Key Takeaways

- U.S. manufacturing expansion and policy support position Hanwha Solutions to gain market share and improve margins as local content becomes more valuable.

- Integrated solar solutions and ESG trends create recurring, high-margin revenue streams and enhance access to funding, supporting long-term financial growth.

- Heavy dependence on volatile revenues, rising debt, and operational weaknesses in key segments threaten financial stability and hinder long-term growth amid uncertain market and regulatory conditions.

Catalysts

About Hanwha Solutions- Operates in the chemicals, energy solutions, and advanced materials business areas in South Korea and internationally.

- Strategic U.S. manufacturing capacity expansion enables Hanwha Solutions to benefit from domestic content incentives and tariffs, positioning the company to gain market share as imports from China decline. This should boost revenue growth and raise net margins as local manufacturing becomes more valuable in the U.S. market.

- Growing adoption of residential solar and energy financing solutions (TPO model) in the U.S. taps into long-term demand for renewables and the trend toward electrification, offering recurring revenue streams with higher margins and supporting sustainable earnings growth.

- Recovery in U.S. module pricing, reinforced by policy support (e.g., IRA AMPC and new tariffs on Southeast Asian exporters), is likely to improve profitability of Hanwha's solar module business, enhancing gross margins and operating income.

- Vertical integration across the solar value chain (from manufacturing to installation and financing) creates margin synergies and pricing power, supporting both revenue stability and net margin expansion.

- Strengthening ESG mandates and capital flows toward green businesses elevate the potential for higher valuations and wider access to funding, positively impacting the company's financial flexibility and long-term earnings prospects.

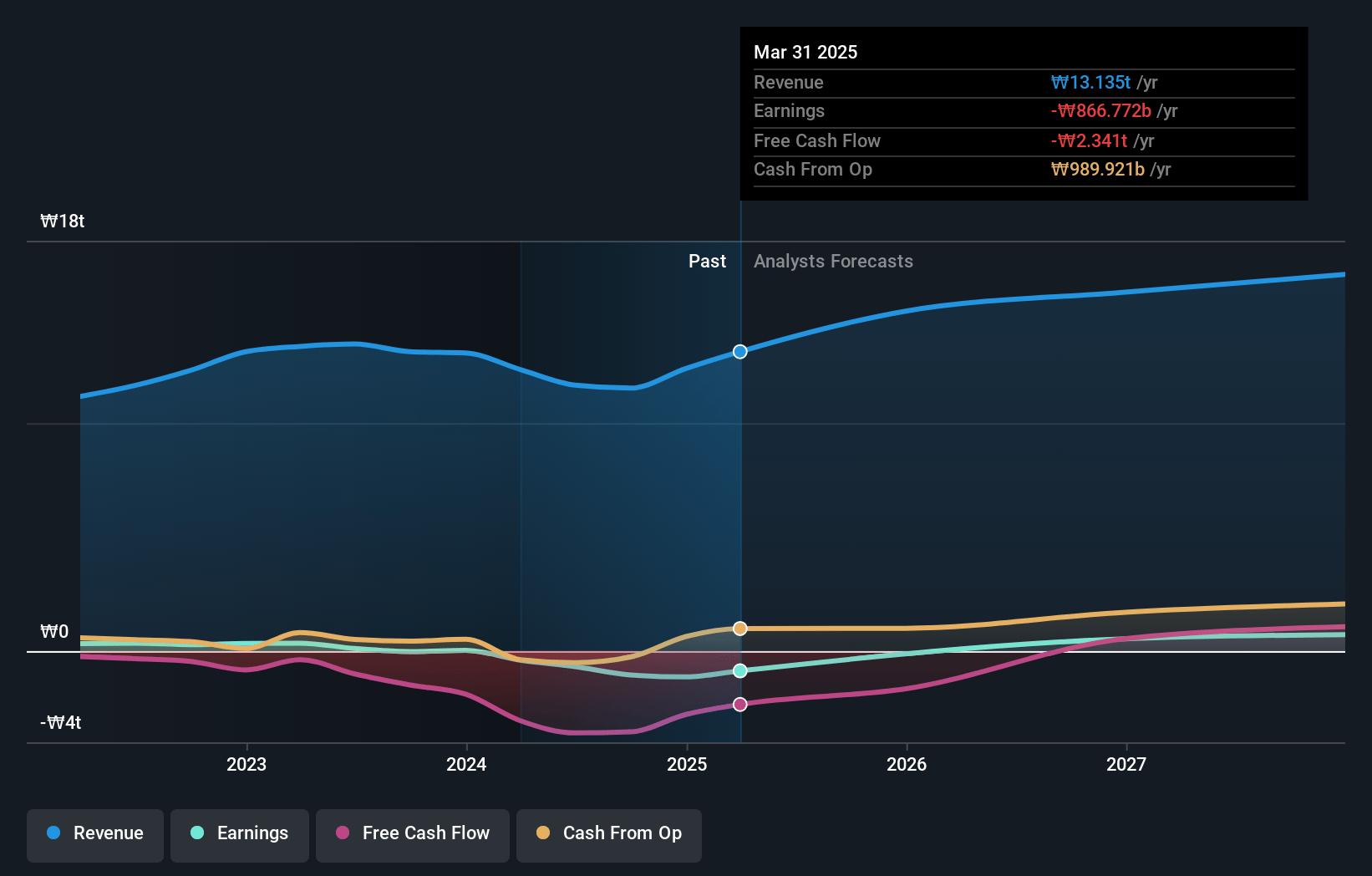

Hanwha Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hanwha Solutions's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.6% today to 6.9% in 3 years time.

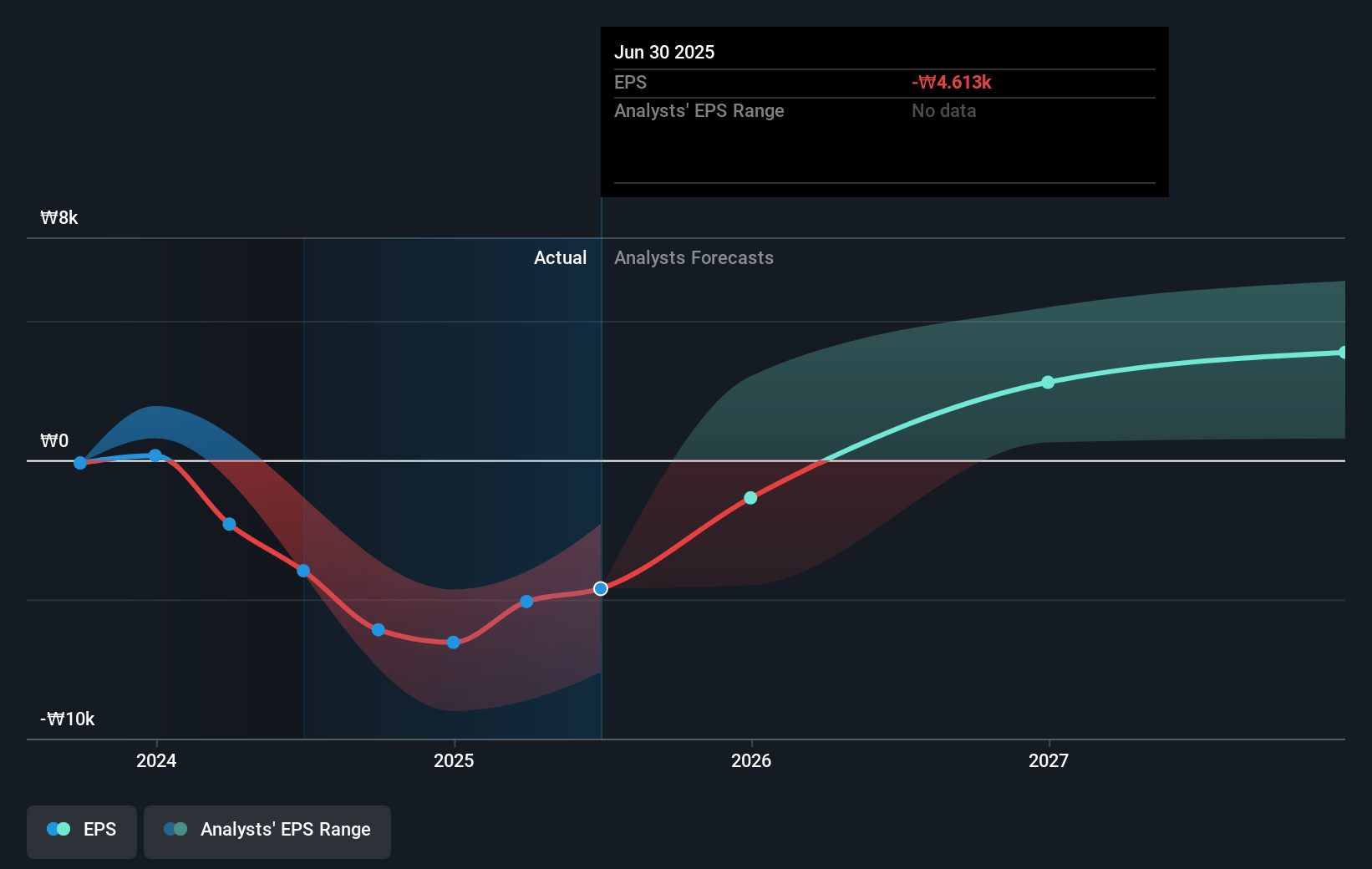

- Analysts expect earnings to reach ₩1198.5 billion (and earnings per share of ₩3965.5) by about July 2028, up from ₩-866.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₩133.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, up from -7.5x today. This future PE is lower than the current PE for the KR Chemicals industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 1.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.81%, as per the Simply Wall St company report.

Hanwha Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hanwha Solutions' consolidated revenue and operating profit have experienced significant year-on-year declines-33% and 72% respectively in the first quarter of 2025-primarily due to reliance on volatile asset sales and declining EPC/module shipments, signaling potential structural weakness in the sustainability of revenue streams and raising risks to near

- and long-term earnings growth.

- High leverage is a mounting concern, with total liabilities, borrowing, and net borrowings each rising substantially and the debt-to-equity and net debt ratios now at elevated levels (192% and 112%), which could be problematic given rising interest rates and tighter financial conditions, thereby squeezing net margins and limiting financial flexibility for investment or expansion.

- The Residential Energy segment's recent surge in profitability is largely attributed to a one-off shift in business model (such as ABS securitization and asset sales), with management acknowledging it is too premature to provide forward guidance in an early-stage, potentially volatile business; this heightens uncertainty regarding recurring revenues and stable margins over time.

- Ongoing operating losses and margin pressures in the Chemicals and module manufacturing businesses-exacerbated by high raw material costs, thin margins, and recurring maintenance issues-reflect the risk that Hanwha Solutions may lag in its transition away from lower-growth, carbon-intensive segments, potentially hampering overall margin recovery and profitability in an environment of rising regulatory and sustainability demands.

- While short-term benefits are realized from U.S. tariffs limiting Chinese competitors, future regulatory shifts or ongoing global trade tensions could unpredictably alter Hanwha's competitive positioning, particularly as persistent overcapacity, pricing pressure, and the threat of emerging solar technologies raise risks of eroding market share, stranded assets, and prolonged margin compression across core businesses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩37450.0 for Hanwha Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩51000.0, and the most bearish reporting a price target of just ₩15000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩17245.9 billion, earnings will come to ₩1198.5 billion, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 11.8%.

- Given the current share price of ₩37800.0, the analyst price target of ₩37450.0 is 0.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.