Narratives are currently in beta

Key Takeaways

- Slowing cloud service growth and stable operating margins may challenge Oracle's future revenue and earnings growth potential.

- Exchange rate benefits could be reversed, impacting net income and operational costs due to currency fluctuation risks.

- Strong demand for cloud services and strategic deals in Japan suggest Oracle Japan may see sustained revenue growth, challenging expectations of a declining share price.

Catalysts

About Oracle Corporation Japan- Engages in the development and sale of software and hardware products and solutions in Japan.

- The demand for Oracle’s cloud services, though strong, showed signs of deceleration, with a reported growth rate of 9%, which is a slowdown compared to previous periods. This deceleration may impact future cloud service revenue growth potential.

- Oracle's operating margin is expected to remain stable in the early 30s percentage range, despite recent improvements. This suggests limited margin expansion prospects, which could cap future earnings growth.

- With no significant cost model transformations or major outsourcing expenses changes foreseen, Oracle’s ability to enhance net margins through cost efficiencies may be constrained, potentially affecting future profitability.

- Seasonality issues affecting Q1 results are expected to normalize, but there is uncertainty about consistent double-digit growth returning, which could cast doubt on sustained revenue growth acceleration for Oracle’s cloud services.

- While benefiting from favorable exchange rates in the short term, Oracle may face challenges if currency fluctuations reverse, potentially impacting net income and operational expenses due to its exposure to foreign exchange risks.

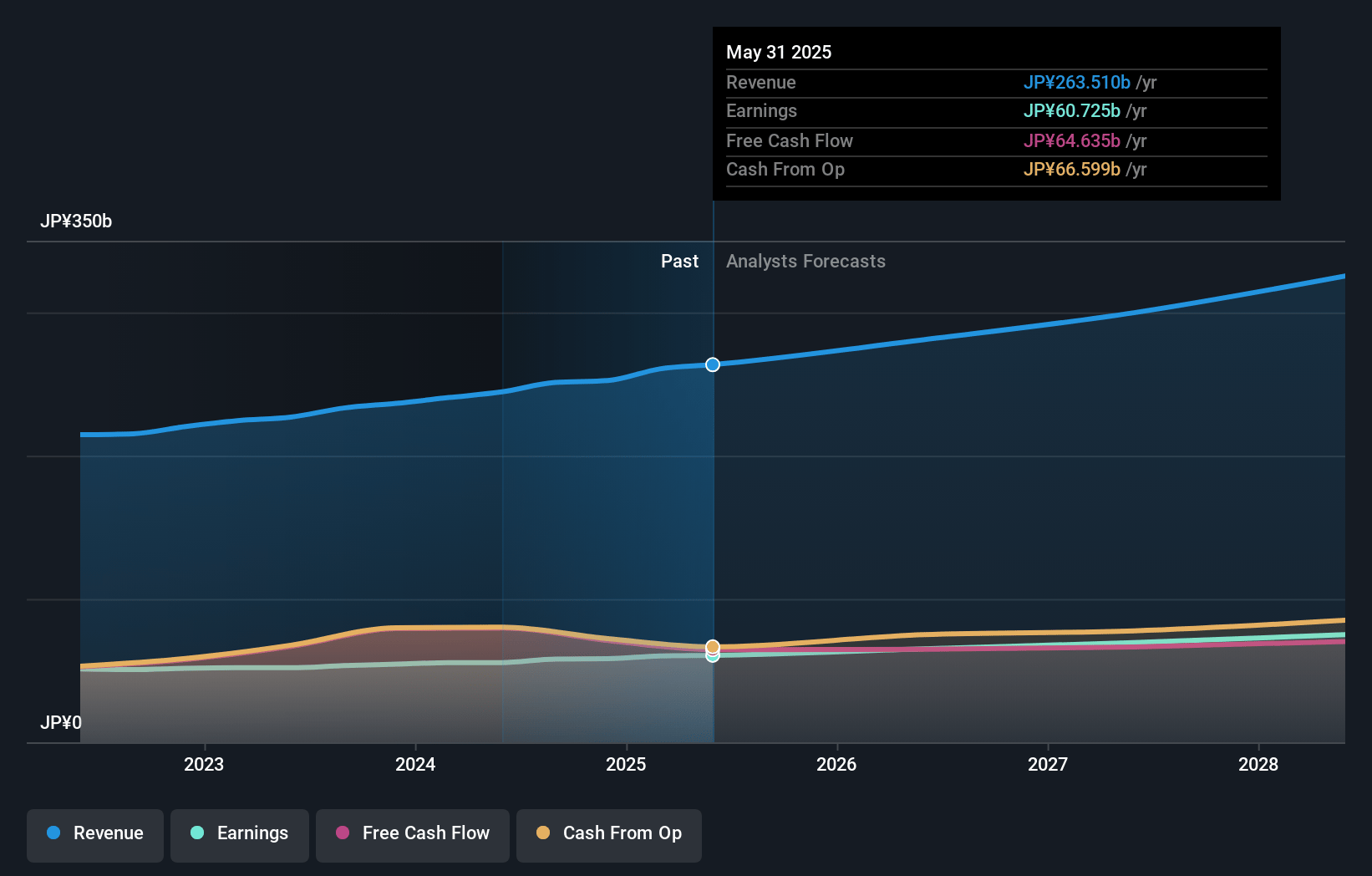

Oracle Corporation Japan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oracle Corporation Japan's revenue will grow by 7.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.1% today to 24.0% in 3 years time.

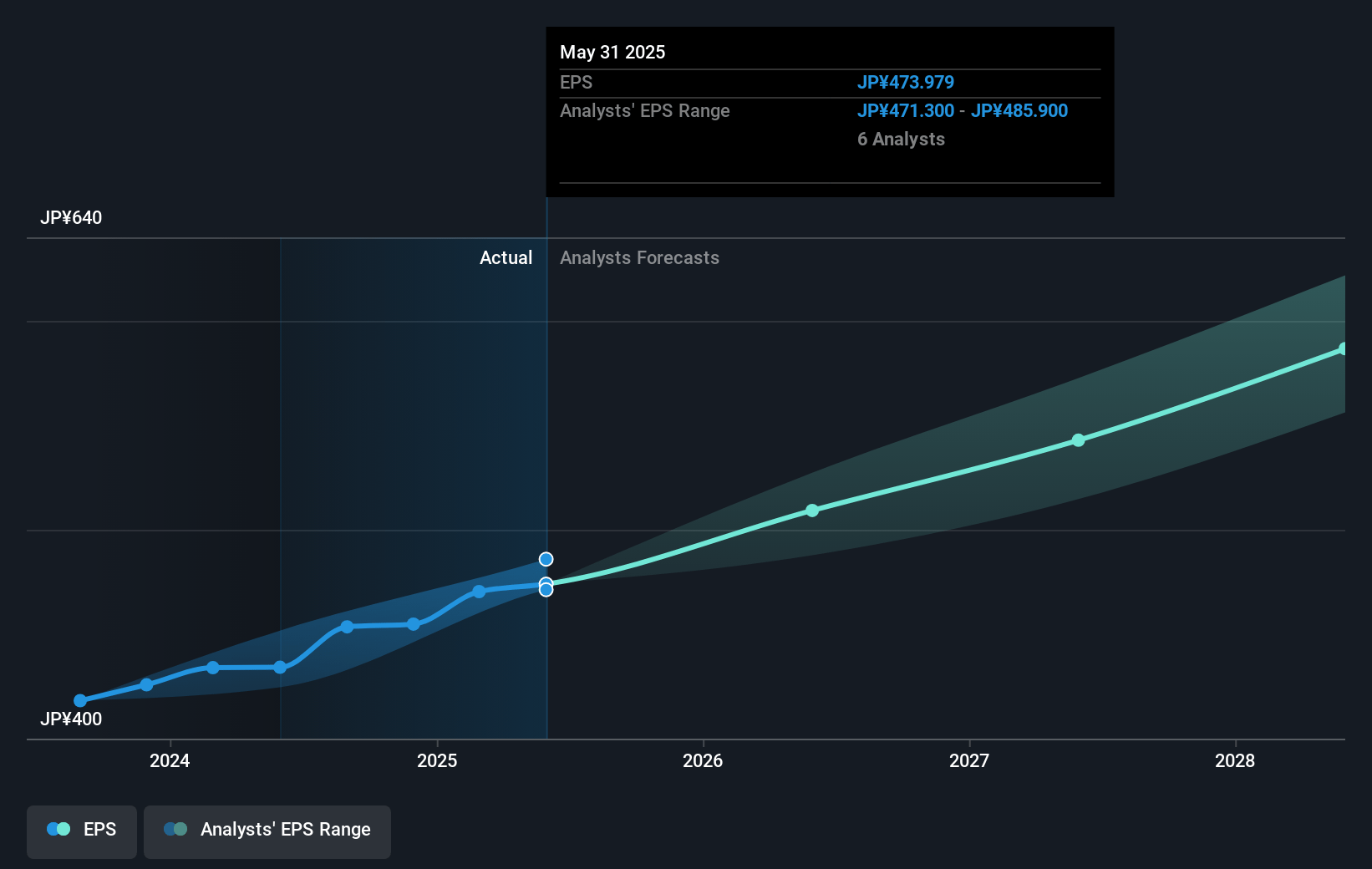

- Analysts expect earnings to reach ¥74.3 billion (and earnings per share of ¥581.21) by about December 2027, up from ¥58.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥86.1 billion in earnings, and the most bearish expecting ¥63.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.9x on those 2027 earnings, down from 32.8x today. This future PE is lower than the current PE for the JP Software industry at 43.0x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.52%, as per the Simply Wall St company report.

Oracle Corporation Japan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Oracle Japan's strong performance in Q1, with substantial demand for its cloud business and on-premise licenses, indicates robust revenue growth, which could challenge the expectation of a declining share price. This performance could lead to sustained growth in revenues.

- The expansion of Oracle's customer base for OCI and Fusion, particularly in the Japanese market with notable clients like Hitachi Construction Machinery and Wakayama City, suggests continued revenue growth potential and stability in earnings.

- Significant deals and projects, such as with Yashima Denki Co. and Pocketalk Corporation, underscore Oracle's broad market outreach and involvement in mission-critical systems, supporting consistent revenue streams and strong net margins.

- The reported increase in operating and net income demonstrates effective cost management and efficiency improvements, suggesting potential to sustain or improve net margins and overall earnings.

- Management's expectation of growth acceleration in upcoming quarters, along with consistent operating margins and strategic investments, challenges the belief of a declining stock price by indicating potential earnings stability or growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥13400.0 for Oracle Corporation Japan based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥16000.0, and the most bearish reporting a price target of just ¥9800.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be ¥309.1 billion, earnings will come to ¥74.3 billion, and it would be trading on a PE ratio of 26.9x, assuming you use a discount rate of 5.5%.

- Given the current share price of ¥14835.0, the analyst's price target of ¥13400.0 is 10.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives