Key Takeaways

- LEQEMBI's global rollout in key regions is poised to drive significant revenue growth through market expansion and adoption.

- Improved infusion capacity and streamlined dosing regimens in the U.S. are set to enhance treatment access and reduce operational costs, boosting net margins.

- LEQEMBI's launch and regulatory risks, combined with high initial costs, could pressure operating margins and affect future revenue growth.

Catalysts

About Eisai- Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals in Japan.

- Eisai's LEQEMBI, a treatment for Alzheimer's, is still in the early stages of market introduction in major regions like the U.S., Japan, and China. Accelerated and full-scale launches are expected to significantly drive future revenue growth as the product gains broader approval and therapeutic adoption.

- The infusion capacity in the U.S. is being substantially expanded from 10,000 to an expected 26,000 by the end of fiscal year 2025. This increase should alleviate bottlenecks in treatment administration, potentially boosting revenues and improving net margins due to increased patient throughput.

- The introduction of Subcutaneous Autoinjector (SC-AI) and maintenance IV dosing regimens for LEQEMBI could streamline the treatment pathway and reduce healthcare resource requirements, improving net margins by reducing operational costs associated with IV infusion.

- Legislative changes in the U.S., such as enhancements in reimbursement for confirmatory PET scans and BBM tests, are likely to increase patient accessibility to LEQEMBI, driving higher sales volumes and consequently, revenue growth.

- Expansion into markets like China, which despite being a self-pay market, shows growth in private insurance and health examinations, positioning LEQEMBI to tap into a growing market segment. This is expected to lead to revenue growth and broaden Eisai's market reach.

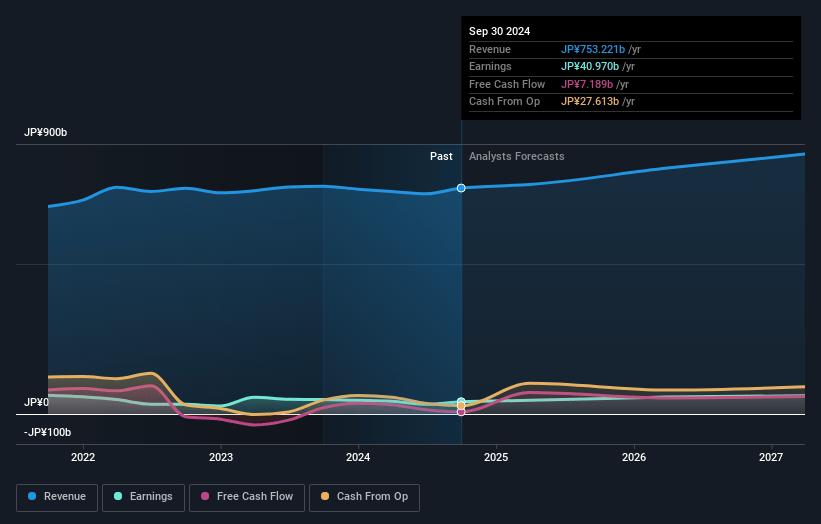

Eisai Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eisai's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.4% today to 6.4% in 3 years time.

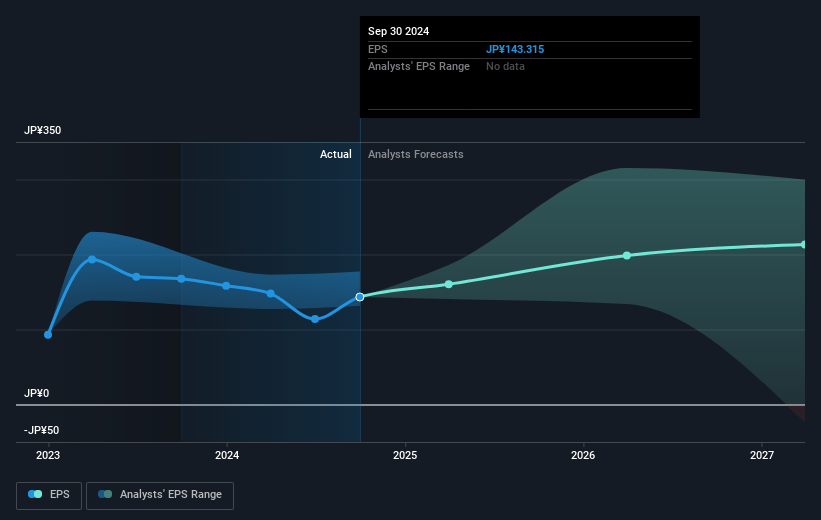

- Analysts expect earnings to reach ¥56.8 billion (and earnings per share of ¥200.3) by about January 2028, up from ¥41.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥85.9 billion in earnings, and the most bearish expecting ¥-6.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.4x on those 2028 earnings, up from 31.9x today. This future PE is greater than the current PE for the JP Pharmaceuticals industry at 16.0x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.29%, as per the Simply Wall St company report.

Eisai Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Operating profit decreased by 13% year-on-year largely due to increased SG&A expenses, which were driven by shared profit expenses for Lenvima and ongoing launch costs for LEQEMBI, potentially impacting net margins negatively.

- Revenue growth was moderated by a decrease in one-time income compared to the previous year, suggesting potential volatility in reported earnings.

- The LEQEMBI business faces a bottleneck in infusion capacity in the U.S., causing a delay in patient treatment and thereby impacting current revenue potential and growth outlook.

- Approval processes, like the ongoing reexamination by the EMA, introduce regulatory risks that could impede market expansion and sales in Europe, affecting revenue growth forecasts.

- Despite efforts to reduce manufacturing costs, current profitability targets for LEQEMBI are pushed to fiscal 2026 due to initial high production costs and capacity constraints, indicating potential pressure on operating margins in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥5743.8 for Eisai based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥8500.0, and the most bearish reporting a price target of just ¥4000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥882.8 billion, earnings will come to ¥56.8 billion, and it would be trading on a PE ratio of 32.4x, assuming you use a discount rate of 4.3%.

- Given the current share price of ¥4631.0, the analyst's price target of ¥5743.8 is 19.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives