Last Update 08 Nov 25

Fair value Increased 5.59%3401: Revenue Outlook Will Moderate Risks While Supporting Balanced Opportunity

Analysts have raised their price target for Teijin from ¥1,180 to ¥1,246. This reflects an improved revenue growth outlook and a lower discount rate in updated forecasts.

Valuation Changes

- Fair Value Estimate has increased from ¥1,180 to ¥1,246, reflecting a modest upward revision.

- Discount Rate has fallen from 9.37% to 8.43%, which lowers the company's perceived risk and cost of capital.

- Revenue Growth forecast has improved slightly from -3.42% to -2.70%, which indicates a smaller decline in expected sales.

- Net Profit Margin projection has declined slightly from 2.49% to 2.33%.

- Future P/E ratio has risen from 13.30x to 15.05x. This suggests a higher valuation multiple on expected earnings.

Key Takeaways

- Refocus on high-margin specialty materials and healthcare segments, combined with operational reforms, is expected to drive margin expansion and more stable earnings.

- Innovation in sustainable materials and divestment of low-yield businesses position the company for new growth opportunities and improved earnings quality.

- Heavy reliance on cost-cutting amid weak demand, competition, and divestitures raises concerns about long-term growth, margin sustainability, and increasing structural risks at Teijin.

Catalysts

About Teijin- Engages in the fibers, films and sheets, composites, healthcare, and IT businesses worldwide.

- Anticipated global growth in demand for lightweight, high-performance materials in automotive, aerospace, and renewable energy sectors-driven by sustainability and stricter environmental regulations-positions Teijin's advanced composites and aramid fibers for revenue recovery and long-term topline growth, especially as cost structure reforms begin to take full effect.

- Increasing adoption of home medical devices, notably CPAP rentals for sleep apnea treatment (supported by significant potential patient pools globally and stable growth in home healthcare), is expected to drive steady sales expansion and higher adjusted operating income in Teijin's healthcare segment as fixed cost reductions are fully realized.

- Strategic divestment of low-margin businesses (e.g., North American Composites) and focus on higher-margin specialty segments align the company for improved net margins and earnings quality, as segment profitability becomes less exposed to cyclical pressures and operational drag.

- Ongoing introduction of cost reforms-including workforce realignment, impairment-related fixed cost reductions, and optimization of production-should undergird gross margin expansion and enable Teijin to partially offset industry price pressures and demand volatility, leading to improved earnings resilience.

- Strong R&D and product innovation targeting sustainable and recyclable materials (such as renewable plastics and aramids for infrastructure applications like submarine power cables) are likely to open up new markets and premium pricing opportunities, supporting long-term revenue growth and helping to fulfill rising circular economy and sustainability requirements.

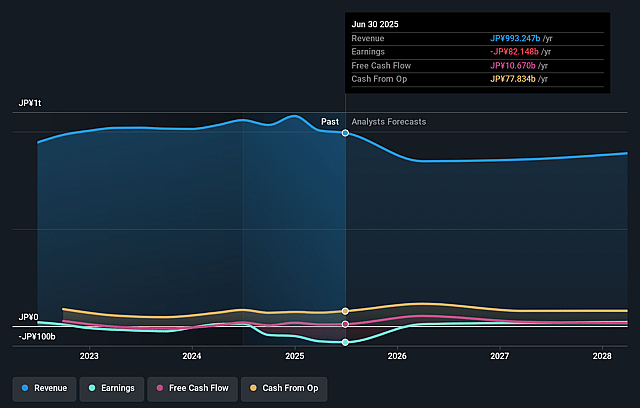

Teijin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Teijin's revenue will decrease by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -8.3% today to 2.5% in 3 years time.

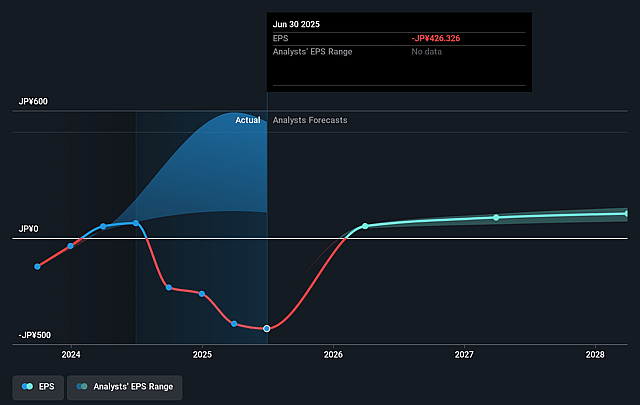

- Analysts expect earnings to reach ¥22.3 billion (and earnings per share of ¥119.37) by about September 2028, up from ¥-82.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥26.3 billion in earnings, and the most bearish expecting ¥15.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from -3.1x today. This future PE is greater than the current PE for the JP Chemicals industry at 12.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.37%, as per the Simply Wall St company report.

Teijin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued decline in sales prices and profits for Aramid and Carbon Fibers-driven by competition from low-cost Chinese and Korean manufacturers and weak demand in applications like optical fiber and industrials-signals long-term price pressure and margin compression in advanced materials, reducing Teijin's ability to grow revenue and net margins.

- The sale and exit of the North American Composites business, while possibly improving short-term profitability through divestitures, shrinks Teijin's geographic footprint and accelerates exposure to domestic market stagnation, leading to a risk of flat or declining topline growth due to reduced diversification.

- Structural reforms, impairment losses, and recurring headcount reductions-particularly in the Aramid business-reflect ongoing underperformance and a lack of clear competitive differentiation in key segments, raising concerns about the sustainability of net margin improvements and the potential for increased restructuring costs over the long term.

- Flat or declining revenue in the Healthcare segment, amid ongoing price pressure from government drug price revisions and reduced sales in core pharmaceuticals, suggests that cost cuts currently offsetting these headwinds may not be sustainable, potentially eroding future earnings growth as cost levers are exhausted.

- The company's historical reliance on cost-cutting (such as lower depreciation after write-downs and fixed cost reductions) to stabilize earnings, rather than broad-based volume or price growth, heightens execution risk if anticipated sales recoveries or R&D-driven innovations (like those in carbon fiber or healthcare) continue to lag, threatening long-term revenue and operating income growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1180.0 for Teijin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1300.0, and the most bearish reporting a price target of just ¥1070.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥894.7 billion, earnings will come to ¥22.3 billion, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 9.4%.

- Given the current share price of ¥1302.0, the analyst price target of ¥1180.0 is 10.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.