Key Takeaways

- Infrastructure upgrades, digitalization, and grid modernization are driving efficiency, differentiating ACEA’s offering, and enabling revenue and margin growth in competitive urban markets.

- Expansion in renewables and waste-to-energy, supported by partnerships and supportive policy, is increasing revenue streams and reducing exposure to regulatory and environmental risks.

- Regulatory uncertainty, declining margins, intensifying competition, high capital intensity, and project execution risks threaten ACEA’s profitability, cash flow, and long-term financial stability.

Catalysts

About ACEA- Develops and operate safe and sustainable infrastructure in Italy.

- Ongoing and expected regulatory approval of integrated and updated tariffs in the Water and Electricity segments, combined with sizeable public co-financing for infrastructure upgrades (such as the Peschiera aqueduct), positions ACEA to capitalize on rising urban utility demand—supporting both revenue growth and improved EBITDA margins as investments translate into higher regulated returns.

- Substantial investments in grid modernization, digital technologies, and smart public lighting are improving operational efficiency and network resilience—critical as urbanization increases utility loads—thereby helping to maintain or expand net margins and differentiate ACEA’s service offering in increasingly competitive markets.

- Expansion in renewable generation, particularly in solar and hydro, is set to increase ACEA’s green energy mix; this aligns with supportive government policy on decarbonization and the higher market value of clean energy, creating a forward-looking driver for revenue growth and partially shielding against margin compression from carbon price risk.

- Participation in large-scale waste-to-energy (WTE) projects and leadership in water management, supported by public-private partnerships and EU/infrastructure funding, positions ACEA to benefit from the shift toward circular economy models and resource efficiency, driving recurring revenue streams and boosting long-term EBITDA.

- Potential further consolidation and scale through M&A in electricity or gas grids, as well as possible 20-year concession extensions, could significantly increase ACEA’s regulated asset base and earnings visibility, while allowing efficient financing (such as green or hybrid bonds) to limit upward pressure on net debt/EBITDA and support long-term free cash flow.

ACEA Future Earnings and Revenue Growth

Assumptions

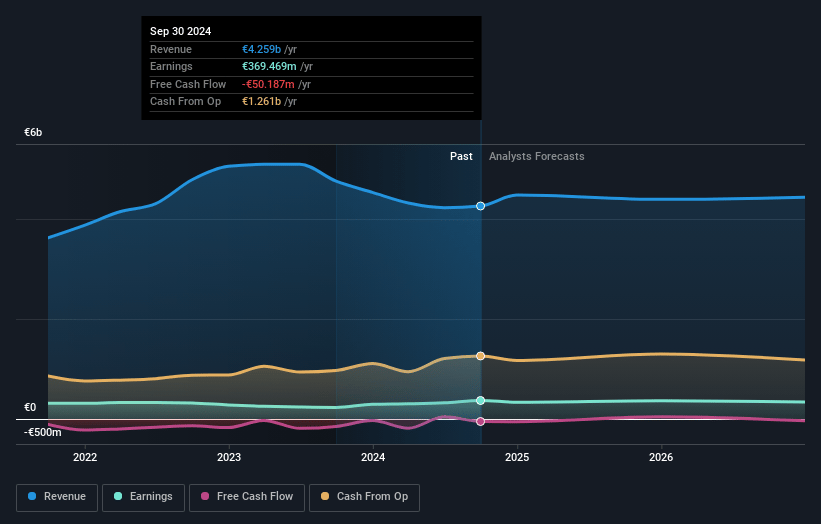

How have these above catalysts been quantified?- Analysts are assuming ACEA's revenue will grow by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.2% today to 8.0% in 3 years time.

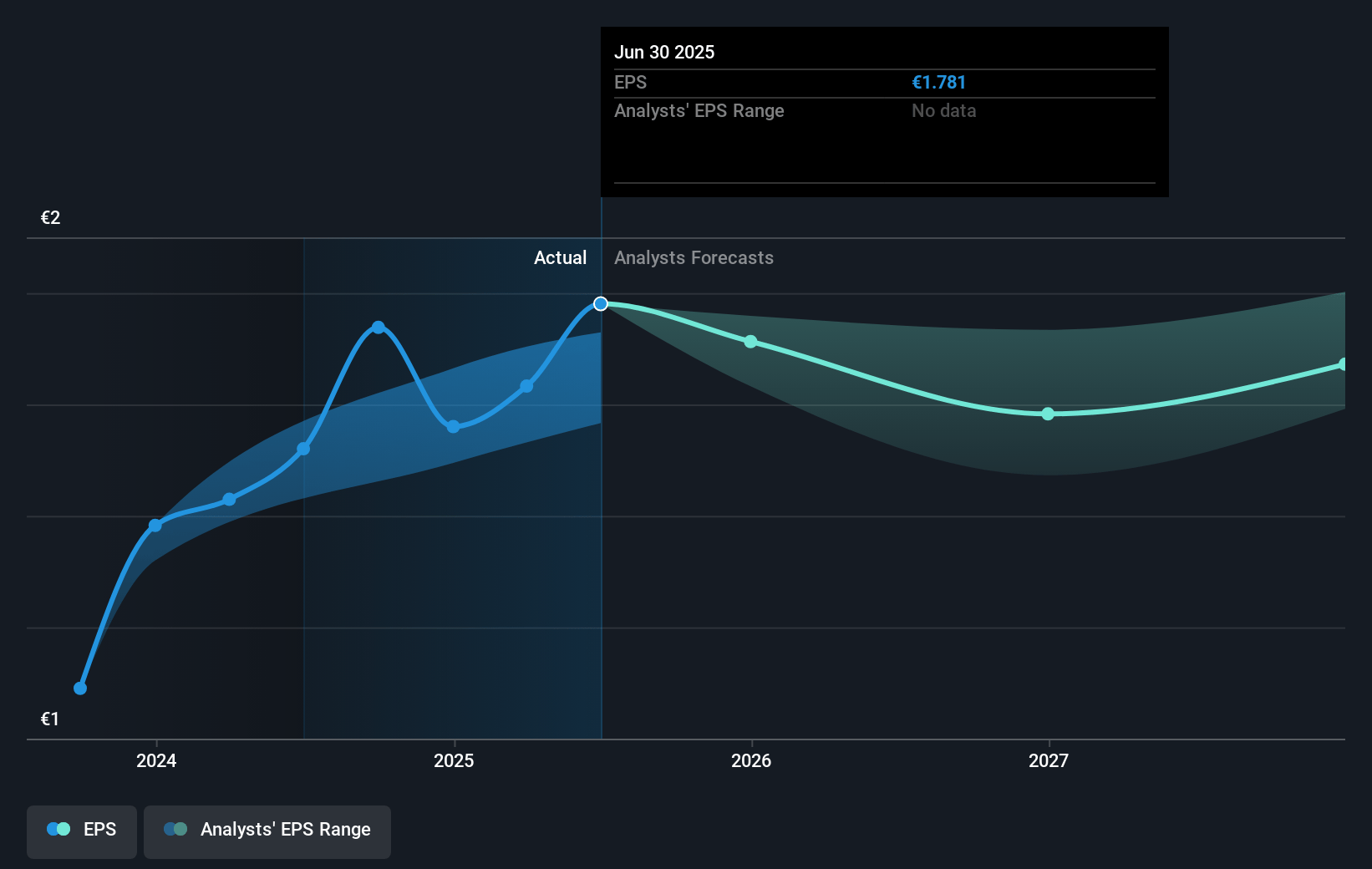

- Analysts expect earnings to reach €372.8 million (and earnings per share of €1.75) by about July 2028, up from €347.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from 11.8x today. This future PE is greater than the current PE for the GB Integrated Utilities industry at 11.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.58%, as per the Simply Wall St company report.

ACEA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The outcome of the electricity distribution concession renewal process in Italy remains highly uncertain, as regulatory authorities and the Antitrust Authority have expressed concerns about automatic renewals; if concessions are not extended or are extended on less favorable terms, this poses a significant risk to ACEA’s long-term regulated revenue streams and asset base.

- An ongoing decline in regulated returns (WACC) for water and electricity grids, along with the potential for further tariff reductions due to regulatory revaluations, could compress ACEA’s margins and recurring earnings, impacting the profitability and predictability of its core regulated businesses.

- Persistent competitive pressure, particularly in the commercial segment (energy and gas retail), is expected to reduce margins as new entrants and digital providers acquire large customer bases; this intensifying competition could erode ACEA’s pricing power and put sustained pressure on net income.

- ACEA’s high capital intensity and growing leverage—driven by heavy investment in infrastructure, grid upgrades, and large projects like the Peschiera Aqueduct and WTE plant—risks further increases in debt and interest expenses; this could restrict future free cash flow, constrain dividend growth, and amplify financial vulnerability if market conditions worsen.

- Delays, cost overruns, or changes in public funding for major infrastructure investments (e.g., Aqueduct Peschiera, grid modernization) or exclusion from project consolidation (as with the WTE not being fully consolidated) may limit the expected EBITDA growth from these projects, increasing uncertainty over future revenue and net margin contribution.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €21.625 for ACEA based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €4.7 billion, earnings will come to €372.8 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of €19.32, the analyst price target of €21.62 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.