Catalysts

About PHC Holdings

PHC Holdings develops and supplies precision health care solutions spanning diabetes management, diagnostics, biomedical equipment and health care IT.

What are the underlying business or industry changes driving this perspective?

- Although BGM is gaining share in developed markets, ongoing contraction of the overall blood glucose monitoring market and the divestment of CGM limit long term volume growth potential and cap segment revenue expansion despite current margin improvements.

- Despite growing adoption of digital health infrastructure in Japan and a broadened EMR and medical receipt customer base exceeding 55,000 accounts, the drag from structurally weaker CRO demand and normalization of high margin e prescription revenue could constrain Healthcare Solutions top line and keep operating margins subdued.

- While aging populations and rising R&D investment support long term demand for biomedical and pathology equipment, prolonged capital expenditure restraint in North America and tariff related cost pressures risk keeping Diagnostics & Life Sciences revenue sluggish and depressing net margins.

- Although PHC is rationalizing its portfolio through the CGM transfer and structural reforms, high goodwill, sizable interest bearing debt and recurring FX valuation swings leave earnings per share vulnerable to macro shocks and higher discount rates.

- While management is investing in recurring consumables, genetic testing and other higher value offerings, the time needed to scale these franchises in a competitive global landscape may delay a meaningful uplift in consolidated revenue growth and EBITDA margin.

Assumptions

This narrative explores a more pessimistic perspective on PHC Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

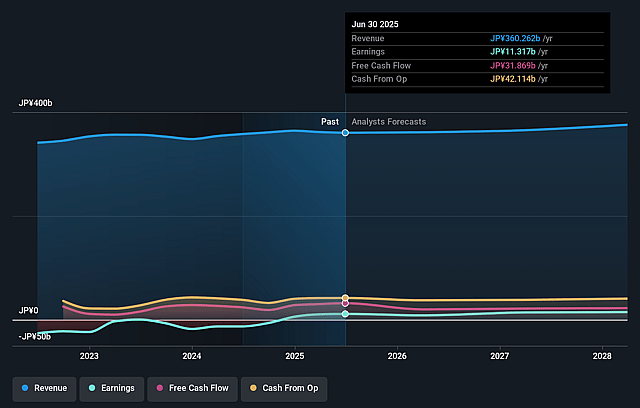

- The bearish analysts are assuming PHC Holdings's revenue will grow by 1.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.6% today to 4.4% in 3 years time.

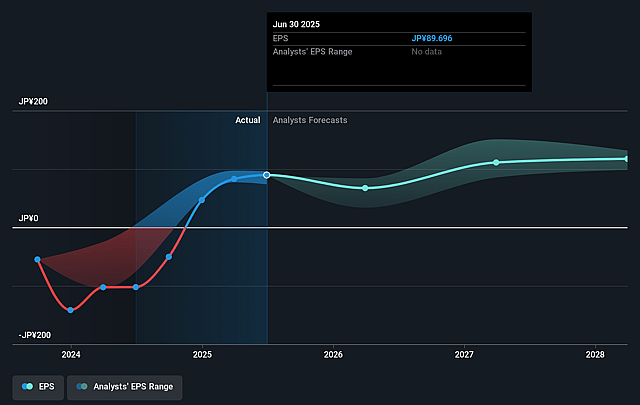

- The bearish analysts expect earnings to reach ¥16.8 billion (and earnings per share of ¥132.63) by about December 2028, up from ¥5.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ¥21.1 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, down from 23.5x today. This future PE is lower than the current PE for the JP Medical Equipment industry at 15.7x.

- The bearish analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.71%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- A faster than expected recovery in U.S. capital expenditure for diagnostics and life sciences equipment, supported by large scale pharmaceutical investment into American production capacity, could accelerate Biomedical and Pathology instrument demand and drive higher long term revenue and operating profit growth than currently assumed. This could support a higher share price through stronger earnings.

- Structural tailwinds from healthcare digitalization in Japan, including government backed healthcare DX, expanding EMR and medical receipt system adoption across over 55,000 accounts and growing telemedicine and health management needs, may translate into sustained high margin software and service revenue expansion and improving net margins. This could push the valuation above today’s level.

- Continued market share gains in blood glucose monitoring as weaker competitors exit, coupled with successful price increases in the U.S. and disciplined channel selection in China and the Middle East, could more than offset underlying market contraction and keep Diabetes Management profit margins elevated. This may lift overall earnings and justify share price appreciation.

- Execution of portfolio optimization, including the transfer of the loss making CGM business, ongoing structural reforms and disciplined cost control in SG&A and production, may structurally raise the group’s profitability profile and return on equity. This could lead investors to re rate the stock upward on improved earnings quality.

- Effective mitigation of tariff headwinds through supply chain reconfiguration, increased U.S. production, and further price hikes, together with recognized product innovation and awards in diagnostics and life sciences, may restore growth momentum and margin resilience in that segment. This could enhance medium term revenue visibility and support a higher earnings multiple and share price.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for PHC Holdings is ¥1000.0, which represents up to two standard deviations below the consensus price target of ¥1244.29. This valuation is based on what can be assumed as the expectations of PHC Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥2100.0, and the most bearish reporting a price target of just ¥1000.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ¥379.0 billion, earnings will come to ¥16.8 billion, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 9.7%.

- Given the current share price of ¥1084.0, the analyst price target of ¥1000.0 is 8.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PHC Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.