Last Update 06 Sep 25

Milbon's consensus price target remains steady at ¥2680, as both the discount rate and future P/E ratio saw negligible movement, indicating no material change in analysts' outlook or fair value.

What's in the News

- Board resolved to repurchase own shares.

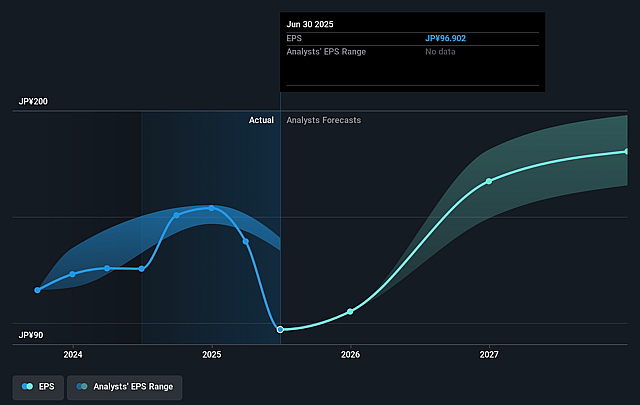

- Company lowered FY2025 consolidated earnings guidance: net sales now forecast at ¥52.3bn (previously ¥54.25bn), operating income ¥5.3bn (was ¥7bn), profit attributable to owners of parent ¥3bn (was ¥5.2bn), and EPS ¥92.09 (was ¥159.69).

- Downward revisions reflect weaker domestic sales due to consumer budget-consciousness and competitive pressures, inventory valuation losses, and an investment securities valuation loss; overseas sales remain in line with plan; no change to dividend forecast.

- Announced share repurchase program of 870,000 shares (2.67% of capital) for up to ¥2bn, aiming to enhance shareholder returns and improve capital efficiency; program runs until December 23, 2025.

Valuation Changes

Summary of Valuation Changes for Milbon

- The Consensus Analyst Price Target remained effectively unchanged, at ¥2680.

- The Discount Rate for Milbon remained effectively unchanged, moving only marginally from 5.68% to 5.67%.

- The Future P/E for Milbon remained effectively unchanged, at 17.87x.

Key Takeaways

- Expansion in global markets and emphasis on premium, innovative beauty products are accelerating revenue growth and strengthening brand differentiation.

- Investments in digital platforms, salon training, and sustainable product development are boosting customer retention, margins, and long-term earnings potential.

- Structural demographic shifts, international headwinds, pricing risks, and digital disruption threaten Milbon's traditional business model and future profitability.

Catalysts

About Milbon- Engages in the manufacturing and sale of cosmetic products in Japan and internationally.

- Expansion in South Korea, the United States, and Europe positions Milbon to capitalize on rising disposable incomes and a larger middle class in Asia and globally, driving sustained revenue growth through premiumization and broader market penetration.

- Growing demand for anti-aging and scalp treatment solutions, especially among mature consumers, aligns with Milbon's ongoing investments in R&D and new high-value product lines like scalp care and the Aujua Alterior line, supporting higher gross margins and long-term earnings growth.

- Enhanced product education, salon technical training, and launch of the milbon:iD digital platform and Smart Salon initiatives are increasing salon loyalty, customer retention, and take-home product sales per salon-translating to improved revenue per customer and higher net margins.

- Focused product innovation in clean, organic, and sustainable beauty (e.g., Villa Lodola organic color, eyebrow solutions) enables Milbon to differentiate its brand and increases pricing power in a market where consumers are scrutinizing product safety, positively impacting gross profit margins.

- The company's medium

- to long-term strategy of achieving overseas sales ratio of 35%+ and targeting leadership in trend-setting Asian markets, reinforced by robust capital allocation to growth and digital infrastructure, is expected to fuel accelerated revenue growth and improved EBITDA margin over time.

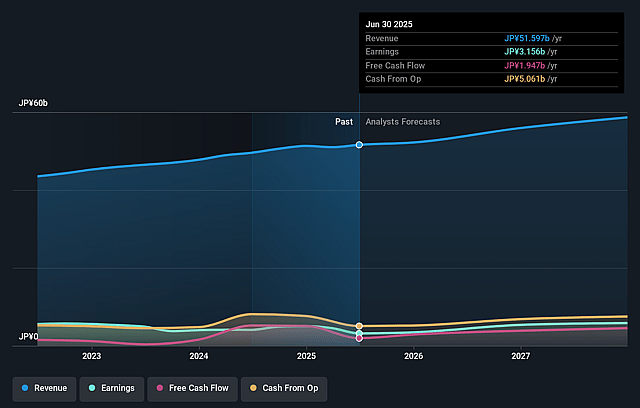

Milbon Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Milbon's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.1% today to 9.5% in 3 years time.

- Analysts expect earnings to reach ¥5.7 billion (and earnings per share of ¥178.34) by about September 2028, up from ¥3.2 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ¥6.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, down from 26.0x today. This future PE is lower than the current PE for the JP Personal Products industry at 23.6x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.68%, as per the Simply Wall St company report.

Milbon Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Japan's aging and shrinking population, highlighted as a continued headwind by management, is expected to reduce the core addressable market for domestic salon services and hair/coloring product sales; this puts structural pressure on long-term domestic revenue growth.

- Persistent weak demand and macroeconomic challenges in China remain unresolved, with management only expecting a gradual recovery and slower pace of improvement; this risks prolonged underperformance in a key overseas market, negatively impacting consolidated revenue and future earnings growth.

- The planned mid-2025 price increases for core products in Japan introduce uncertainty, as management acknowledged difficulty in forecasting volume declines (estimating a potential 5% decrease in shipments for a 10% price hike); any negative impact could compress revenue, reduce market share, and pressure operating margins.

- Operating losses in the US-explicitly expected to continue for several years-highlight the execution risk of international expansion, while delays in achieving operating profitability in this key growth market may drag on overall group earnings and net margin improvement.

- Overall industry trends toward direct-to-consumer and digital channels, as well as increasing competition from international and indie brands, challenge Milbon's traditional salon-focused business model; slow adaptation could lead to margin erosion and long-term pressure on both revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥2680.0 for Milbon based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥59.5 billion, earnings will come to ¥5.7 billion, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 5.7%.

- Given the current share price of ¥2517.0, the analyst price target of ¥2680.0 is 6.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.