Narratives are currently in beta

Key Takeaways

- Spin-off into distinct units streamlines operations, enhancing focus on core businesses and potentially improving efficiencies and margins.

- Robust demand boosts Land Systems division, securing strong future revenue growth and stability through significant international contracts and inquiries.

- Strategic divestments and investments pose risks to profitability and financial stability, with potential impacts on revenue, margins, and earnings across various business segments.

Catalysts

About Hanwha Aerospace- Engages in the development, production, and maintenance of aircraft engines worldwide.

- The completion of the spin-off and restructuring into Hanwha Aerospace and Hanwha Industrial Solutions can streamline operations, allowing for a stronger focus on core businesses, potentially improving overall efficiencies and net margins.

- The substantial increase in sales and operating profit for the Land Systems division, bolstered by strong domestic and international demand, especially from countries like Poland, bodes well for future revenue growth.

- The large order backlog for Land Systems, including significant contracts like the K9 contract with Romania and the MOU with Poland's WB Group for localized production, suggests sustained high revenue visibility and potential future earnings stability.

- Planned investments, such as the ₩700 billion propellant smart factory, though initially increasing debt, are aimed at addressing expected mid-to-long-term demand, which could significantly boost revenues post-2027, aligning with future operating profit improvements as CapEx effects taper off.

- Strengthened global market position and increased inquiries for products, notably in defense segments across Europe, the Middle East, and Asia Pacific, suggest potential for further revenue growth and an expanding international footprint, leading to diversified revenue streams and reduced risk exposure.

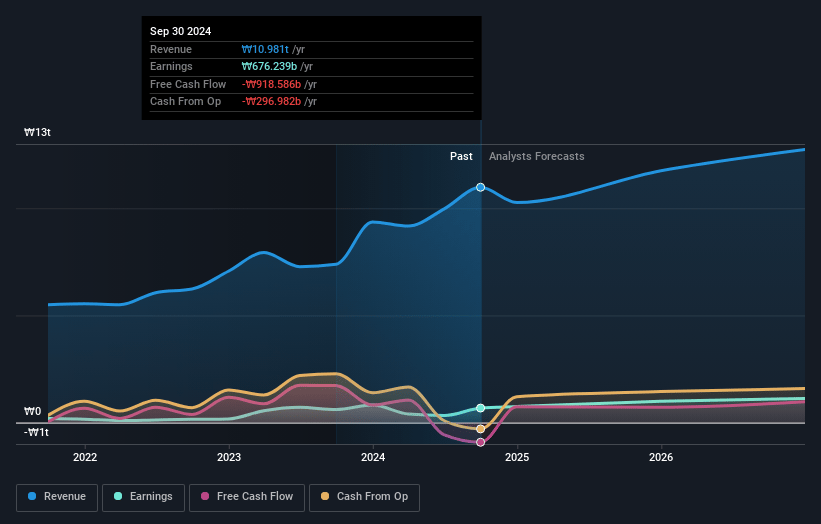

Hanwha Aerospace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hanwha Aerospace's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.2% today to 11.3% in 3 years time.

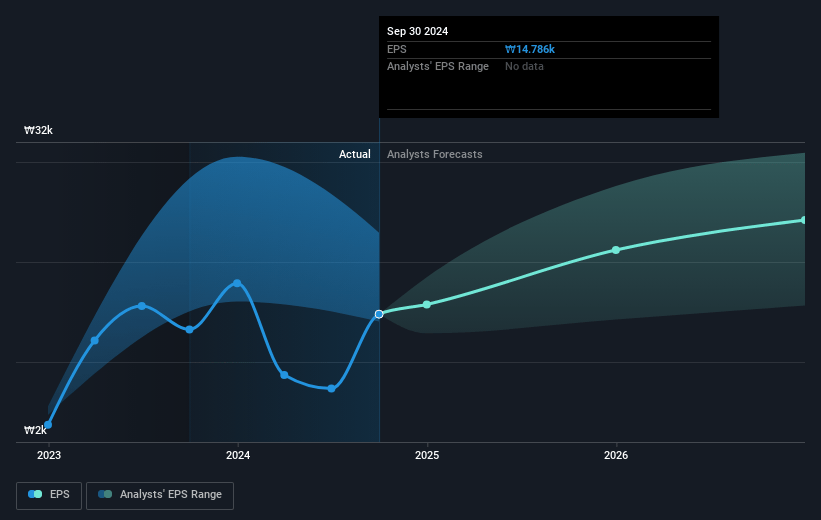

- Analysts expect earnings to reach ₩1453.6 billion (and earnings per share of ₩31881.87) by about January 2028, up from ₩676.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₩762.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, down from 26.2x today. This future PE is lower than the current PE for the KR Aerospace & Defense industry at 23.8x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.31%, as per the Simply Wall St company report.

Hanwha Aerospace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The spin-off of Hanwha Vision and Hanwha Precision Machinery could lead to reduced consolidated revenues and net margins if those divisions had previously contributed significantly to overall profitability.

- The substantial investment in the propellant smart factory, worth ₩700 billion, lacks committed customers and volume predictions, indicating potential risk to future revenue generation and cash flow.

- Although net debt is expected to decrease over time, the current high net debt-to-equity ratio of around 100% could affect financial stability and increase interest expense, negatively impacting net earnings.

- The negative operating profit in the Aerospace segment, driven by losses from GTF engine sales, highlights a significant risk to net margins and overall profitability in that segment.

- Potential margin reductions resulting from the localization of manufacturing in Poland, as part of contract 2-3 discussions, could negatively impact future net margins if local production proves less profitable than current operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩467688.55 for Hanwha Aerospace based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩560000.0, and the most bearish reporting a price target of just ₩277691.48.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩12881.9 billion, earnings will come to ₩1453.6 billion, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 7.3%.

- Given the current share price of ₩389000.0, the analyst's price target of ₩467688.55 is 16.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives