Catalysts

About Mizuho Financial Group

Mizuho Financial Group is a global financial institution providing corporate and investment banking, retail banking, and asset and wealth management services in Japan and overseas.

What are the underlying business or industry changes driving this perspective?

- Accelerating expansion of the Americas CIB platform, enhanced by the Greenhill acquisition, positions Mizuho to move into the global top 10 in investment banking, supporting sustained double digit fee growth and higher group revenue and earnings.

- Ongoing shift toward fee based and advisory driven income, including M&A, ECM and IR or SR services for both large corporates and high growth mid caps, reduces reliance on domestic interest income and supports structurally higher net margins and ROE.

- Deepening retail and wealth franchises, underpinned by NISA adoption, a growing mass retail client base and scalable digital channels with Rakuten and MiRaI, is expected to drive recurring AUM, stable fee revenue and rising earnings through the cycle.

- Disciplined balance sheet and capital optimization, including continued cross shareholding reductions, focus on investment grade assets and a resilient bond portfolio, is intended to enable higher asset returns and support further growth in net income and EPS.

- Productivity gains from targeted IT and AI investments, workforce streamlining and sharp reductions in third party spend are expected to lower the expense ratio toward 60 percent, which could directly lift operating leverage, net margins and earnings growth.

Assumptions

This narrative explores a more optimistic perspective on Mizuho Financial Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

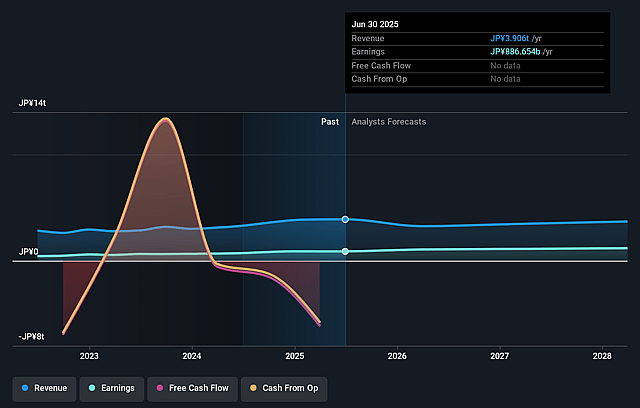

- The bullish analysts are assuming Mizuho Financial Group's revenue will grow by 1.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 25.5% today to 34.8% in 3 years time.

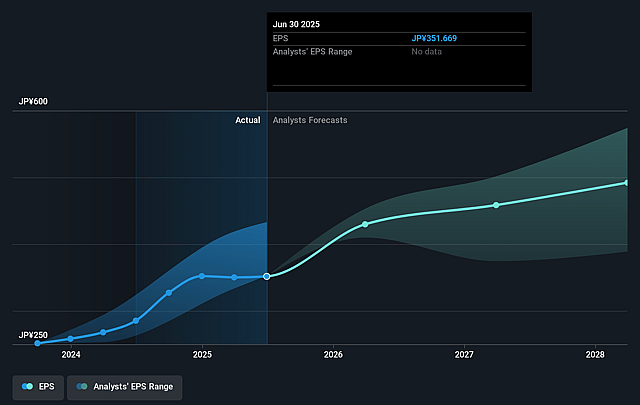

- The bullish analysts expect earnings to reach ¥1433.4 billion (and earnings per share of ¥627.65) by about December 2028, up from ¥1009.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ¥1160.3 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, down from 13.7x today. This future PE is greater than the current PE for the US Banks industry at 11.5x.

- The bullish analysts expect the number of shares outstanding to decline by 1.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.2%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The strategy of using securities and bond portfolios to smooth earnings across interest rate cycles relies on benign markets and low duration. However, a prolonged period of higher-for-longer global rates, renewed inflation, or credit stress could erode bond valuations and constrain the ability to recycle capital efficiently, pressuring both revenue growth and net margins over the long term.

- Continued expansion of the Americas CIB franchise and reliance on large advisory mandates and cross-border M&A exposes Mizuho to cyclicality in investment banking volumes and fee pools. A structural slowdown in deal activity, tighter financial conditions, or rising competition from global peers could cap fee income growth and undermine earnings resilience.

- The group is allocating substantial resources to technology, AI, and overseas growth while also targeting a sustained expense ratio around 60 percent. If wage inflation, regulatory compliance demands, or IT overruns persist, cost savings and productivity gains may fall short, limiting operating leverage and compressing net margins over time.

- The long-term pivot toward mass retail, wealth, and asset management through partnerships such as Rakuten, MiRaI, and external managers depends on deepening client trust and stable fee generation. Any reputational issues, mis-selling concerns, underperformance of recommended products, or weaker-than-expected NISA-driven flows could slow assets under management growth and dampen recurring revenue.

- Management is pursuing higher ROE and EPS through balance sheet optimization, cross-shareholding reductions, and aggressive capital returns. If forward-looking reserves prove insufficient in a downturn, credit costs rise structurally, or regulatory capital requirements tighten, the bank may be forced to moderate buybacks and dividends, which would weigh on earnings growth and constrain valuation uplift.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Mizuho Financial Group is ¥6540.0, which represents up to two standard deviations above the consensus price target of ¥5435.45. This valuation is based on what can be assumed as the expectations of Mizuho Financial Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥6540.0, and the most bearish reporting a price target of just ¥4200.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be ¥4115.3 billion, earnings will come to ¥1433.4 billion, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of ¥5584.0, the analyst price target of ¥6540.0 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Mizuho Financial Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.