Last Update 21 Sep 25

Fair value Increased 1.89%Japan's Office Market Will Suffer Under Remote Work Shift

The upward revision in Nippon Building Fund’s consensus price target is primarily driven by a significant increase in revenue growth forecasts, while other key valuation metrics remained largely unchanged, resulting in a modest fair value increase to ¥143,792.

What's in the News

- Dividend guidance lowered for periods ending June and December 2025 compared to prior year.

- Earnings guidance issued, projecting steady revenues and net income through mid-2026.

- Completed a ¥17.7 billion follow-on equity offering, issuing 80,027 and 58,018 units at a discount.

- Nomura Securities appointed as lead underwriter for the follow-on equity offering.

- Board approved new investment unit issuance via third-party allocation.

Valuation Changes

Summary of Valuation Changes for Nippon Building Fund

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from ¥141125 to ¥143792.

- The Consensus Revenue Growth forecasts for Nippon Building Fund has significantly risen from 0.9% per annum to 1.4% per annum.

- The Future P/E for Nippon Building Fund remained effectively unchanged, moving only marginally from 28.29x to 28.45x.

Key Takeaways

- Overly optimistic projections may overlook declining office demand from Japan's demographic challenges and rising adoption of remote and hybrid work.

- Sustainability trends and higher costs could reduce asset values, pressure margins, and hinder occupancy, rent growth, and earnings.

- Robust Tokyo office demand, effective rent increases, prudent debt strategy, ESG leadership, and savvy portfolio management collectively support strong and sustainable earnings growth.

Catalysts

About Nippon Building Fund- NBF (Nippon Building Fund Inc.) is an office-focused J-REIT that invests in office buildings.

- Current valuations may be incorporating overly optimistic assumptions about continued robust rental revenue and occupancy growth, despite mounting structural headwinds such as Japan's demographic decline and aging workforce, which could lead to reduced long-term demand for office space-potentially resulting in revenue and net income disappointment versus current projections.

- The market appears to be discounting the medium-to-long term impact of increased adoption of remote and hybrid work models, which is likely to structurally lower office utilization rates; this trend may pressure occupancy, limit rent increases, and eventually erode revenue and net earnings growth.

- Investors may be underestimating the risk of "brown discounting," as evolving sustainability and ESG mandates drive tenants toward newer or greener properties-placing downward pressure on valuations and rent levels for older assets in NBF's portfolio, and negatively affecting margins and top-line growth if required capex escalates.

- Ambitious DPU and EPU growth targets seem heavily reliant on continued smooth execution of property acquisitions, re-leasing, and securing new tenants, whereas any increase in tenant churn (as evidenced by negative tenant replacement impact in the 50th period) or inability to fill vacated space quickly could weigh on revenue and profit.

- Forward estimates may not fully reflect the risk of upward pressure on operating and financing costs (from rising building management expenses, taxes, and expected higher interest rates), which could outpace rental income growth over time and compress net margins and earnings.

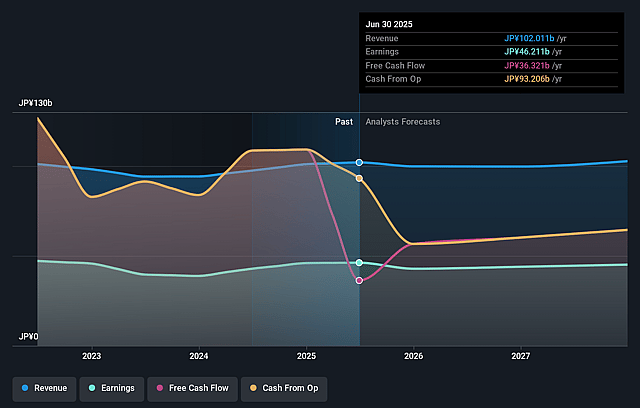

Nippon Building Fund Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nippon Building Fund's revenue will decrease by 0.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 45.5% today to 44.3% in 3 years time.

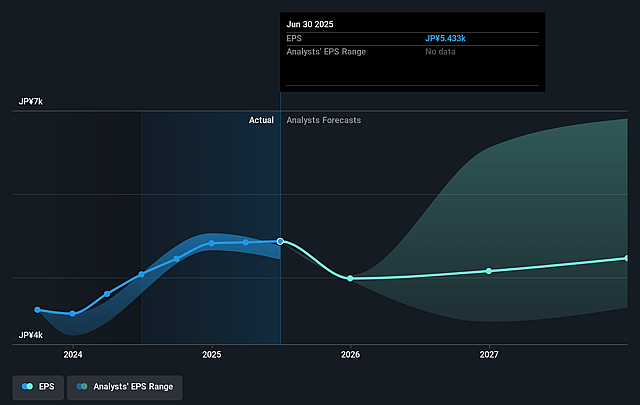

- Analysts expect earnings to reach ¥44.5 billion (and earnings per share of ¥5202.05) by about September 2028, down from ¥46.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥59.7 billion in earnings, and the most bearish expecting ¥38.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.4x on those 2028 earnings, up from 26.7x today. This future PE is greater than the current PE for the JP Office REITs industry at 23.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.42%, as per the Simply Wall St company report.

Nippon Building Fund Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Tokyo office market remains robust with high occupancy rates (above 98%) and steady rental income growth, supported by ongoing urbanization and enduring demand for central office locations-this trend is likely to bolster NBF's revenue and sustain earnings growth.

- NBF continues to achieve internal growth via rental increases (rent increases account for about 55% of recent negotiations, with a growing rent gap suggesting further upside), which provides potential for ongoing improvements in net margins and topline revenue, despite broader concerns about office demand.

- Prudent financial management, including long-maturity, low-cost fixed-rate debt and a moderate LTV ratio, positions NBF to minimize rising interest expense risks and maintain healthy net income even as rates shift in the market.

- The company's ongoing focus on ESG initiatives (100% green building certifications and outperformance of emission reduction targets) strengthens appeal to major tenants with sustainability mandates, helping to safeguard occupancy, command premium rental rates, and drive revenue stability.

- Strategic use of equity offerings to unlock external growth, disciplined property acquisitions, and opportunistic asset disposals (with significant disposal gains already boosting distributions) provide NBF with multiple levers to enhance distributable and per-unit earnings, supporting long-term DPU and EPU growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥139625.0 for Nippon Building Fund based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥160500.0, and the most bearish reporting a price target of just ¥112000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥100.4 billion, earnings will come to ¥44.5 billion, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 5.4%.

- Given the current share price of ¥142400.0, the analyst price target of ¥139625.0 is 2.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.