Key Takeaways

- Expanding into Saudi Arabia and Southeast Asia aims to significantly increase international revenue, positively impacting future income.

- Innovations in customer acquisition and fintech investments position SBI Holdings for enhanced long-term earnings and leadership in emerging financial services.

- Volatile markets, geopolitical risks, and costly R&D in semiconductors threaten profits and future growth at SBI Holdings.

Catalysts

About SBI Holdings- Engages in the online securities and investment businesses in Japn and Saudi Arabia.

- SBI Holdings is focusing on expanding its overseas business presence, highlighting Saudi Arabia and Southeast Asia as key areas for expansion. This initiative aims to grow international revenue from the current 12% to between 20% and 30% over the next three years, positively impacting future revenue.

- The successful implementation of the ZERO Revolution, characterized by innovations in customer acquisition and service offerings, is expected to continue driving growth in revenue and customer base, further bolstering financial results.

- The company's strategic focus on developing its asset management business, targeting a total AUM of ¥20 trillion, promises to create a significant new revenue stream, impacting earnings favorably.

- The integration and expansion of banking operations, underpinned by the sustained growth of SBI Shinsei Bank, promises increased profitability and synergies with the broader SBI Group, affecting net margins positively.

- The company’s involvement in next-generation growth areas such as digital assets and fintech investments is poised to position SBI Holdings as a leader in emerging financial services, potentially enhancing long-term earnings prospects.

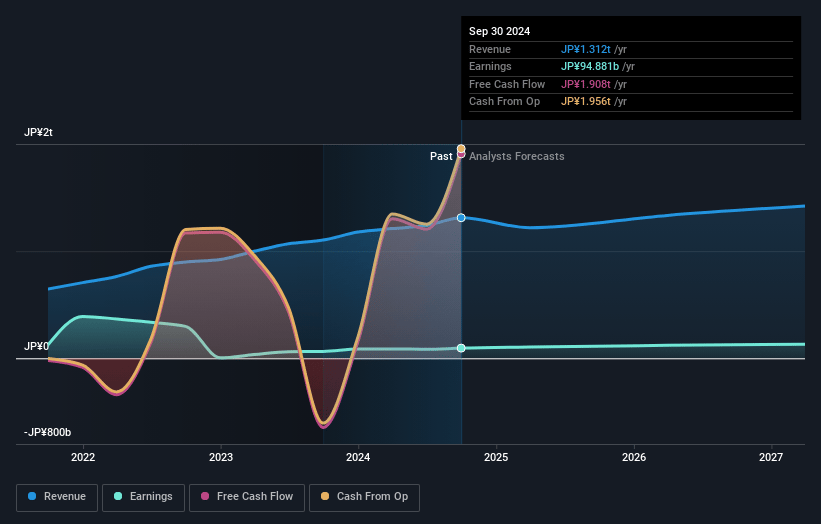

SBI Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SBI Holdings's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.2% today to 9.1% in 3 years time.

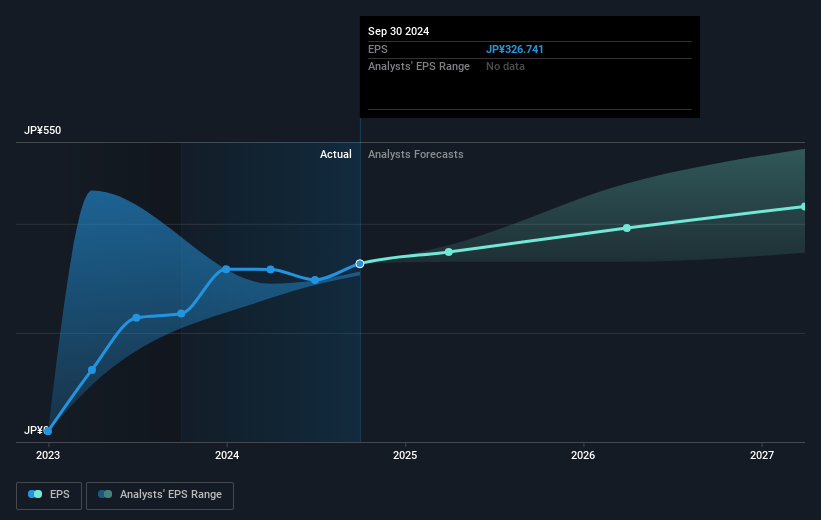

- Analysts expect earnings to reach ¥130.8 billion (and earnings per share of ¥436.35) by about January 2028, up from ¥94.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ¥105.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, down from 13.9x today. This future PE is greater than the current PE for the JP Capital Markets industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.27%, as per the Simply Wall St company report.

SBI Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The investment business reported negative numbers due to losses from changes in fair value, which could lead to decreased profit margins if market conditions remain volatile.

- The digital area is currently not profitable and being considered an advanced investment, indicating that ongoing losses could impact overall net margins if these ventures do not soon yield returns.

- Uncertain political climates, including changes in U.S. administration and instability in Japan, pose risks that could affect strategic planning and future earnings negatively.

- The reliance on emerging markets and geopolitical risks, such as those in South Korea and Taiwan, may lead to fluctuating revenues and increased risk due to economic and political instability in these regions.

- The semiconductor business faces challenges due to high capital expenditure requirements and rapid technological advancements, which could compress profit margins and hinder revenue growth if these are not managed efficiently.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥4501.43 for SBI Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5570.0, and the most bearish reporting a price target of just ¥3800.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥1438.7 billion, earnings will come to ¥130.8 billion, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 10.3%.

- Given the current share price of ¥4364.0, the analyst's price target of ¥4501.43 is 3.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives