Last Update 10 Aug 25

Fair value Increased 7.97%Despite a moderation in revenue growth forecasts, analysts have raised Telecom Italia’s price target as improved net profit margins signal enhanced profitability, lifting fair value from €0.401 to €0.435.

What's in the News

- Poste Italiane acquired an additional 15% stake in Telecom Italia from Vivendi for approximately €680 million, raising its total stake to 24.81% of ordinary shares and 17.81% of total share capital, becoming Telecom Italia's largest shareholder.

- Vivendi retains a minority stake with 2.51% of ordinary shares and 1.80% of share capital.

- Poste Italiane does not plan to exceed the mandatory public tender offer threshold.

- The transaction was financed with available cash and required notification to the Italian Competition Authority.

- The acquisition was completed by Poste Italiane as of May 29, 2025.

Valuation Changes

Summary of Valuation Changes for Telecom Italia

- The Consensus Analyst Price Target has risen from €0.401 to €0.435.

- The Consensus Revenue Growth forecasts for Telecom Italia has significantly fallen from 0.9% per annum to 0.7% per annum.

- The Net Profit Margin for Telecom Italia has significantly risen from 3.38% to 3.79%.

Key Takeaways

- Expansion in digital, cloud, fiber, and 5G services is boosting revenue growth, margins, and strengthens Telecom Italia's strategic position in high-value enterprise and consumer markets.

- Asset sales, rigorous cost controls, and EU-backed industry trends are enhancing financial stability, profitability, and long-term earnings viability.

- Intense competition, high debt, demographic challenges, and disruptive technology trends threaten Telecom Italia's revenue growth, margin expansion, and long-term financial flexibility.

Catalysts

About Telecom Italia- Engages in the fixed and mobile telecommunications services in Italy and internationally.

- The rollout of higher-value digital and cloud services is accelerating, with TIM Enterprise demonstrating strong double-digit growth in cloud (+25%) and continued leadership in secure, sovereign digital services-this positions the company to capture a larger share of high-margin B2B and public sector demand, likely driving revenue growth and margin expansion in the coming years.

- Ongoing asset monetization (notably, the completed NetCo disposal and advanced concession fee payment) materially improves Telecom Italia's balance sheet and financial flexibility, resulting in lower debt and reduced interest costs, which enhances net earnings and supports future shareholder returns.

- The robust adoption of fiber-to-the-home (FTTH) and the expansion of 5G fixed wireless access-with coverage already reaching 70% of the Italian population-enables higher ARPU, reduced churn, and positions the company to benefit from continued growth in data consumption, directly supporting top-line growth and long-term operating income.

- European Union support for 5G and broadband rollout, along with positive signals for market consolidation in Spain and France, are increasingly setting the stage for similar regulatory and M&A opportunities in Italy-this could lead to improved pricing discipline, cost efficiencies, and sustained margin improvement across the industry, benefitting Telecom Italia's earnings potential.

- TIM's disciplined cost transformation program-including OpEx reductions, labor cost savings from renewed agreements, and industrial efficiency gains following network separation-is already driving notable improvements in EBITDA margins, supporting a structural shift towards positive free cash flow and long-term profitability.

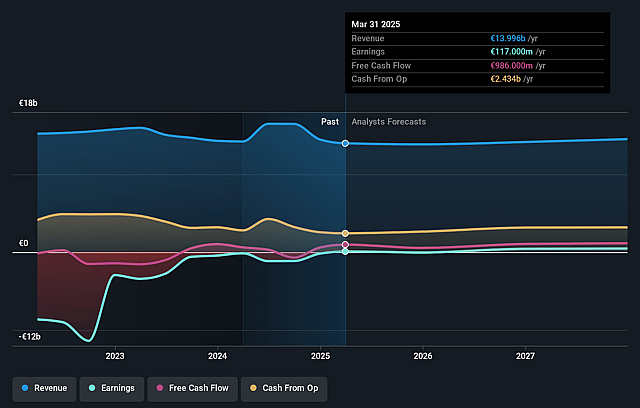

Telecom Italia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Telecom Italia's revenue will decrease by 0.7% annually over the next 3 years.

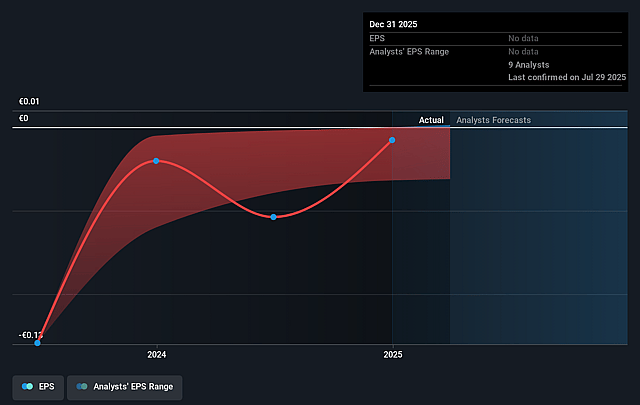

- Analysts assume that profit margins will increase from -1.9% today to 3.8% in 3 years time.

- Analysts expect earnings to reach €563.7 million (and earnings per share of €0.03) by about September 2028, up from €-282.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €863.3 million in earnings, and the most bearish expecting €155 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.6x on those 2028 earnings, up from -31.5x today. This future PE is greater than the current PE for the US Telecom industry at 20.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.67%, as per the Simply Wall St company report.

Telecom Italia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Italian telecom market continues to face intense competition and price sensitivity, which, despite recent price increases, could ultimately trigger renewed price wars or regulatory pushback, risking future revenue growth and net margins.

- The company's ongoing transformation relies heavily on cost-cutting, asset disposals, and efficiencies following the NetCo separation; any setback or inability to sustain these savings-especially if fixed wireless or cloud migration fails to offset legacy declines-could pressure EBITDA expansion and structural earnings improvements.

- Telecom Italia's domestic revenue growth remains modest and subject to headwinds from demographic stagnation in Italy, as aging and shrinking population trends place long-term limitations on potential customer base expansion, negatively impacting long-term revenue prospects.

- High and persistent debt levels (€7.5 billion net debt after lease), while recently stabilized and reduced, continue to limit strategic flexibility and expose the company to risks from rising interest rates or unfavorable refinancing conditions, which could depress net margins and future cash flows.

- The emergence of alternative technology platforms (big tech, OTT players, new cloud competitors) and rapid technological change, including the potential commoditization of traditional connectivity services and need for continual high CapEx for network upgrades, threatens Telecom Italia's ability to grow high-margin revenue streams and maintain competitive operating income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €0.433 for Telecom Italia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €0.52, and the most bearish reporting a price target of just €0.28.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €14.8 billion, earnings will come to €563.7 million, and it would be trading on a PE ratio of 21.6x, assuming you use a discount rate of 9.7%.

- Given the current share price of €0.42, the analyst price target of €0.43 is 3.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.