Narratives are currently in beta

Key Takeaways

- Expanding into the energy management business and advanced ESS solutions could drive growth through new market entries.

- Strategic technological advancements and CapEx reductions may enhance production efficiency, improving net margins and earnings.

- Increased borrowings and currency losses, compounded by competitive and macroeconomic uncertainties, threaten net margins, future growth, and revenue stability.

Catalysts

About LG Energy Solution- Provides energy solutions worldwide.

- LG Energy Solution is signing large-scale supply contracts with top global OEMs totaling 160 gigawatt hours, which could lead to increased revenue from higher battery sales and diversified customer portfolios.

- By mass-producing and supplying batteries for commercial vehicles in Europe with advanced NCM technology, LG Energy Solution aims to improve production efficiency and drive revenue growth in the European market from 2026.

- The company is actively developing new technologies, such as cell-to-pack and dry electrode processes, to enhance product competitiveness, which could lead to improved net margins due to lower production costs and better energy efficiencies.

- LG Energy Solution is expanding into the energy management business and introducing ESS solutions with increased energy density, which can boost revenue through new market entries and better product offerings in the ESS sector.

- By optimizing capacity and exercising strategic CapEx reductions, LG Energy Solution aims to improve overall production efficiency and cost management, which may positively impact net margins and earnings.

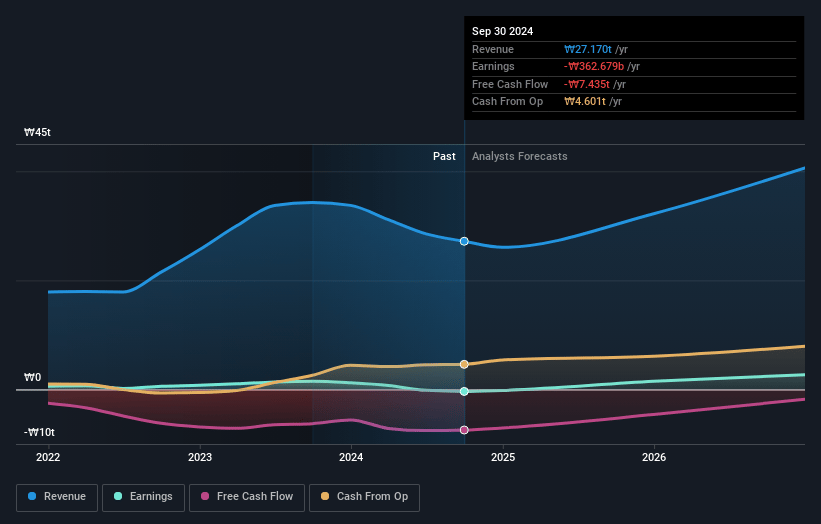

LG Energy Solution Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LG Energy Solution's revenue will grow by 23.8% annually over the next 3 years.

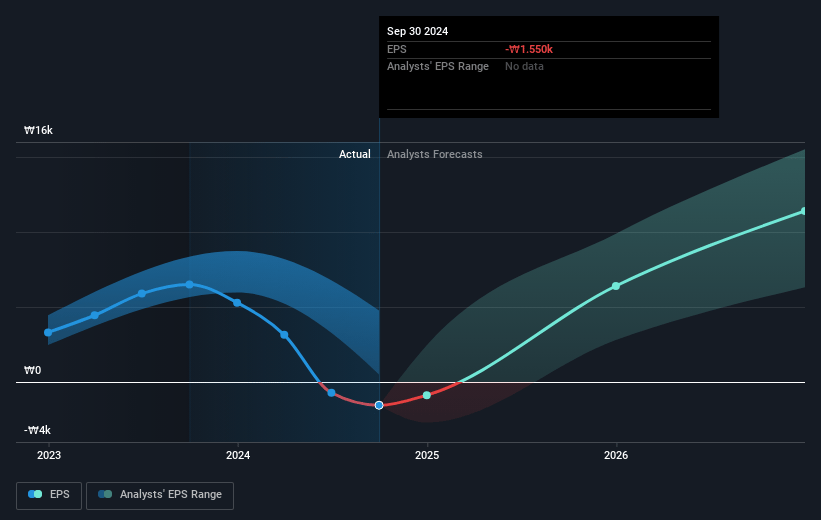

- Analysts assume that profit margins will increase from -1.3% today to 7.6% in 3 years time.

- Analysts expect earnings to reach ₩3910.8 billion (and earnings per share of ₩16272.12) by about January 2028, up from ₩-362.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.0x on those 2028 earnings, up from -224.5x today. This future PE is greater than the current PE for the KR Electrical industry at 22.9x.

- Analysts expect the number of shares outstanding to grow by 0.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

LG Energy Solution Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased borrowings and resulting net interest expenses, along with currency valuation losses, have led to nonoperating losses, potentially impacting net margins and earnings.

- The anticipated adjustments in inventory levels by key customers, including GM, could lead to reduced shipment volumes and revenue fluctuations in the short term.

- Competitive pressures, particularly from Chinese companies exporting batteries and OEMs internalizing their battery production, might constrain revenue growth and profit margins.

- With uncertainties in global macroeconomic conditions and geopolitical risks, along with an upcoming U.S. election, there could be unpredictable impacts on future demand and revenue forecasts.

- Planned moderation of CapEx execution and capacity additions, in response to an overcapacity risk and sluggish EV demand, might limit future growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩460379.31 for LG Energy Solution based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩600000.0, and the most bearish reporting a price target of just ₩270000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩51548.3 billion, earnings will come to ₩3910.8 billion, and it would be trading on a PE ratio of 36.0x, assuming you use a discount rate of 8.4%.

- Given the current share price of ₩348000.0, the analyst's price target of ₩460379.31 is 24.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives