Last Update 27 Nov 25

Fair value Increased 2.21%8572: Upcoming Dividend Hike And Rising Risks Signal Measured Outlook

Analysts have increased their price target for Acom from ¥452.5 to ¥462.5, citing improved revenue growth forecasts. This adjustment comes despite a slight uptick in the discount rate and a marginal dip in the projected profit margin.

What's in the News

- Acom Co., Ltd. announced a dividend increase for the second quarter of the fiscal year ending March 31, 2026. The dividend will be raised to JPY 10.00 per share from JPY 7.00 per share for the same period last year (Key Developments).

- The commencement date for the dividend payment is set for December 1, 2025 (Key Developments).

Valuation Changes

- Fair Value has risen from ¥452.5 to ¥462.5, reflecting higher analyst expectations.

- Discount Rate increased from 7.36% to 8.02%. This indicates a modest rise in perceived risk or cost of capital.

- Revenue Growth forecast edged up from 4.37% to 4.73%. This suggests an improved business outlook.

- Net Profit Margin saw a slight decrease, moving from 19.19% to 18.98%.

- Future P/E ratio rose slightly from 12.45x to 12.80x.

Key Takeaways

- Strong loan and credit demand and strategic international growth could significantly boost Acom's future revenues and earnings.

- Effective financial strategies, including cost management and innovative services, are expected to support profit growth and net margin stability.

- A data breach and rising financial expenses pose risks to ACOM's reputation and earnings, while regulatory changes and economic volatility challenge revenue growth.

Catalysts

About Acom- Offers loans, credit cards, and loan guarantee services in Japan and internationally.

- The strong loan demand and receivables growth in both the Loan and Credit Card business, and the Guarantee business, indicate a potential for increased operating revenue in the future. This growth is crucial for increasing revenue and could enhance overall earnings.

- ACOM's international operations, especially in Thailand, the Philippines, and Malaysia, show potential for sustained growth despite some regional challenges. As these economies grow, ACOM's revenues and earnings from international operations could similarly benefit.

- The company's focus on embedded finance, highlighted through the GeNiE's Money Lamp service, can create new revenue streams by integrating lending services into existing digital platforms. This innovation is expected to drive future revenue growth.

- ACOM's strategy to manage funding costs effectively by optimizing long-term and short-term debt balance, protected mostly against rate hikes, supports maintaining net margins despite rising interest rates. This financial strategy is essential for future profit growth.

- The decline in claims for interest repayments and the related decreases in reserves suggest a potential for lower financial expenses in the future, positively impacting net margins and profitability.

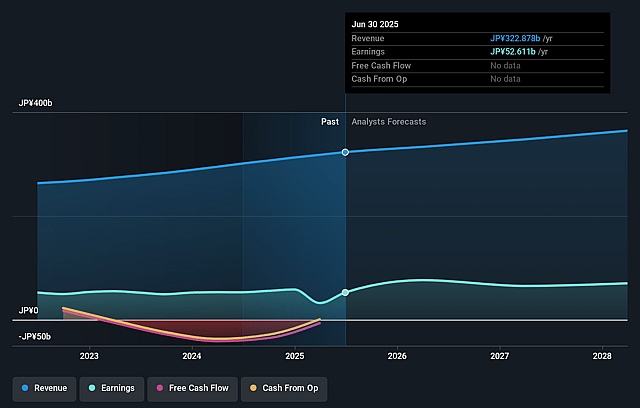

Acom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Acom's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.3% today to 19.2% in 3 years time.

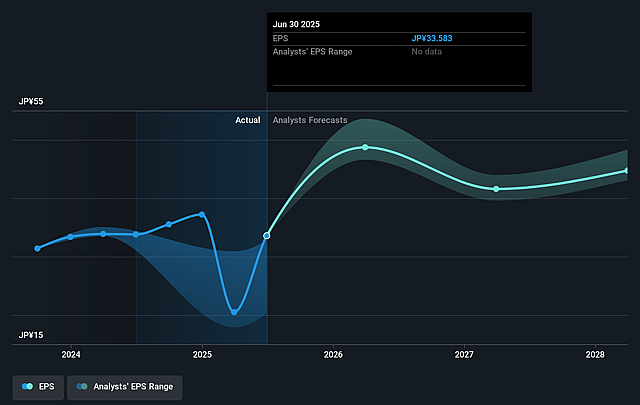

- Analysts expect earnings to reach ¥70.4 billion (and earnings per share of ¥43.94) by about September 2028, up from ¥52.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, down from 13.9x today. This future PE is lower than the current PE for the JP Consumer Finance industry at 13.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

Acom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The data breach involving customer personal information, although contained, could damage ACOM’s reputation and impact customer trust, affecting future revenue and market positioning.

- Economic volatility in overseas markets might affect Japan’s economy and dampen personal consumption, potentially impacting ACOM’s loan demand and revenue growth.

- The introduction of responsible lending requirements in Thailand might affect future loan expectations and revenue in the region due to tighter regulations.

- The increasing provision for bad debt, particularly with newer borrowers, indicates a potential risk to net margins and could continue to affect earnings until loan stability is achieved.

- Rising financial expenses due to higher market rates, both in Japan and Thailand, could increase operational costs and impact net earnings if interest rates continue to climb.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥452.5 for Acom based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥367.1 billion, earnings will come to ¥70.4 billion, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of ¥466.8, the analyst price target of ¥452.5 is 3.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Acom?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.