Catalysts

About Nomura Holdings

Nomura Holdings is a leading global financial services group providing wealth management, investment management, wholesale and banking solutions to clients in Japan and worldwide.

What are the underlying business or industry changes driving this perspective?

- Accelerating shift in Japan from savings to investments is driving sustained net inflows into Wealth Management and Investment Management, supporting continued growth in recurring fee revenue and a higher, more durable revenue base.

- Rising adoption of long term diversified investment products, such as investment trusts, discretionary investments and Japan equity ETFs, is expanding assets under management and should lift fee income and operating leverage as scale increases.

- Expansion of alternative and private assets, including American Century Investments and Nomura Capital Partners strategies, is deepening higher margin product mix and is poised to support stronger net revenue growth and EPS over time.

- Globalization of advisory and capital markets activity, with strong Japan related M&A and growing contributions from EMEA and the Americas, positions Nomura to capture larger cross border fee pools and enhance earnings resilience and ROE.

- Build out of the Banking platform, including growing loan and trust balances and the upcoming deposit sweep service, is laying the groundwork for more stable interest and fee income and improving overall net margins.

Assumptions

This narrative explores a more optimistic perspective on Nomura Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

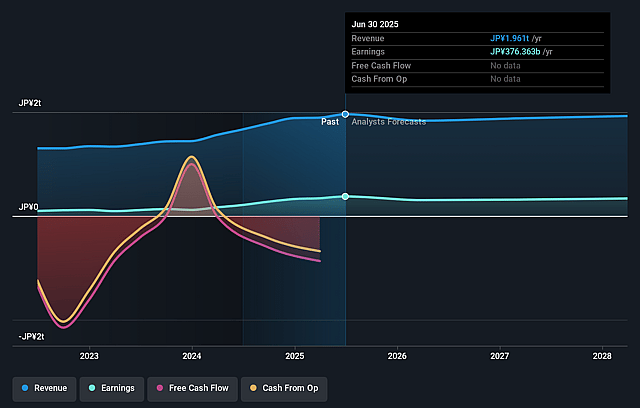

- The bullish analysts are assuming Nomura Holdings's revenue will remain fairly flat over the next 3 years.

- The bullish analysts assume that profit margins will increase from 18.6% today to 19.8% in 3 years time.

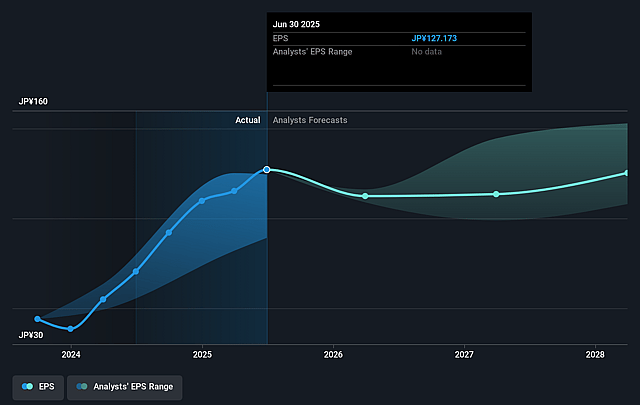

- The bullish analysts expect earnings to reach ¥402.2 billion (and earnings per share of ¥151.61) by about December 2028, up from ¥370.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ¥306.4 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.6x on those 2028 earnings, up from 10.1x today. This future PE is greater than the current PE for the US Capital Markets industry at 14.7x.

- The bullish analysts expect the number of shares outstanding to decline by 0.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.1%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The strategy of allocating more balance sheet to high quality Wholesale and structured private credit deals, including SPPC and securitized products, increases exposure to credit and concentration risks, and if market or counterparty stress emerges, trading losses and higher provisions could erode net revenue and compress earnings.

- The planned acquisition of Macquarie Group's U.S. asset management business and the ongoing build-out of international operations will depress the CET1 ratio and push risk-weighted assets higher. As a result, any regulatory shock, risk management issues or underperformance in these acquired assets could constrain capital returns and dilute net margins and earnings growth.

- Rising compensation and benefits, including higher performance-linked bonuses and unusually large retirement payments, along with system upgrade depreciation and increased costs from security incidents like phishing scams, point to structural cost pressure that may outpace revenue growth and weaken operating leverage and net margins over time.

- The growing reliance on alternative and private assets, such as American Century Investments, Nomura Capital Partners and private equity exits, means that a downturn in equity markets, a slowdown in IPOs or weaker valuations could reduce investment gains and fee income and lead to more volatile revenue and earnings.

- The secular shift from savings to investments in Japan is supporting record recurring revenue assets. However, a reversal in equity markets, prolonged rate volatility or loss of client trust from cyber fraud incidents could slow net inflows into investment trusts and discretionary products, undermining the stability of fee based revenue and limiting future earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Nomura Holdings is ¥1700.0, which represents up to two standard deviations above the consensus price target of ¥1260.0. This valuation is based on what can be assumed as the expectations of Nomura Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1700.0, and the most bearish reporting a price target of just ¥990.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be ¥2032.2 billion, earnings will come to ¥402.2 billion, and it would be trading on a PE ratio of 16.6x, assuming you use a discount rate of 11.1%.

- Given the current share price of ¥1279.0, the analyst price target of ¥1700.0 is 24.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nomura Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.