Last Update 06 Sep 25

With both Kao's Future P/E and discount rate remaining effectively unchanged, the consensus analyst price target also held steady at ¥7630.

What's in the News

- Kao joined a 27-company consortium, led by Resonac, to co-develop materials and equipment for next-generation panel-level organic interposers in advanced semiconductor packaging.

- Opened a new tertiary amine production plant in Texas, boosting supply chain efficiency for the U.S. market and supporting Kao's Global Sharp Top strategy.

- Announced a share repurchase program of up to 15 million shares (3.22% of issued capital), worth ¥80 billion, to enhance capital efficiency and shareholder returns.

- Increased interim dividend to JPY 77 per share from 76 the previous year.

- Raised fiscal 2025 consolidated earnings guidance: net sales to JPY 1,690 billion and net income to JPY 121 billion, both above prior forecasts.

Valuation Changes

Summary of Valuation Changes for Kao

- The Consensus Analyst Price Target remained effectively unchanged, at ¥7630.

- The Future P/E for Kao remained effectively unchanged, moving only marginally from 27.78x to 28.02x.

- The Discount Rate for Kao remained effectively unchanged, moving only marginally from 5.86% to 5.85%.

Key Takeaways

- Premium product innovation and e-commerce expansion in core segments are driving higher margins by matching urban consumer trends and health-focused demand.

- Emerging market growth, cost optimization, and digital transformation are expanding the company's market reach while supporting operational efficiency and earnings stability.

- Heavy reliance on Japan, cost pressures, weak overseas growth, and slow global expansion heighten risks to revenue diversification, margins, and successful international brand development.

Catalysts

About Kao- Develops and sells hygiene living care, health beauty care, life care, cosmetics, and chemical products.

- Kao's consistent investment in developing high value-added and premium products, particularly in fabric care and hair care, responds to increasing consumer demand in Asia's growing urban middle class, supporting sustained revenue growth and improved net margin through pricing power.

- The company's accelerated expansion into emerging markets-including strong rollouts of core brands in ASEAN and China, as well as continued growth in Thailand-leverages demographic tailwinds and urbanization, which will expand Kao's addressable market and drive topline revenue.

- Kao's strategic focus on cost optimization (via structural reforms, digital transformation, and supply chain efficiencies) alongside ongoing margin improvements in core businesses (e.g., Cosmetics, Fabric & Home Care) is set to enhance operating margins and long-term earnings stability.

- Strong momentum and successful reform in the Cosmetics segment, supported by sharper brand focus and direct-to-consumer e-commerce expansion, aligns with long-term consumer interest in health, wellness, and functional beauty products, bolstering both revenue and margin expansion.

- Ongoing investments in digitalization, AI, and data-driven management are improving agility in product innovation and marketing, enabling Kao to better capitalize on the shift to e-commerce and higher-margin digital sales channels, which should positively impact both revenue growth and net margins.

Kao Future Earnings and Revenue Growth

Assumptions

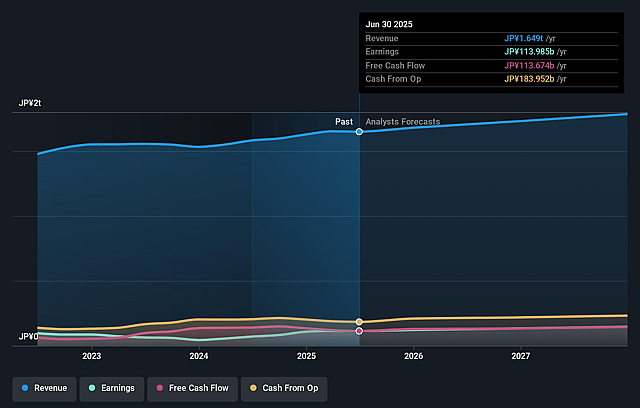

How have these above catalysts been quantified?- Analysts are assuming Kao's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.9% today to 8.3% in 3 years time.

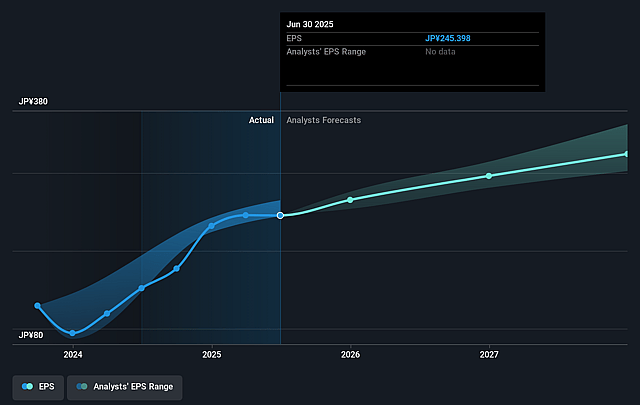

- Analysts expect earnings to reach ¥149.9 billion (and earnings per share of ¥335.94) by about September 2028, up from ¥114.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.8x on those 2028 earnings, which is the same as it is today today. This future PE is greater than the current PE for the JP Personal Products industry at 23.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.86%, as per the Simply Wall St company report.

Kao Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in Asia, Americas, and Europe-particularly cost-conscious consumer environments in Europe and the US, along with overall overseas sales declining by 4.1%-signal Kao's exposure to increased market rivalry and weak demand outside Japan, risking long-term revenue growth projections and achieving overseas expansion targets.

- Ongoing overreliance on the domestic Japanese market, with Japan driving the majority of recent revenue and profit growth while overseas expansion (particularly in global hair and cosmetics, and business transformation segments) is taking longer than expected; this exposes Kao to Japan's slow demographic growth and limits topline revenue diversification.

- Persistently high raw material costs and continued exposure to global macro and energy price volatility, coupled with only partial pass-through via price increases, could lead to sustained gross margin and net margin pressure, especially if cost of sales savings or price hikes are insufficient in the long term.

- Heavy investment in marketing, digital transformation, and restructuring-though supporting future growth-raises operating costs; if the ramp-up of premium and international brands faces delays or fails to gain traction (as indicated in slower global hair salon and skin care expansion), this could suppress earnings and reduce return on invested capital.

- Industry-wide and regulatory pressures for sustainability, as well as necessity for ongoing product innovation and responses to environmental demands, pose both operational and reputational risks; slow adaptation or underperformance relative to competitors could undermine Kao's market share, lead to higher compliance costs, and further compress long-term margins and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥7630.0 for Kao based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥8900.0, and the most bearish reporting a price target of just ¥7000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥1815.8 billion, earnings will come to ¥149.9 billion, and it would be trading on a PE ratio of 27.8x, assuming you use a discount rate of 5.9%.

- Given the current share price of ¥6869.0, the analyst price target of ¥7630.0 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.