Narratives are currently in beta

Key Takeaways

- Ecopro BM anticipates increased sales from emission controls in Europe and new North American customers, boosting revenue prospects.

- Issuance of hybrid securities aims to enhance equity capital, reduce borrowing costs, and improve net margins.

- Ecopro BM faces financial challenges due to declining revenue, operating loss, inventory valuation losses, and potential liquidity risks impacting future growth and profitability.

Catalysts

About Ecopro BM- Ecopro BM Co. Ltd. develops and sells cathode materials used in batteries in Korea and internationally.

- Ecopro BM expects to see a rebound in sales volume in Q1 2025 due to stronger emission controls for EVs in Europe and ramping up of new customer factories in North America, which could positively impact future revenue.

- The company is planning to issue ₩336 billion of hybrid securities to be counted towards equity capital, aiming to improve its financial position and potentially lowering borrowing costs, thereby positively impacting net margins.

- Ecopro Materials projects a significant increase in non-captive precursor sales from the fourth quarter, addressing limitations of internal captive demand, which could enhance profitability.

- Ecopro HN is entering a peak season in Q4, expecting ongoing revenue growth, and is completing new production facilities, indicating potential for increased earnings from new business lines starting in 2025.

- Ecopro is expanding its nickel smelting business and integrating the cathode supply chain, which could enhance competitiveness and cost-effectiveness, contributing positively to future earnings.

Ecopro BM Future Earnings and Revenue Growth

Assumptions

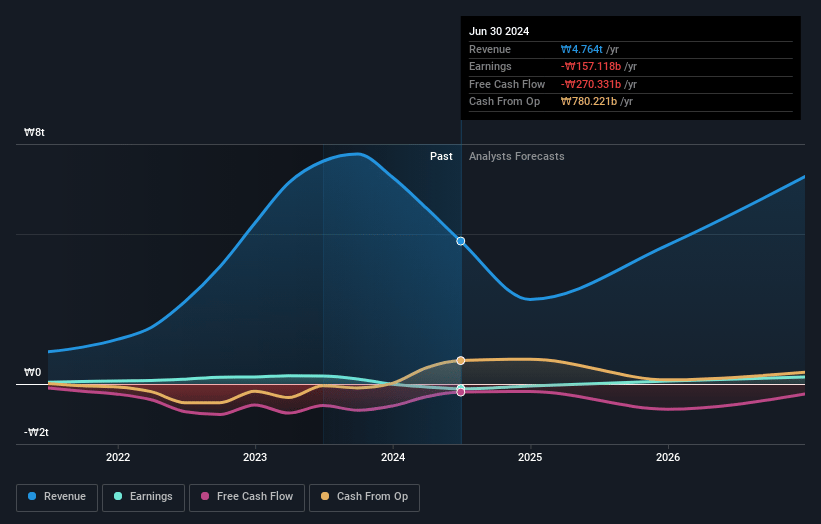

How have these above catalysts been quantified?- Analysts are assuming Ecopro BM's revenue will grow by 30.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.2% today to 2.4% in 3 years time.

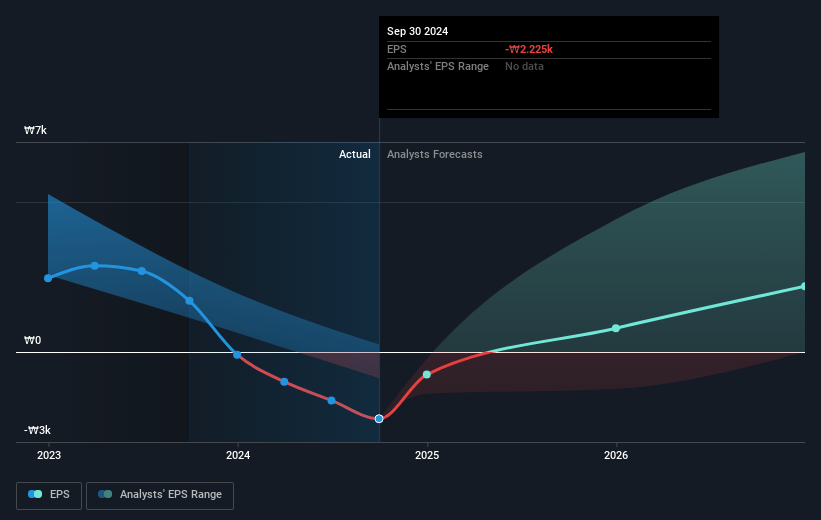

- Analysts expect earnings to reach ₩180.3 billion (and earnings per share of ₩2022.09) by about January 2028, up from ₩-217.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩211.0 billion in earnings, and the most bearish expecting ₩1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 90.4x on those 2028 earnings, up from -58.3x today. This future PE is greater than the current PE for the KR Electrical industry at 21.0x.

- Analysts expect the number of shares outstanding to decline by 2.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

Ecopro BM Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ecopro BM reported a significant drop in revenue by 36% in Q3 2024, with an operating loss, which highlights the risk of continued declining demand for EV and Power Tools affecting future revenue and net margins.

- The decrease in lithium hydroxide prices and unfavorable currency exchange rates have led to substantial inventory valuation losses, suggesting ongoing challenges in managing cost impacts on earnings and profitability.

- A high level of inventory coupled with falling metal prices poses a risk of further inventory valuation losses, directly impacting net margins and earnings if metal prices do not recover in the short term.

- Sluggish performance in the lithium and recycling businesses, combined with competition for feed and falling metal prices, poses challenges to revenue stability and operating margins.

- Ecopro BM's increased borrowing and rising debt ratio signal potential liquidity and financial stability risks, which could hinder future investments and growth in revenue-generating capacity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩142608.7 for Ecopro BM based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩240000.0, and the most bearish reporting a price target of just ₩60000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩7651.9 billion, earnings will come to ₩180.3 billion, and it would be trading on a PE ratio of 90.4x, assuming you use a discount rate of 8.7%.

- Given the current share price of ₩129600.0, the analyst's price target of ₩142608.7 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives