segment stands to benefit from the long-term global acceleration in EV adoption and energy storage demand, ongoing weakness in metal prices, persistent overcapacity, and rising policy uncertainty in North America may limit revenue growth and put sustained pressure on net margins for the next several years.

- Although the global push for sustainable technologies and stricter ESG standards could open new markets for LG Chem's recycling, biomaterials, and circular economy initiatives, slow market development and selective investment due to uncertain returns could constrain the realization of cost efficiencies and dampen near

- to mid-term earnings improvements.

- While joint ventures in North America and advanced investment in next-generation battery chemistries should, over time, boost market share and future profitability, recent downward adjustments in planned manufacturing capacity reflect management's more cautious stance; this response to weak downstream demand could curb top-line growth and delay margin expansion.

- Even though the ongoing industry consolidation and vertical integration may ultimately favor large, diversified players like LG Chem, persistent oversupply in both the petrochemicals and battery sectors and the entry of new, well-capitalized competitors in China and the US may erode LG Chem's market share, causing revenue and net margins to face continued headwinds.

- Despite efforts to rationalize lower-margin commodity lines and focus on high-value, less cyclical specialty chemicals, mounting capital expenditure demands for plant upgrades and R&D, along with restrictions on access to government incentives for large conglomerates, could depress free cash flow and slow the recovery of earnings.

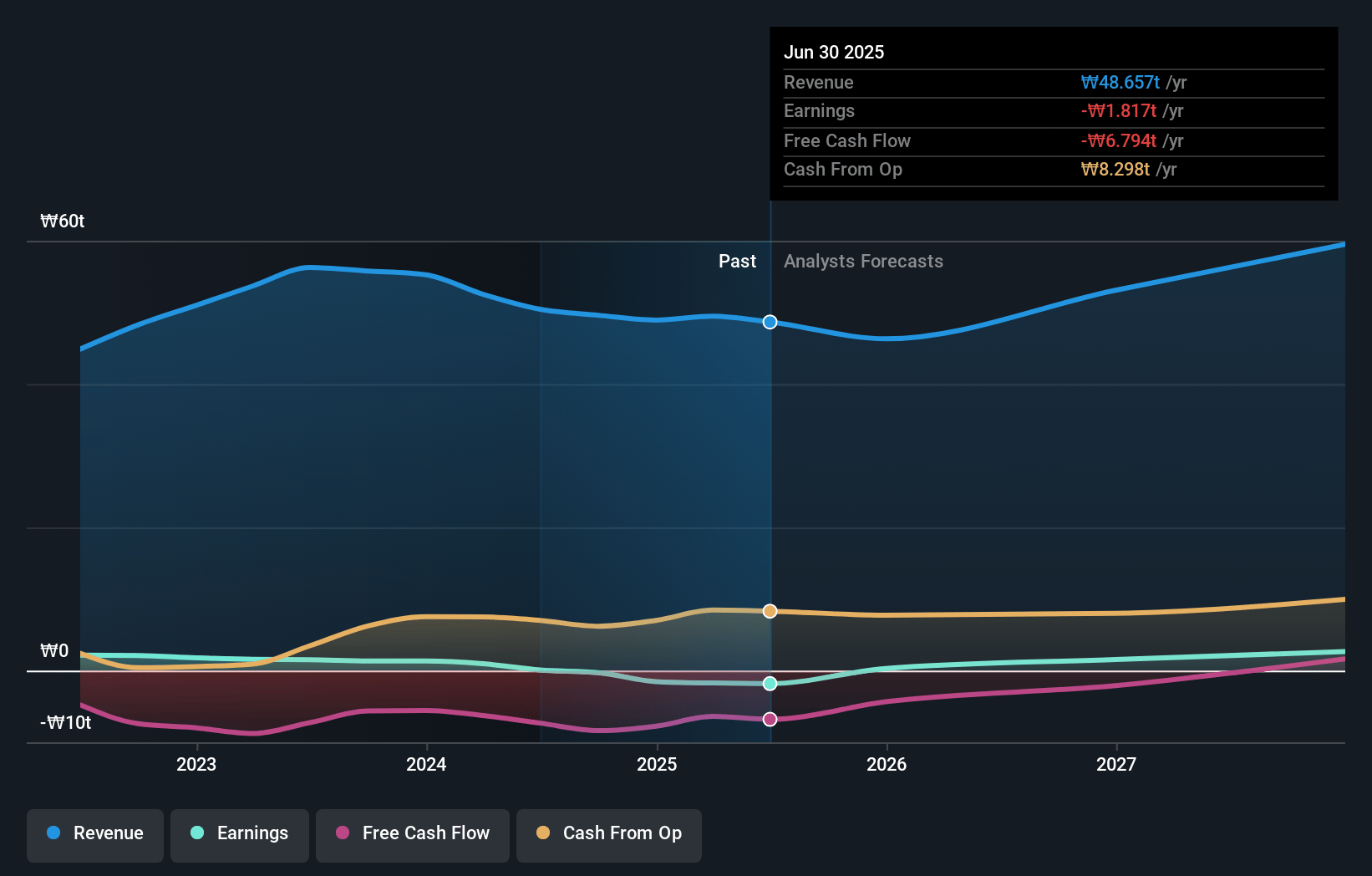

LG Chem Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on LG Chem compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming LG Chem's revenue will decrease by 0.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -3.5% today to 4.5% in 3 years time.

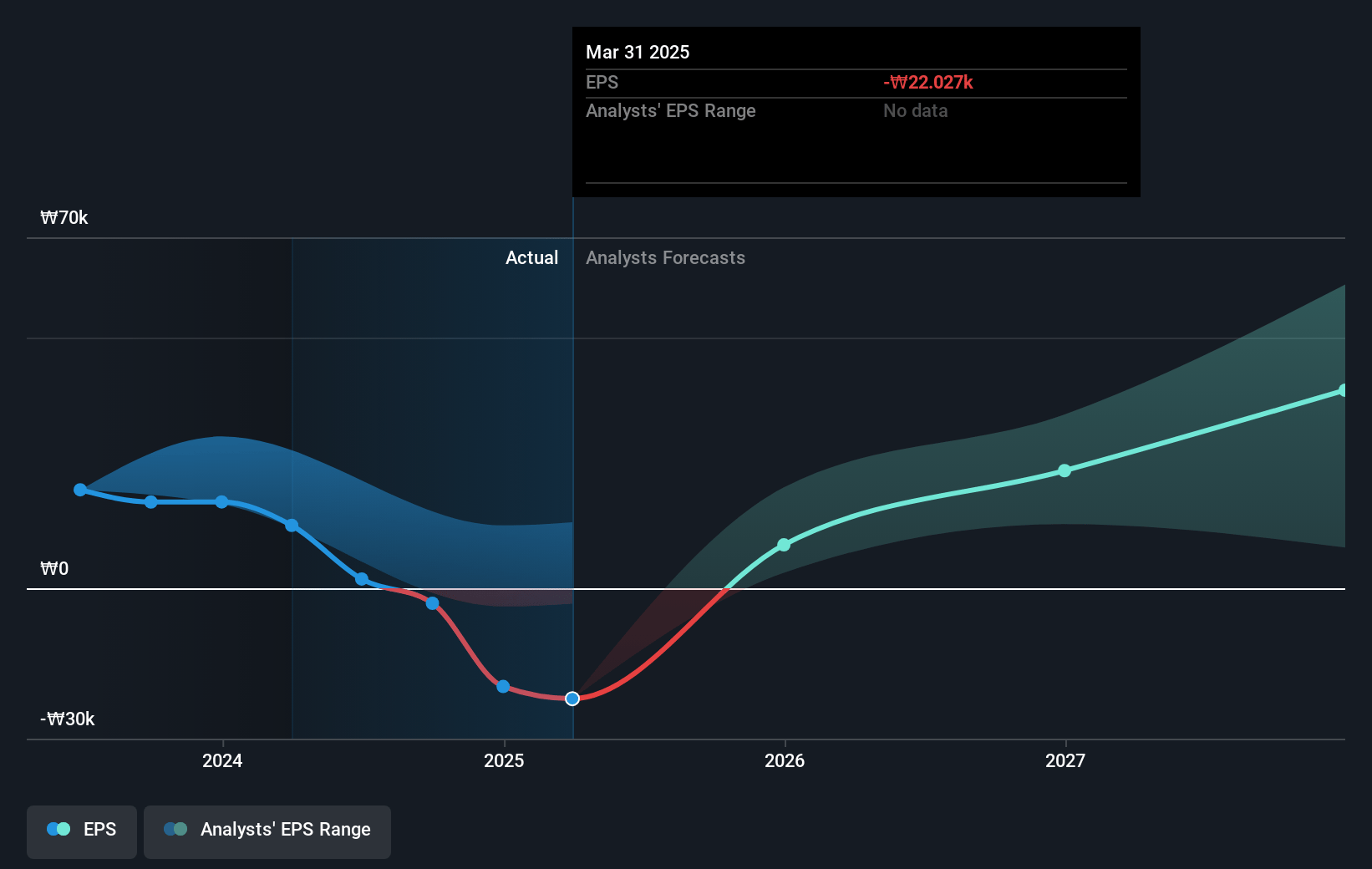

- The bearish analysts expect earnings to reach ₩2228.9 billion (and earnings per share of ₩10599.45) by about July 2028, up from ₩-1724.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from -13.2x today. This future PE is greater than the current PE for the KR Chemicals industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.11%, as per the Simply Wall St company report.

LG Chem Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent global oversupply and weak demand in the petrochemical sector, along with delayed economic recovery in China, could lead to continued decline in LG Chem's core materials revenues and prolonged pressure on net margins.

- Heightened uncertainty and potential rollback of environmental policies in major economies, as well as slowing growth in downstream EV and semiconductor markets, may limit expansion in battery materials sales and restrict both revenue and profitability.

- Ongoing capital expenditure requirements for R&D, capacity expansion, and gigafactory buildouts-especially amid a slower-than-expected market ripening for sustainability businesses-could stress LG Chem's balance sheet and reduce free cash flow, negatively impacting earnings.

- The risk of recognition of impairment losses, as seen in the separator business and new drug development projects, along with significant interest expenses and foreign exchange losses, may continue to drag on net profits and contribute to earnings volatility.

- Continued oversupply and commoditization in the global battery and petrochemicals markets, combined with competition from large, vertically integrated rivals and evolving next-generation battery technologies, could lead to downward pressure on pricing, compressing top-line growth and eroding competitiveness in net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for LG Chem is ₩275000.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of LG Chem's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩500000.0, and the most bearish reporting a price target of just ₩275000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩49226.5 billion, earnings will come to ₩2228.9 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 10.1%.

- Given the current share price of ₩291000.0, the bearish analyst price target of ₩275000.0 is 5.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.