Key Takeaways

- Expansion in high-demand areas and transitioning to renewable energy can enhance property values and boost revenue through increased tenant demand.

- Strategic portfolio management and treasury stock plans are aimed at maintaining profit margins and driving shareholder value.

- Economic challenges and strategic focus on specific regions raise business risks, potentially affecting Tokyu's profitability and long-term revenue growth.

Catalysts

About Tokyu- Engages in the transportation, real estate, life services, and hotel and resort businesses in Japan and internationally.

- Tokyu's expansion into high-demand areas like Shibuya with competitive real estate projects can drive rental income growth, ultimately boosting revenue.

- Active measures to manage rising construction costs and inflation through strategic portfolio management can protect profit margins and enhance overall earnings.

- Tokyu's diverse business model, combining transportation, retail, real estate, and hospitality, allows for increased cross-sector earnings, aiding in boosting overall profitability.

- Transitioning properties to renewable energy and obtaining environmental certifications may lead to enhanced property values and tenant demand, positively impacting revenue and net margins.

- Treasury stock acquisition plans are expected to improve EPS and capital efficiency, thus driving shareholder value and impacting earnings growth.

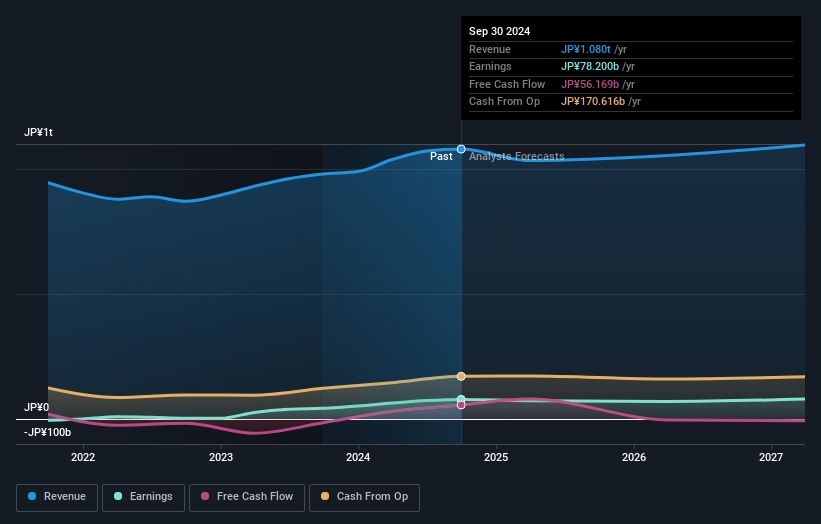

Tokyu Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tokyu's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.2% today to 7.0% in 3 years time.

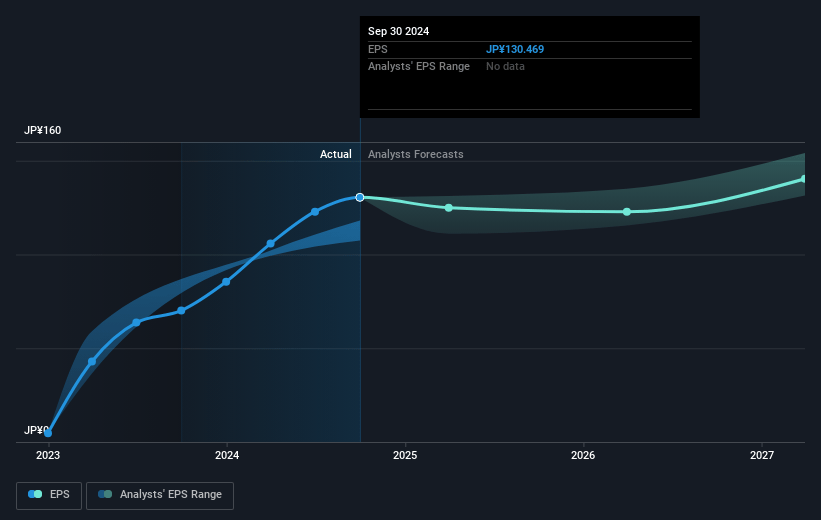

- Analysts expect earnings to reach ¥77.8 billion (and earnings per share of ¥138.28) by about January 2028, down from ¥78.2 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ¥87.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, up from 13.0x today. This future PE is greater than the current PE for the JP Transportation industry at 10.7x.

- Analysts expect the number of shares outstanding to decline by 1.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.85%, as per the Simply Wall St company report.

Tokyu Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising construction costs due to labor shortages and material price increases may impact real estate development, leading to potential deterioration in project balance sheets, thus affecting net margins and earnings.

- Inflation and rising interest rates pose risks to Tokyu's main railway business, which is sensitive to fare regulation and lagging rent increases, potentially impacting revenue and overall profitability.

- The vulnerability of Tokyu's transportation and real estate segments to economic downturns may lead to decreased passenger numbers and rental income, adversely affecting earnings.

- The company's focus on certain areas for large-scale projects may lead to excessive reliance on specific regions, increasing business risk and potentially impacting long-term revenue growth.

- Potential delays or cancellations of redevelopment plans, despite being seen as opportunities, suggest a challenging environment that could disrupt profitability and projected revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥2000.0 for Tokyu based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥2400.0, and the most bearish reporting a price target of just ¥1800.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥1108.8 billion, earnings will come to ¥77.8 billion, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 7.9%.

- Given the current share price of ¥1747.0, the analyst's price target of ¥2000.0 is 12.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives