Key Takeaways

- Slowing transaction growth and looming regulatory challenges threaten projected revenue and margin expansion, raising concerns about Kakao Pay's ability to sustain current momentum.

- Competitive and technological disruption from global players and new financial platforms could erode pricing power and profitability if adaptation is costly or slow.

- Rapid growth, diversified financial services, ecosystem integration, advanced AI use, and ongoing product innovation position Kakao Pay for sustained profitability and expanding market share.

Catalysts

About Kakao Pay- Operates a mobile payment system in South Korea.

- Market expectations may be overly optimistic about Kakao Pay's ability to sustain rapid revenue growth, given that annualized TPV growth (8% YoY) now lags far behind headline revenue growth (20% YoY), signaling that accelerating digital payments adoption may already be priced in while future transaction volume gains could slow, risking future top-line disappointment.

- Investors seem to be extrapolating sharp growth in high-margin financial and insurance products, but this optimism may ignore potential headwinds from tightening regulations on data privacy and fintech operations, which could limit Kakao Pay's ability to launch and monetize new services-posing a downside risk to future net margins.

- There is an increasing reliance on AI and data analytics for service personalization and operational efficiency; however, expectations for transformation may be overextended as data privacy regulations intensify globally, which can lead to higher compliance costs and constrain the ability to deploy advanced analytics-putting pressure on both operating expenses and profitability.

- The aggressive expansion into adjacent sectors like insurance, investments, and auto financing assumes continued regulatory support and benign competitive dynamics, yet rising competition from global tech giants and local banks could force Kakao Pay to innovate at higher cost and accept lower pricing power, which could compress gross and net margins.

- The stock may be overvalued if current prices reflect a view that Kakao Pay will easily overcome technology disruption risks from emerging decentralized finance and blockchain platforms, which could eventually pull users and transaction volume away, undermining long-term revenue and earnings trajectories if adaptation proves slower or more expensive than anticipated.

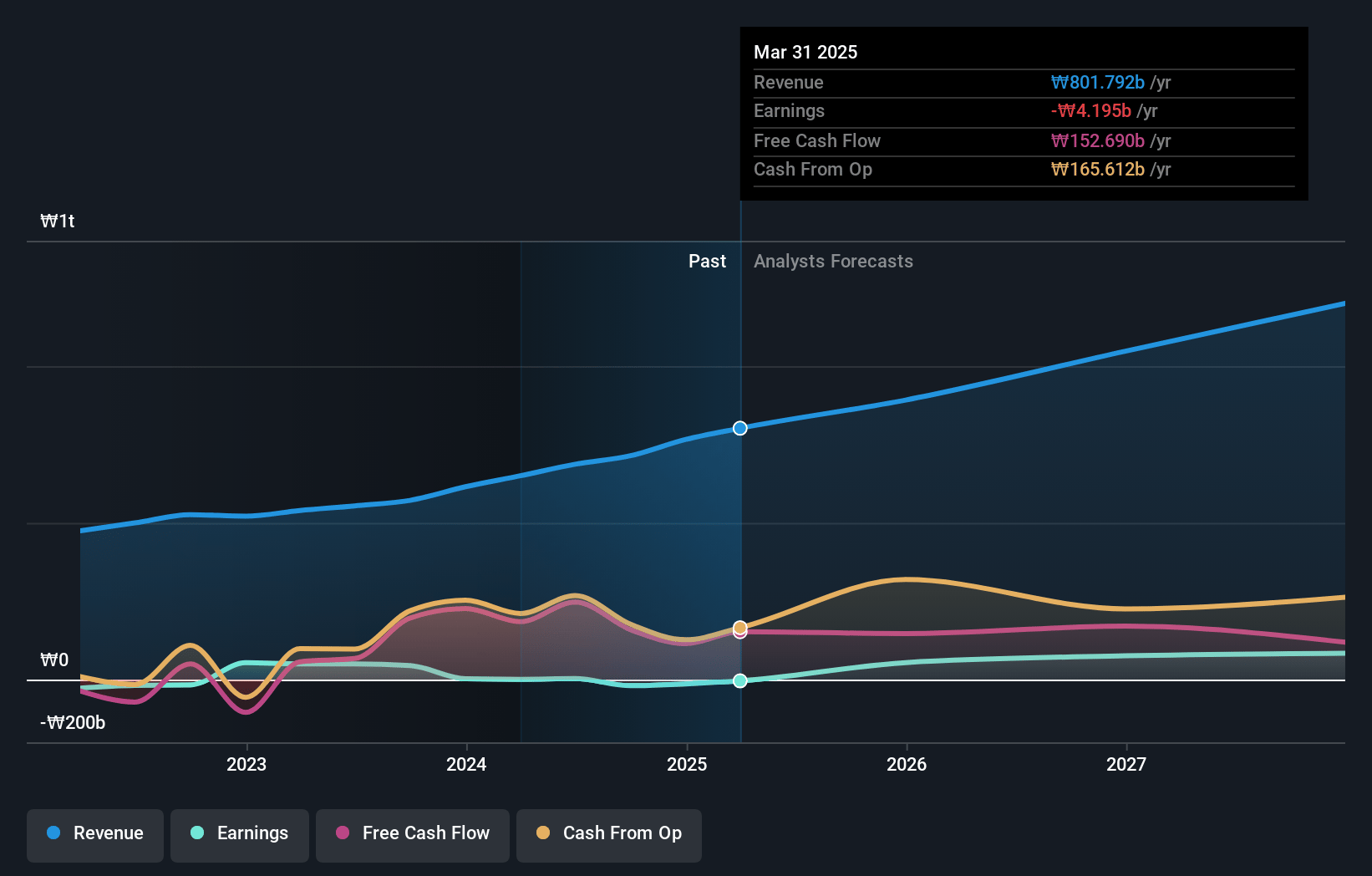

Kakao Pay Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kakao Pay's revenue will grow by 20.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.5% today to 8.8% in 3 years time.

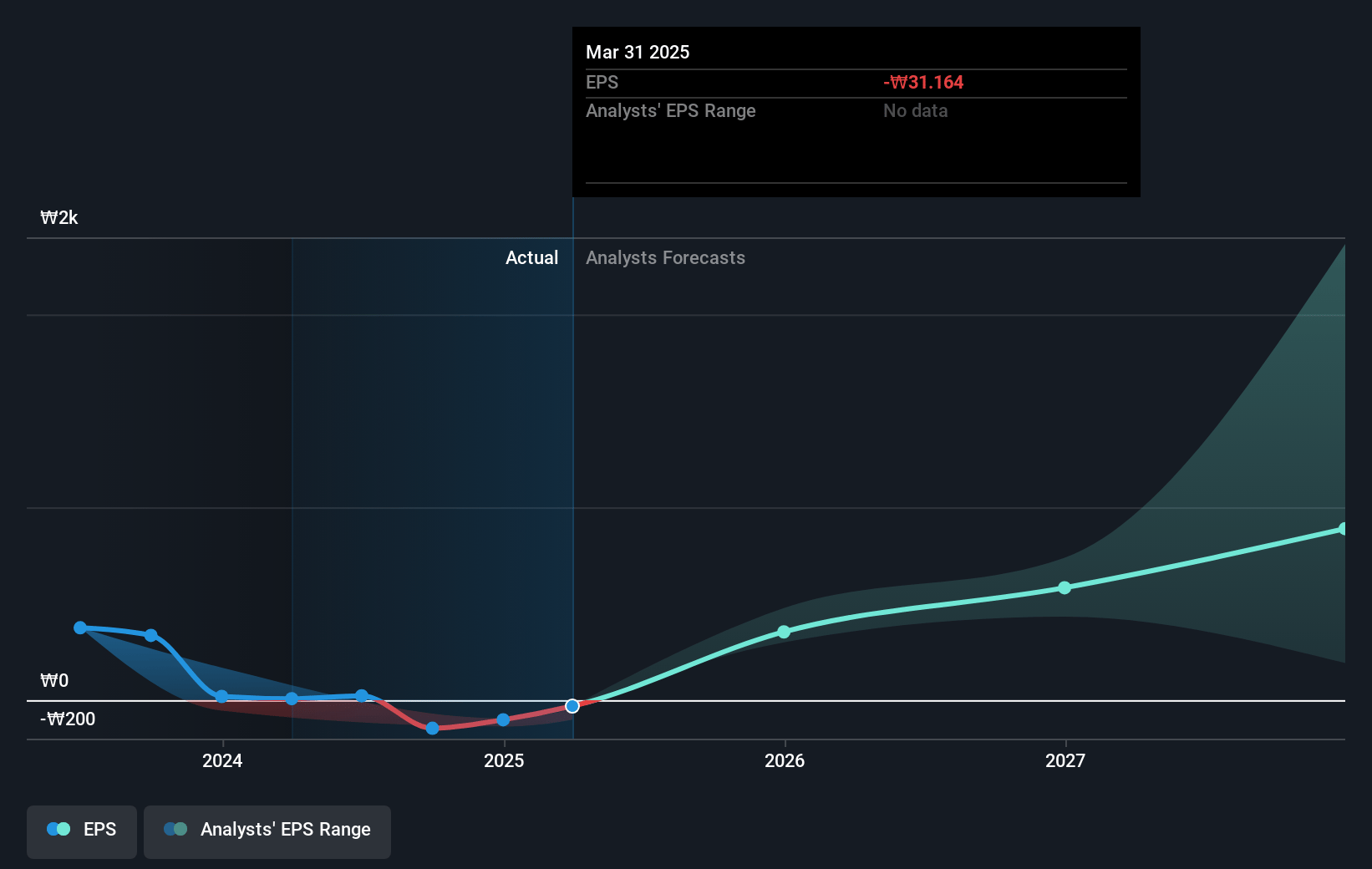

- Analysts expect earnings to reach ₩124.0 billion (and earnings per share of ₩851.5) by about July 2028, up from ₩-4.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₩26.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.5x on those 2028 earnings, up from -2161.1x today. This future PE is greater than the current PE for the KR Diversified Financial industry at 18.4x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.54%, as per the Simply Wall St company report.

Kakao Pay Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong year-over-year growth in core metrics such as Total Payment Volume (TPV), revenue (up 20.2%), financial services contribution (38% of revenue), and a turnaround to consolidated operating profitability indicate that Kakao Pay's top line and net income may continue to expand, contradicting expectations of declining share price.

- Expansion and market leadership in multiple high-margin financial services-including insurance (Q1 insurance revenue up 138% YoY, product pipeline expansion), loans (credit loan user count up 39% YoY, revenue up 22% YoY), and securities (stock trading volume up 54% YoY, deposit assets up 56% YoY)-suggest a broadening and diversifying revenue stream that may improve long-term earnings and margins.

- Advanced adoption of AI and data analytics-leveraging Kakao ecosystem's massive user base (20 million MyData users) for hyper-personalized financial advice, marketing, product recommendations, alternative credit scoring, and operational efficiency-positions Kakao Pay for increased ARPU, improved risk management, and operational leverage, which support sustained profit growth.

- Strengthening of ecosystem integration (cross-selling between payments, securities, asset management, insurance, and loans) and increasing daily active user engagement (DAU up 8% YoY, ARPU up 24% YoY) captures greater wallet share, raises switching costs, and builds a durable user moat, which may drive compounding revenue growth.

- Continuous product innovation (e.g., Good Deal for offline retail, auto financing/rental portal, health and family-focused insurance products) and growing national presence in core financial service verticals, together with supportive regulatory trends (financial inclusion, open banking), could unlock new addressable markets and maintain strong momentum in user acquisition, further supporting revenue and profitability prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩37341.667 for Kakao Pay based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩61000.0, and the most bearish reporting a price target of just ₩22000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩1414.1 billion, earnings will come to ₩124.0 billion, and it would be trading on a PE ratio of 50.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of ₩67300.0, the analyst price target of ₩37341.67 is 80.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.