Key Takeaways

- Ajinomoto is prioritizing expansion in electronic materials, CDMO biopharma, and organic growth overseas to enhance revenue and profitability.

- Strategic shifts in coffee products and operational efficiency improvements aim to stabilize revenue, improve margins, and boost earnings per share.

- Ajinomoto faces profit pressures from rising costs and currency fluctuations, impacting domestic and overseas segments, with potential stress on margins and financial stability.

Catalysts

About Ajinomoto- Engages in the seasonings and foods, frozen foods, and healthcare and other businesses in Japan and internationally.

- Ajinomoto's focus on expanding their electronic materials and CDMO biopharma services is expected to drive future growth. Recovery and steady performance in these sectors are anticipated to enhance revenue streams and bolster earnings.

- The company plans to aggressively invest in organic growth overseas, particularly in their seasonings and food segments, with promising potential in newer markets like Cambodia and Laos. This expansion is forecasted to maintain high margins and contribute to overall revenue and profitability.

- Ajinomoto's strategic shift in its coffee portfolio from regular and instant coffee to sticks and powder drinks is a long-term initiative aimed at minimizing the impact of volatile coffee bean prices. This transformation is likely to stabilize revenue and enhance margins over time.

- Efforts are underway to improve operational efficiency, particularly in working capital management, leading to an improved cash flow situation. This, combined with strategic price increases in Japan, is expected to strengthen the company's earnings capability.

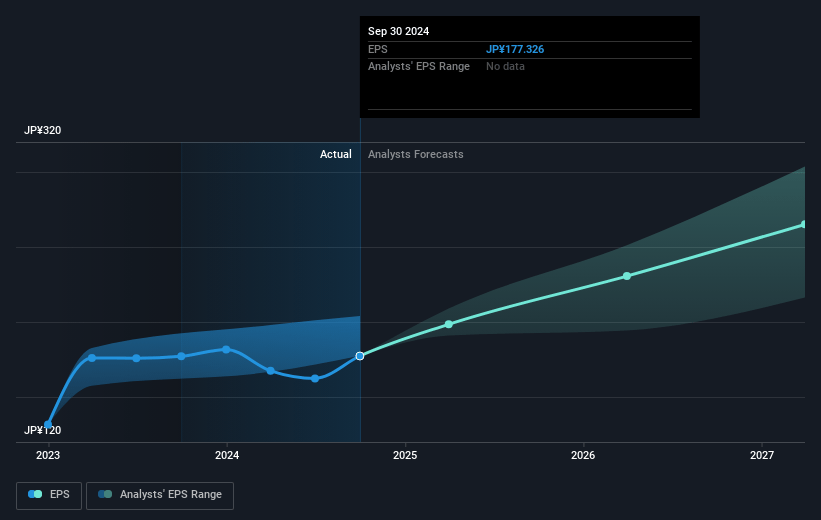

- Ajinomoto's share repurchase programs, up to ¥90 billion in FY '24, combined with a 2-for-1 stock split, are strategic moves aimed at delivering shareholder value and are expected to positively impact earnings per share (EPS) going forward.

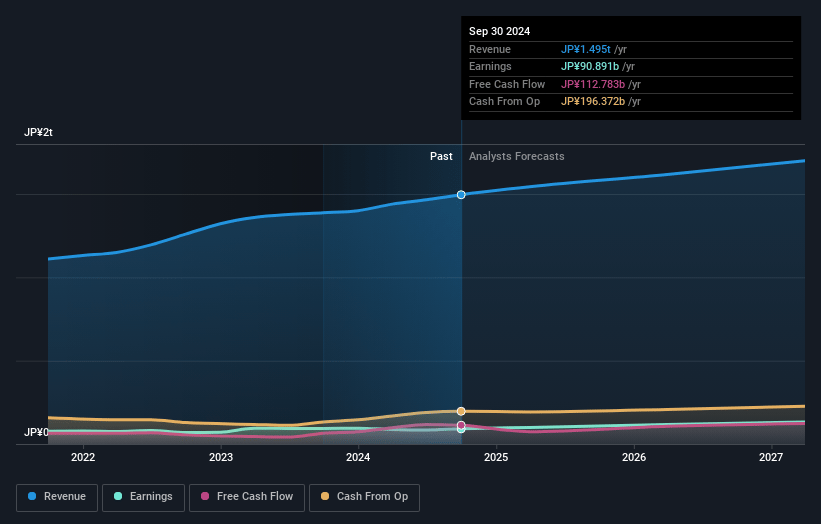

Ajinomoto Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ajinomoto's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.1% today to 8.1% in 3 years time.

- Analysts expect earnings to reach ¥144.9 billion (and earnings per share of ¥297.43) by about January 2028, up from ¥90.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥160.5 billion in earnings, and the most bearish expecting ¥119.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.8x on those 2028 earnings, down from 34.2x today. This future PE is greater than the current PE for the JP Food industry at 15.3x.

- Analysts expect the number of shares outstanding to decline by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.29%, as per the Simply Wall St company report.

Ajinomoto Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The coffee business in Japan has been struggling with increased raw coffee bean prices, leading to insufficient price increases to cover the cost, affecting profit margins and resulting in a downward revision of business profit by ¥2 billion. This could potentially impact revenue and net margins.

- The frozen food segment in Japan is facing challenges due to increased costs for ingredients like cacao and rice and the impact of a weaker yen, leading to declined profits despite price increases. This could negatively affect earnings and profit margins.

- The Functional Materials segment showed a decline in the previous fiscal year due to factors such as high costs for servers and data centers, although there is some recovery. Uncertainty in product mix and possible external factors could affect revenue and business profits.

- Currency fluctuations have played a significant role in recent profit dynamics. The exclusion of positive effects from currency translation, if reversed, could have a perceptible negative impact on revenue and earnings, with increased foreign exchange risks potentially affecting financial stability.

- Despite growth overseas, the domestic food business in Japan is struggling with profit pressure and increasing shared company-wide expenses for future investments, indicating potential stress on net margins and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥7033.85 for Ajinomoto based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥8200.0, and the most bearish reporting a price target of just ¥5400.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥1784.7 billion, earnings will come to ¥144.9 billion, and it would be trading on a PE ratio of 26.8x, assuming you use a discount rate of 4.3%.

- Given the current share price of ¥6229.0, the analyst's price target of ¥7033.85 is 11.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives