Key Takeaways

- Slowing user growth, intense competition, and shifting consumer trends threaten Mercari's long-term revenue prospects and undermine its ability to sustain expansion.

- Rising compliance costs and persistent marketing spend are expected to compress margins and challenge long-term profitability, especially amid ongoing regulatory scrutiny.

- Sustained product innovation, fintech growth, operational efficiency, and adaptive management are positioning Mercari for enhanced profitability, improved user engagement, and successful international expansion.

Catalysts

About Mercari- Plans, develops, and operates Mercari marketplace applications in Japan and the United States.

- The slowing growth rates in Gross Merchandise Value for both Japan and U.S. businesses signal that the market for peer-to-peer resale may be nearing saturation in Mercari's mature domestic market, while the steep year-on-year GMV decline of 27 percent in the U.S. raises concerns that demographic headwinds and limited new user acquisition potential could undermine Mercari's ability to drive sustained top-line expansion.

- Increased regulatory scrutiny on e-commerce platforms, combined with persistent issues around fraudulent activity and the need for extensive user protection and compliance investments, are poised to drive up operating costs and compress net margins over the long term, especially as Mercari must continually enhance security measures and systems to satisfy authorities and maintain trust.

- With the global shift toward more robust and localized circular economy models such as rental, repair, and neighborhood resale initiatives, demand is likely to shift away from traditional peer-to-peer marketplaces like Mercari, weakening future transaction growth and long-term revenue.

- Escalating competition from established players and new entrants with advanced technology or differentiated offerings (such as Rakuten and Yahoo! Auctions) is expected to intensify price-based competition, putting ongoing pressure on take rates and further eroding Mercari's revenue and net income.

- The requirement for consistently high marketing and promotion spend, particularly in the U.S. where user engagement and transaction volumes are already declining, is expected to weigh on profitability, as increasing customer acquisition costs outpace user growth and threaten the sustainability of earnings.

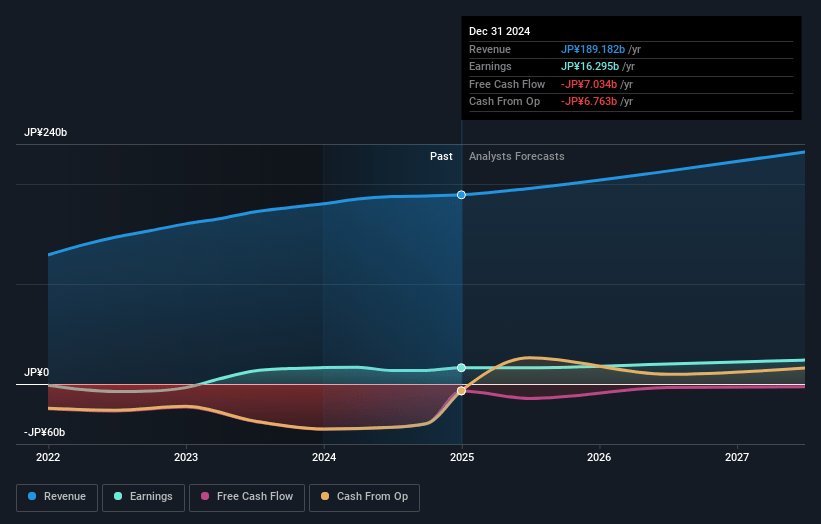

Mercari Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mercari compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mercari's revenue will grow by 6.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.6% today to 10.2% in 3 years time.

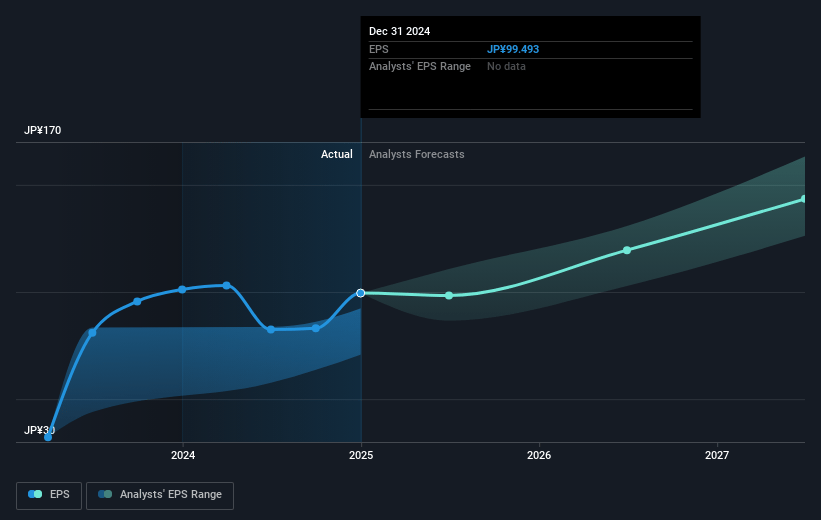

- The bearish analysts expect earnings to reach ¥23.1 billion (and earnings per share of ¥141.24) by about July 2028, up from ¥16.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.7x on those 2028 earnings, down from 24.2x today. This future PE is greater than the current PE for the JP Multiline Retail industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

Mercari Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite the initial slow start in GMV due to external factors like weather and fraud, Mercari returned to positive GMV growth in the latter half of the quarter, which suggests underlying demand is resilient and could support future revenue and profit growth if this recovery trend continues.

- Sustained product innovation, such as an improved home screen, hassle-free car sales, advancements in AI-powered risk detection, and unique cross-border and B2C features, have led to increased app engagement and may enhance user retention and drive higher transaction frequency, positively impacting both revenue and operating margins over time.

- Mercari's fintech segment, especially the credit business, is experiencing rapid credit balance growth of 38 percent year-on-year with three consecutive quarters of profitability, indicating long-term earnings diversification and a growing financial services platform that could boost consolidated profit.

- The company is demonstrating improved profitability, achieving record-breaking core operating profit growth of 79 percent year-on-year, and is focused on operational efficiencies, which may result in higher net margins even if top-line growth is modest.

- Management has shown the ability to adapt and address operational challenges in international markets, notably the United States, by rapidly shifting fee models and reducing operating losses, which points to the potential for successful international expansion and margin improvement that could bolster long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mercari is ¥1981.52, which represents two standard deviations below the consensus price target of ¥2795.38. This valuation is based on what can be assumed as the expectations of Mercari's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3500.0, and the most bearish reporting a price target of just ¥1800.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ¥227.4 billion, earnings will come to ¥23.1 billion, and it would be trading on a PE ratio of 17.7x, assuming you use a discount rate of 7.7%.

- Given the current share price of ¥2423.0, the bearish analyst price target of ¥1981.52 is 22.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.