Key Takeaways

- Diverse pipeline and strategic partnerships position Nxera Pharma to capitalize on demand for innovative, accessible therapies in obesity, neuropsychiatric, and immunology markets.

- Advances in digital drug discovery and commercialization efforts are expected to enhance R&D efficiency, reduce risk, and expand future earnings and market share.

- Heavy reliance on few current drugs, escalating R&D costs, uncertain partnerships, and intense market competition combine to threaten margins, revenue stability, and sustainable growth.

Catalysts

About Nxera Pharma- Develops and sells pharmaceutical products in Japan, the United States, Germany, Switzerland, Bermuda, and the United Kingdom.

- Nxera Pharma's breadth of wholly-owned and partnered programs targeting fast-growing markets such as obesity, neuropsychiatric disorders, and immunology positions the company to benefit from rising global healthcare demand and shifting preferences toward innovative, personalized oral therapies, which supports long-term revenue expansion as these assets mature and commercialize.

- The launch of a comprehensive oral obesity/weight management pipeline and advancement of proprietary candidates (GLP-1, GIP, Amylin, Apelin receptor programs) aligns with major market secular trends (aging populations, lifestyle disease prevalence, and payer focus on accessible treatments), opening significant new addressable markets and the potential for blockbuster revenues over the coming decade.

- Progress in digital and precision medicine, reflected in Nxera's NxWave structure-based drug discovery platform, is improving R&D efficiency and selectivity, decreasing time-to-market for differentiated therapies, which is expected to boost future earnings and margins by reducing development risk and capturing larger market shares in targeted indications.

- Strategic partnerships and licensing deals (e.g., with Neurocrine, Centessa, Tempero Bio, and prominent pharma players for in-licensing in Japan/APAC) provide milestone and royalty inflows, facilitate risk sharing, and broaden the revenue base, enhancing margin stability and smoothing potential volatility from single-asset dependency.

- Upcoming catalysts-including expected late 2024/2025 clinical data readouts, potential option exercise milestones (such as the $65M GPR52 payment), and a Japan in-licensing deal-have the potential to materially impact both top-line revenue and IFRS operating profit, reflecting accelerating progress on key late-stage programs and monetization of pipeline assets.

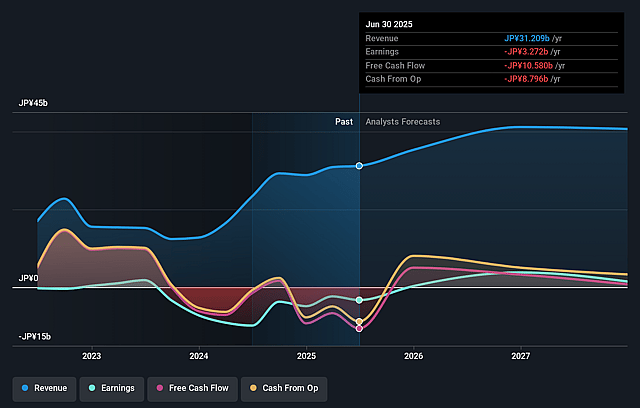

Nxera Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nxera Pharma's revenue will grow by 11.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -10.5% today to 7.3% in 3 years time.

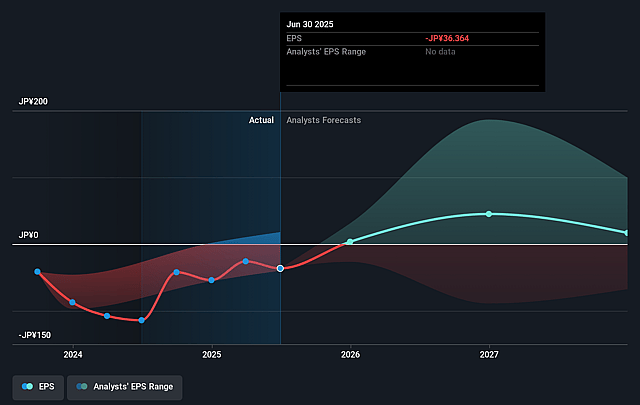

- Analysts expect earnings to reach ¥3.1 billion (and earnings per share of ¥34.51) by about September 2028, up from ¥-3.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥8.9 billion in earnings, and the most bearish expecting ¥-6.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 60.5x on those 2028 earnings, up from -27.6x today. This future PE is greater than the current PE for the JP Pharmaceuticals industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.72%, as per the Simply Wall St company report.

Nxera Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nxera Pharma's significant R&D expense growth, particularly investments in clinical-stage compounds, led to a sharp decline in operating profit in the first half and outpaced the rate of revenue increase, increasing the risk that failed trials, slower approvals, or underperforming assets could pressure net margins and long-term profitability.

- The company's current revenues are heavily reliant on just two commercialized products, PIVLAZ and QUVIVIQ, with future growth hinging on successful late-stage development and commercialization of pipeline assets; setbacks or failures among these key assets could cause abrupt earnings volatility and revenue concentration risk.

- Profitability from QUVIVIQ is currently limited to royalties, with supply profit contribution expected only from 2027 onward, resulting in near-term margin pressure and exposing the company to risk if actual sales or penetration rates underperform or if competitive alternatives erode market share in the DORA insomnia category.

- Uncertainties remain around the success of pivotal partnerships and milestone-triggered deals (e.g., option exercise by Boehringer-Ingelheim on the GPR52 agonist, or the future of Lucerastat depending on competitor trial results), introducing dependency on external decision-making timelines and market events, which could delay or diminish anticipated revenue streams.

- Nxera is entering highly competitive and fast-evolving fields (notably oral GLP-1 agonists and CNS therapeutics) where larger players, ongoing generic/biosimilar threats, pricing pressures from healthcare payers, and expanding regulatory/compliance burdens may restrict premium pricing, slow adoption, and increase overall cost to market-undermining long-term revenue growth and sustainable earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1794.444 for Nxera Pharma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥4500.0, and the most bearish reporting a price target of just ¥1000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥43.1 billion, earnings will come to ¥3.1 billion, and it would be trading on a PE ratio of 60.5x, assuming you use a discount rate of 4.7%.

- Given the current share price of ¥998.0, the analyst price target of ¥1794.44 is 44.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.