Key Takeaways

- The global pivot to renewables, ESG pressures, and investor sentiment threaten S-Oil's margins, financing prospects, and long-term growth.

- Heavy reliance on Middle Eastern crude, limited diversification, and rising regional competition heighten earnings volatility and overexposure to industry downturns.

- The company is positioned for long-term growth and profitability with strategic investments, resilient financials, and an emphasis on sustainable shareholder returns amid favorable industry fundamentals.

Catalysts

About S-Oil- S-Oil Corporation manufacture and sell oil refining, lube, and petrochemical products in South Korea.

- The accelerating shift toward renewables and electric vehicles in key Asian and global export markets poses a structural threat to long-term demand for S-Oil's core refined petroleum and petrochemical products, putting sustained downward pressure on both top-line revenue and gross margins.

- Intensifying ESG regulations and a global investor shift away from high-carbon industries are expected to raise S-Oil's cost of capital and restrict international financing access, impacting future growth opportunities and compressing net margins in the long run.

- S-Oil's heavy dependence on crude imports from the Middle East-primarily its parent, Saudi Aramco-increases vulnerability to geopolitical supply disruptions and input-cost volatility, which could lead to unstable earnings and unpredictable cash flows across cycles.

- The company remains poorly diversified, with limited exposure beyond traditional refining and petrochemicals. This leaves future earnings excessively exposed to cyclical downturns and overcapacity risks in the refining industry, limiting avenues for stable revenue growth.

- Anticipated increases in Asian refining and petrochemical capacity will likely intensify competition and compress industry margins just as S-Oil's major Shaheen Project comes online, heightening the risk that incremental high-margin revenues fall short of expectations and that future return on capital is chronically depressed.

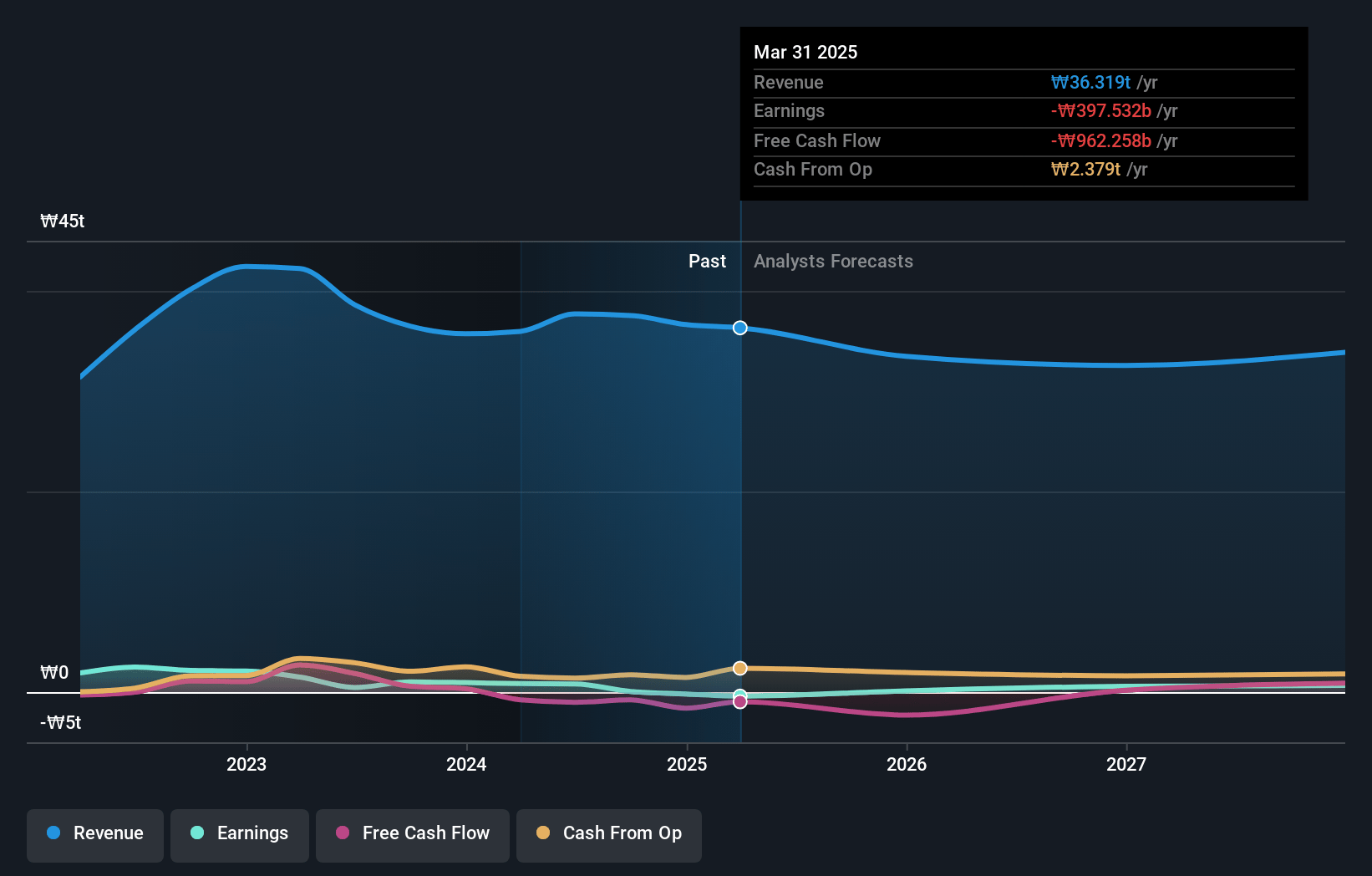

S-Oil Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on S-Oil compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming S-Oil's revenue will decrease by 4.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.1% today to 0.4% in 3 years time.

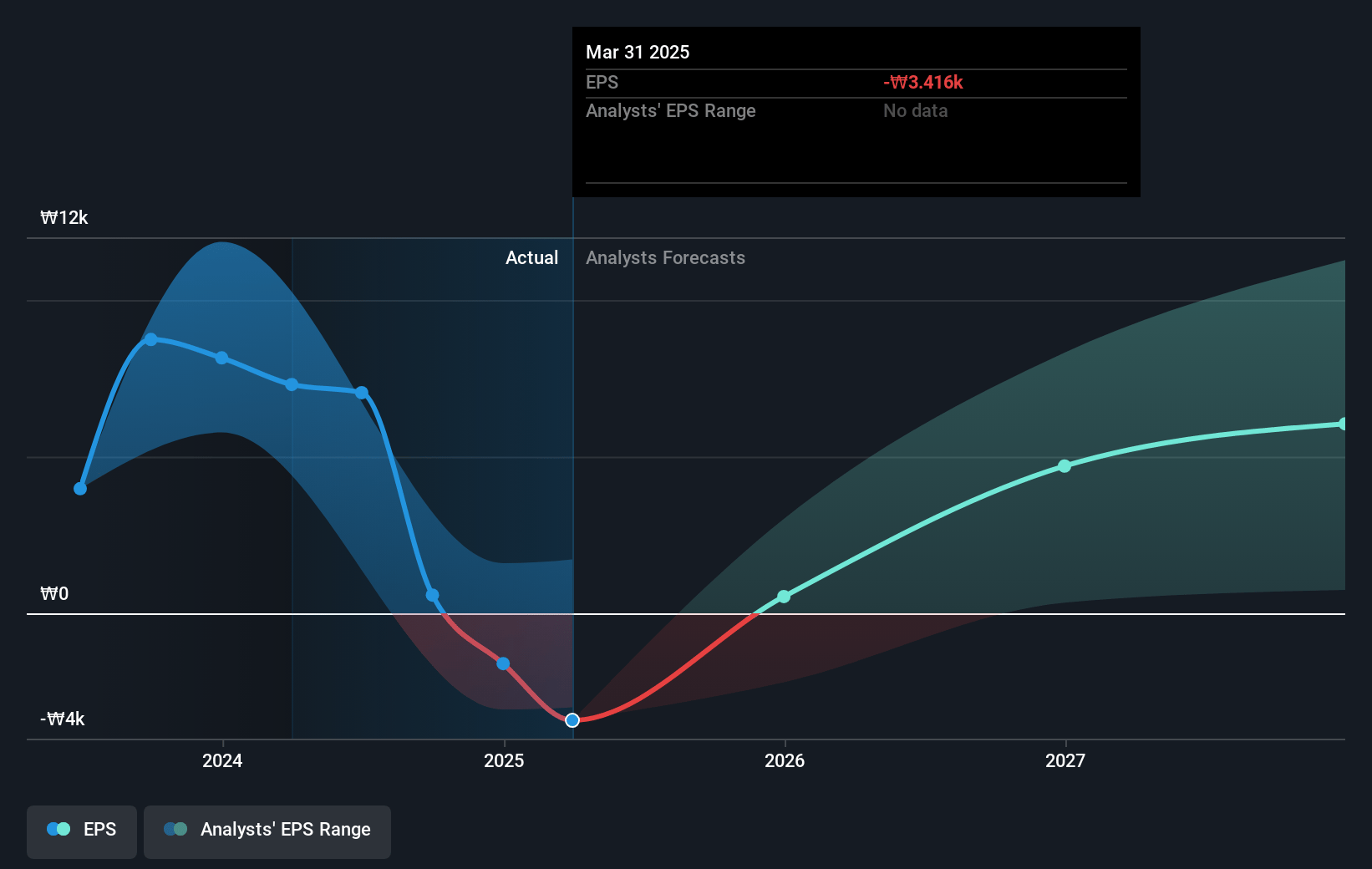

- The bearish analysts expect earnings to reach ₩125.2 billion (and earnings per share of ₩1071.07) by about July 2028, up from ₩-397.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 70.6x on those 2028 earnings, up from -18.4x today. This future PE is greater than the current PE for the KR Oil and Gas industry at 12.0x.

- Analysts expect the number of shares outstanding to grow by 3.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

S-Oil Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Shaheen Project is progressing ahead of schedule and, once completed in 2026–2027, is expected to significantly boost high-margin petrochemicals revenue and enhance overall EBITDA and net margins, supporting long-term earnings growth.

- The company reports that refining margin fundamentals are anticipated to improve as demand growth outpaces net capacity expansion, which supports a positive long-term revenue and margin outlook.

- S-Oil is maintaining a healthy financial structure and sufficient liquidity, allowing it to withstand short-term volatility and positioning it well for future profitability once cyclical downturns subside.

- The company's strategic value-up plan emphasizes both sustainable growth and consistent shareholder returns, including a commitment to maintain a dividend payout ratio of 20% or higher, which may increase the attractiveness of S-Oil's shares and support share price stability or appreciation due to reliable returns.

- Structural underinvestment in global refining outside Asia, combined with capacity additions being limited and some marginal global refineries shutting down, is expected to keep supply tight and support refining margins, which can improve profitability and earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for S-Oil is ₩54456.41, which represents two standard deviations below the consensus price target of ₩73039.13. This valuation is based on what can be assumed as the expectations of S-Oil's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩90000.0, and the most bearish reporting a price target of just ₩54000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩31356.1 billion, earnings will come to ₩125.2 billion, and it would be trading on a PE ratio of 70.6x, assuming you use a discount rate of 8.3%.

- Given the current share price of ₩62700.0, the bearish analyst price target of ₩54456.41 is 15.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.