Key Takeaways

- Strong cost controls, positive pricing, and strategic alliances are set to drive margin expansion and faster innovation despite rising competition and operating pressures.

- Focused electrification, localization, and digital services position Mitsubishi for sales recovery and stable earnings in emerging markets amid shifting global demand and risks.

- Slow EV transition, regional overdependence, underinvestment in innovation, rising competition, and geopolitical risks threaten Mitsubishi Motors' future competitiveness, earnings, and growth prospects.

Catalysts

About Mitsubishi Motors- Engages in the development, production, and sale of passenger vehicles, and its parts and components in Japan, Europe, North America, Oceania, the rest of Asia, and internationally.

- While the analyst consensus expects margin pressures from incentives and operating costs, there is compelling evidence Mitsubishi's disciplined cost-reduction, procurement efficiencies, and positive pricing mix-demonstrated in recent quarters-could more than offset increased competition, supporting an outperformance on net margins over the next 12–24 months.

- Analyst consensus highlights the risk of declining volumes in ASEAN and emerging markets, but Mitsubishi's realigned focus on its hybrid and PHEV strengths, accelerated model launches, and enhanced localization are poised to drive faster-than-expected sales recoveries and revenue growth as demand for electrified, affordable vehicles rebounds in those regions.

- Mitsubishi's deepening integration with Renault-Nissan and new partnerships-including shared BEV, PHEV, and connected vehicle platforms-are unlocking sizable R&D and platform cost savings, which should expand operating margins and provide faster innovation cycles in key growth geographies.

- The company's early investments in connected car services and digital auto finance are forming a foundation for high-margin, recurring revenue streams, positioning Mitsubishi to capture increasing value from the global shift toward digitally-enabled vehicle and service models beyond traditional car sales.

- Mitsubishi's proven agility in product localization, supply chain diversification, and targeted expansion in resilient emerging markets (like the Philippines and Vietnam) provides a natural hedge against currency volatility and geopolitical shocks, likely supporting more stable earnings and improved return on equity going forward.

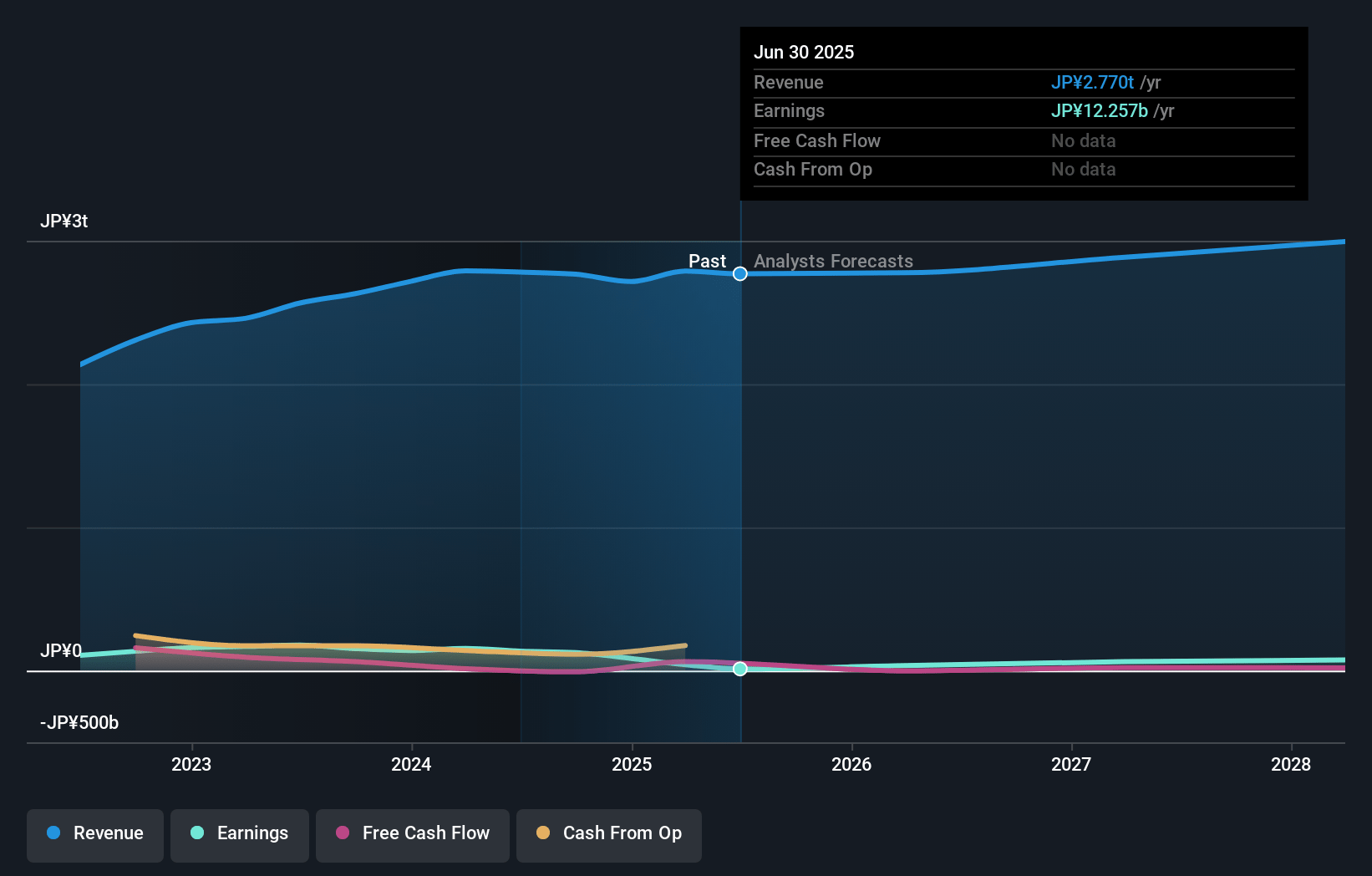

Mitsubishi Motors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Mitsubishi Motors compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Mitsubishi Motors's revenue will grow by 5.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.5% today to 4.4% in 3 years time.

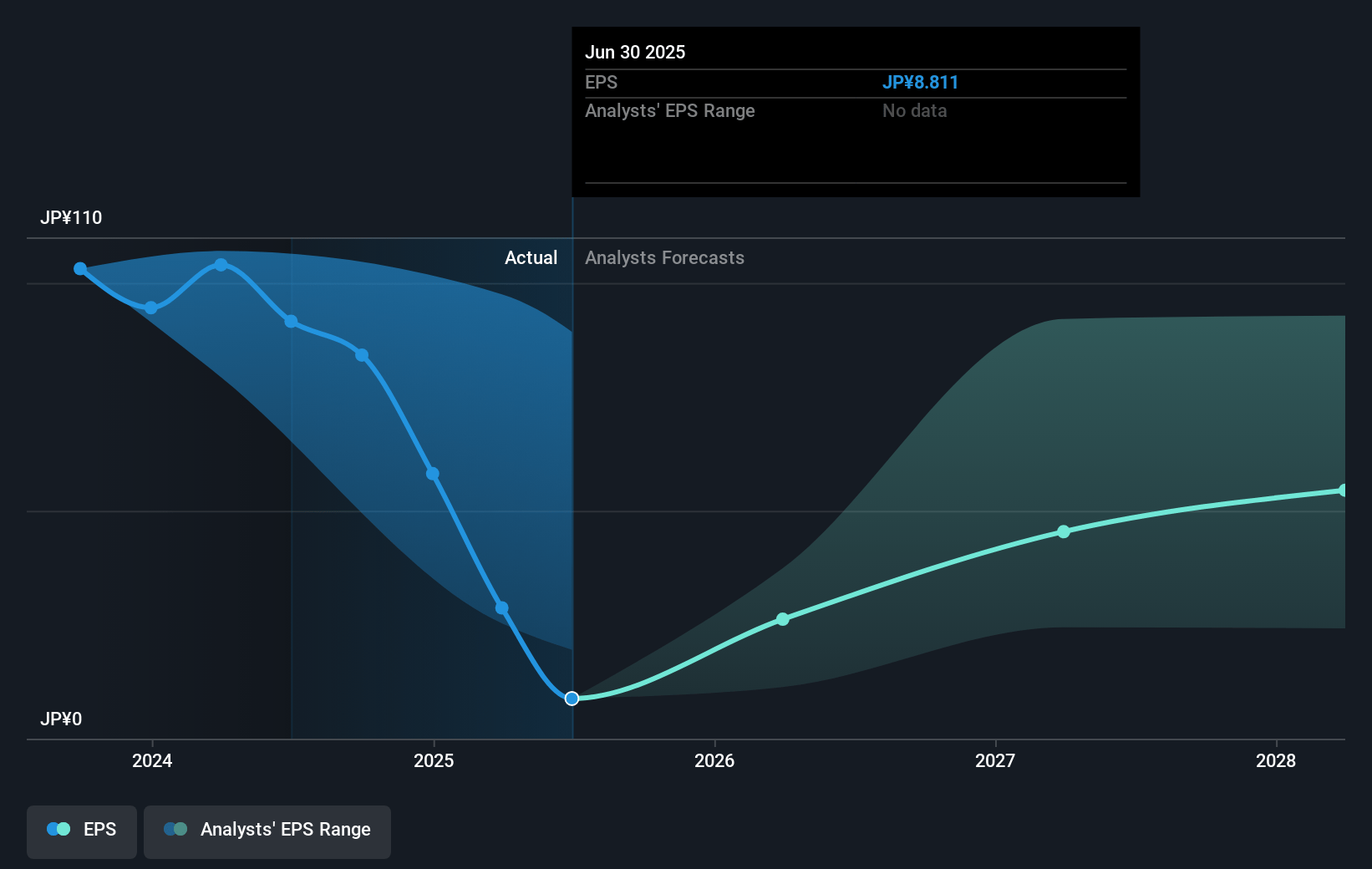

- The bullish analysts expect earnings to reach ¥144.4 billion (and earnings per share of ¥97.37) by about July 2028, up from ¥41.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.0x on those 2028 earnings, down from 15.6x today. This future PE is lower than the current PE for the JP Auto industry at 7.6x.

- Analysts expect the number of shares outstanding to decline by 2.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.99%, as per the Simply Wall St company report.

Mitsubishi Motors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global acceleration toward electric vehicles and tightening emission regulations expose Mitsubishi Motors to strategic risk due to its delayed pivot, limited in-house BEV models, and reliance on OEM partnerships, which threatens its competitiveness and could erode future revenue and market share.

- Persistent underinvestment in research and development for advanced EVs and intelligent vehicle technologies, evidenced by postponed launches and concentration on PHEVs and HEVs, risks leaving Mitsubishi behind industry leaders, jeopardizing long-term revenue growth and profitability as consumer expectations shift.

- Heavy reliance on Southeast Asian markets, combined with the ongoing delayed recovery in key regions like Thailand and Indonesia, increases exposure to regional economic downturns and unstable currency movements, which could destabilize consolidated revenues and net earnings.

- Intensifying competition from new entrants, especially Chinese brands leveraging BEV incentives, has led to oversupply and severe price competition in core Southeast Asian markets, which is already compressing Mitsubishi's margins and weakening its earnings power.

- Growing trade protectionism and geopolitical tensions, particularly new U.S. tariffs, threaten to increase costs, disrupt supply chains, and reduce Mitsubishi's access to major markets such as North America and Latin America, resulting in heightened uncertainty and potential declines in future revenue and operating income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Mitsubishi Motors is ¥543.19, which represents two standard deviations above the consensus price target of ¥415.0. This valuation is based on what can be assumed as the expectations of Mitsubishi Motors's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥550.0, and the most bearish reporting a price target of just ¥330.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ¥3245.7 billion, earnings will come to ¥144.4 billion, and it would be trading on a PE ratio of 7.0x, assuming you use a discount rate of 11.0%.

- Given the current share price of ¥439.9, the bullish analyst price target of ¥543.19 is 19.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.