Narratives are currently in beta

Key Takeaways

- Plans for inventory reduction and cautious capex aim to improve cost efficiencies, stabilize margins, and ensure stronger future financial performance.

- Acquisitions and focus on DDR5 adoption expected to enhance revenue through synergies and integration into key technological trends.

- Renesas faces revenue and margin pressure from weak demand, macroeconomic challenges, and increased borrowing for acquisitions, potentially affecting financial health and investor sentiment.

Catalysts

About Renesas Electronics- Researches, develops, designs, manufactures, sells, and services semiconductors in Japan, China, rest of Asia, Europe, North America, and internationally.

- Renesas Electronics plans to focus on inventory reduction in Q4, with measures including a cutback in production to address weakened demand, which is expected to improve future cost efficiencies and net margins.

- The acquisition of Altium and subsequent consolidation is anticipated to enhance Renesas's industrial infrastructure and IoT segments, fostering revenue growth through synergies and market expansion.

- A cautious approach to capital expenditure and R&D investments is being maintained, which could stabilize future gross margins and operating margins by focusing on efficient resource allocation in areas like 40-nanometer MCU and power semiconductors.

- Renesas is positioning itself to benefit from technological trends like DDR5 adoption, which is expected to impact revenue positively as their memory interface and power management ICs become integral to future product lines.

- The company has a strategy to be conservative in Q1 2024 to avoid excessive inventory build-up, especially with anticipated inventory adjustments from Japanese customers, aiming for a stronger financial performance in subsequent quarters through more balanced operations.

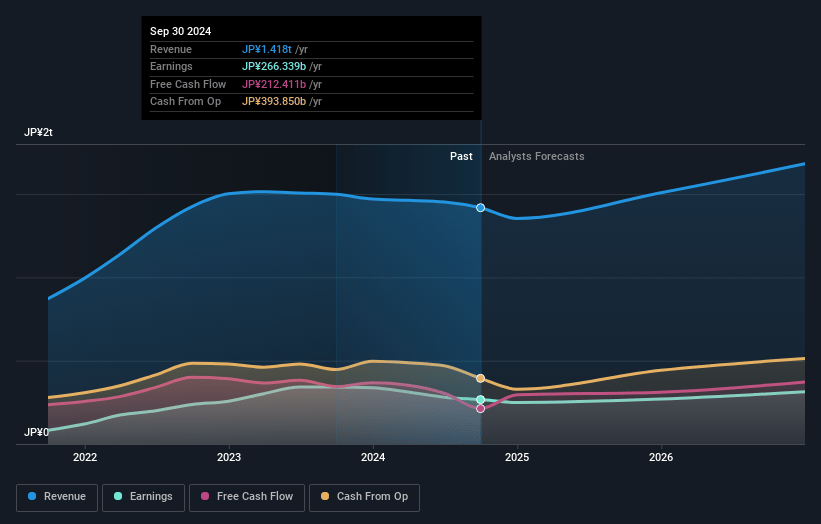

Renesas Electronics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Renesas Electronics's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.8% today to 20.4% in 3 years time.

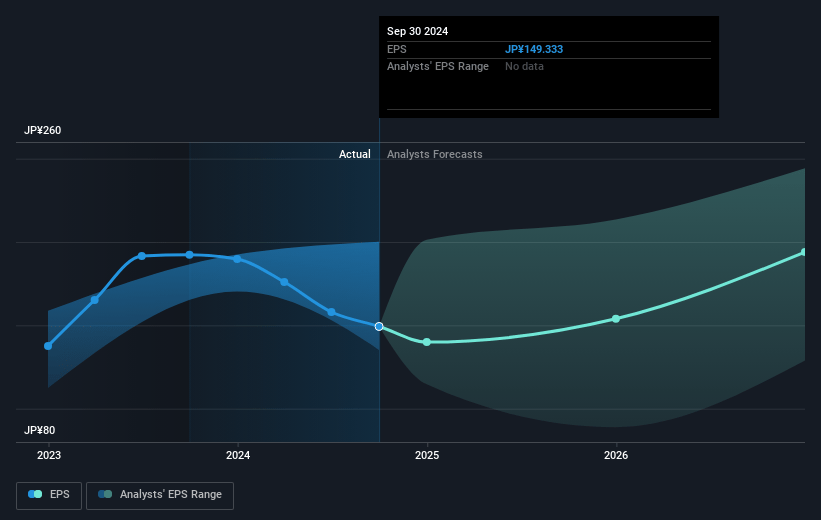

- Analysts expect earnings to reach ¥343.6 billion (and earnings per share of ¥194.66) by about January 2028, up from ¥266.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥508.9 billion in earnings, and the most bearish expecting ¥169.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, up from 14.5x today. This future PE is greater than the current PE for the JP Semiconductor industry at 13.6x.

- Analysts expect the number of shares outstanding to decline by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Renesas Electronics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Renesas' management expressed concerns about weaker than expected demand and indicated a need to reduce inventory levels, highlighting a significant anticipated revenue decline of close to 20% in the fourth quarter, which could impact revenue and net margins.

- The earnings call revealed that macroeconomic factors, such as a stronger yen and industrial and mass market contributions being significantly negative, are impacting the company's ability to meet revenue forecasts, which could affect future earnings.

- The company has seen a decrease in production utilization rates, notably in the automotive and industrial, infrastructure, and IoT segments, leading to a higher emphasis on cost control, which may pressure operating profit margins.

- Renesas is cautious about potential near-term pressure from customer inventory adjustments, particularly in Japan and Europe, and anticipates a further slowdown, which could negatively influence revenue stability and overall financial health in the coming quarters.

- Despite recent acquisitions, such as Altium, that are intended for long-term growth, Renesas' increased borrowing to fund this acquisition might limit liquidity for other strategic initiatives and shareholder returns like dividends, which could impact cash flow and alter investor sentiment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥2973.57 for Renesas Electronics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥4000.0, and the most bearish reporting a price target of just ¥2200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥1688.3 billion, earnings will come to ¥343.6 billion, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 8.0%.

- Given the current share price of ¥2162.5, the analyst's price target of ¥2973.57 is 27.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives