Last Update13 Sep 25Fair value Increased 6.81%

Despite a slight decline in consensus revenue growth expectations, an improved net profit margin has driven a higher consensus analyst price target for PHC Holdings, which has increased from ¥978 to ¥1045.

What's in the News

- Board approved signing a memorandum of understanding to transfer the commercial operation of Eversense Continuous Glucose Monitoring System from subsidiary Ascensia Diabetes CareHoldings AG to Senseonics Holdings, Inc.

- Other business matters to be considered and approved.

Valuation Changes

Summary of Valuation Changes for PHC Holdings

- The Consensus Analyst Price Target has risen from ¥978 to ¥1045.

- The Consensus Revenue Growth forecasts for PHC Holdings has fallen from 1.9% per annum to 1.8% per annum.

- The Net Profit Margin for PHC Holdings has risen from 4.01% to 4.23%.

Key Takeaways

- Expansion in high-margin diabetes and digital pathology products, plus healthcare IT, positions PHC to benefit from digitalization and recurring service revenues.

- Investment in R&D and operational streamlining enhances competitiveness and resilience against external risks, supporting sustainable future growth.

- Revenue and profitability are at risk from stagnant investment, shrinking core markets, restructuring costs, foreign exchange volatility, and global supply chain disruptions.

Catalysts

About PHC Holdings- Through its subsidiaries, provides medical devices, healthcare IT solutions, and life science products and services primarily in Japan.

- Expansion of proprietary, higher-margin products in diabetes management (especially the ongoing growth of the CGM 365-day offering) and digital pathology, aligns with the increasing prevalence of chronic diseases and the global shift to outpatient and home-based diagnostics, supporting future revenue and net margin improvement as mix shifts toward recurring consumables and services.

- Robust demand for healthcare digitization (e.g. cloud-based electronic medical records, digital prescriptions) is reflected in strong performance and new product launches in Healthcare IT Solutions, positioning PHC to capitalize on increased digital healthcare infrastructure investment and enabling a more resilient, higher-margin revenue base.

- The recovery in capital investment demand anticipated in the Biomedical segment, paired with the company's strategy to increase private sector customer exposure and roll out new life science equipment, leverages the long-term rise in biopharma R&D and data-driven medicine-likely boosting top-line growth and improving operating leverage.

- Ongoing investments in R&D for advanced diagnostics and precision medicine platforms (including upcoming product launches in oncology and cellular/gene therapy) enable PHC to tap into secular trends of AI-driven and personalized healthcare, setting the stage for enhanced topline growth and sustainable competitive advantage in future years.

- Strategic streamlining of operations, manufacturing localization, and proactive supply chain optimization in response to geopolitical risks and tariffs provide a buffer to near-term earnings headwinds and lay the groundwork for improved ROIC, cost efficiency, and greater earnings resilience over the long term.

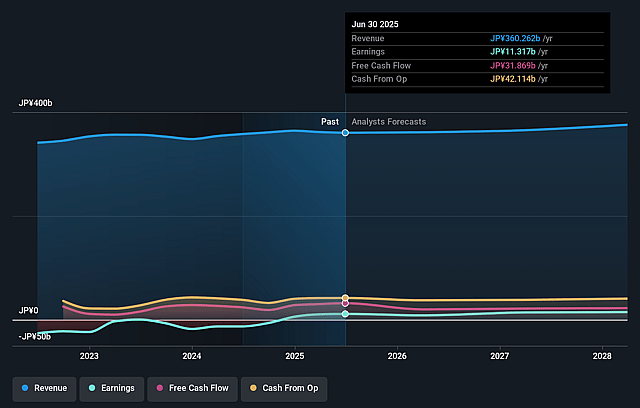

PHC Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PHC Holdings's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 4.0% in 3 years time.

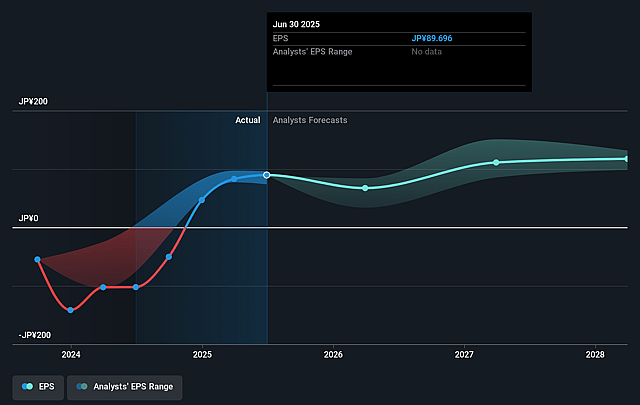

- Analysts expect earnings to reach ¥15.3 billion (and earnings per share of ¥121.06) by about September 2028, up from ¥11.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ¥11.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, down from 11.3x today. This future PE is lower than the current PE for the JP Medical Equipment industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.91%, as per the Simply Wall St company report.

PHC Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- PHC Holdings' Biomedical and Diagnostics & Life Sciences segments are highly exposed to fluctuations in capital investment and public subsidy trends, especially in the U.S. and Europe, with recent declines attributed to stagnant investment demand and uncertainty in government funding; continued or deepening cuts (like recent NIH and CDC subsidy reductions) pose a risk to future revenues and earnings from these segments.

- The company is forecasting only a modest recovery in declining mature product segments, particularly BGM (blood glucose monitoring), in its core Diabetes Management business, and acknowledges the continuous market contraction; sustained market shrinkage or accelerating competition could erode revenue and net margins further if new product launches (such as the CGM 365-day product) do not realize projected sales growth.

- PHC Holdings' future profitability is threatened by ongoing integration and restructuring costs, as highlighted by recurring one-time expenses, cost-cutting needs, and impairments in recent years; if efficiency and synergy gains from M&A or restructuring do not materialize, net margins and long-term earnings could deteriorate.

- Significant exposure to foreign exchange volatility, particularly the weak yen, currently presents both upside and downside risk to reported earnings; normalization or reversal of FX trends could materially reduce reported revenue and operating profit, affecting long-term earnings growth.

- Escalating geopolitical tensions (notably U.S.-China tariffs) and supply chain realignments create uncertainty for global distribution, production costs, and pricing; the company's mitigation measures assume successful price pass-through and logistical optimization, but unabsorbed costs or lost sales due to lower end-market demand may depress both revenue and net profit.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥978.333 for PHC Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1150.0, and the most bearish reporting a price target of just ¥750.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥381.2 billion, earnings will come to ¥15.3 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 9.9%.

- Given the current share price of ¥1013.0, the analyst price target of ¥978.33 is 3.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.