Key Takeaways

- d'Amico's modern, eco-efficient fleet and prudent capital strategy position it to significantly outperform peers as regulations and fleet shortages drive up rates and asset values.

- Long-term global energy trade shifts and constrained new vessel supply set the stage for sustained high utilization, supporting strong shareholder returns and market revaluation.

- Decarbonization, fleet oversupply, volatile spot exposure, stricter regulations, and geopolitical risks pose significant threats to profitability, revenue stability, and future asset values.

Catalysts

About d'Amico International Shipping- Through its subsidiaries, operates as a marine transportation company worldwide.

- While analyst consensus recognizes d'Amico's young, eco-efficient fleet as a competitive advantage under tighter regulations, in reality, their unusually large lead in compliant tonnage may allow them to disproportionately capture market share and command a long-term earnings premium as regulatory enforcement accelerates and sanctions push even more older vessels out, driving both revenue and net margin above peer projections.

- Analyst consensus expects constrained global fleet growth to tighten the freight market, but current orderbook trends, demographic bulges in tanker age, and a likely acceleration in demolitions could mean a severe contraction in the supply of quality tonnage as early as 2027–2029, leading to a potential structural increase in utilization and charter rates, materially boosting d'Amico's top-line and asset values beyond current market assumptions.

- Global energy demand from emerging regions and ongoing refinery shifts-despite near-term demand downgrades for OECD countries-are compounding the rise in long-haul trade flows, embedding a multi-year uplift in ton-mile demand for versatile operators like d'Amico, which should translate into sustained high fleet utilization and above-cycle average revenues.

- New regulations and U.S. port fee uncertainties are sharply discouraging newbuild orders at Chinese shipyards (which comprise over seventy percent of new tanker capacity), risking a multi-year new shipbuilding gap that could drive secondhand values and replacement cost higher, causing NAV per share and book value discounts to close rapidly once shipping rates stabilize.

- d'Amico's disciplined capital allocation-securing long-term charter coverage at attractive rates while maintaining ultra-low leverage and opportunistically acquiring vessels at cycle lows-positions the company for outsized dividend capacity and potential share buybacks, offering material upside to shareholder returns and supporting a re-rating of both earnings and book multiples.

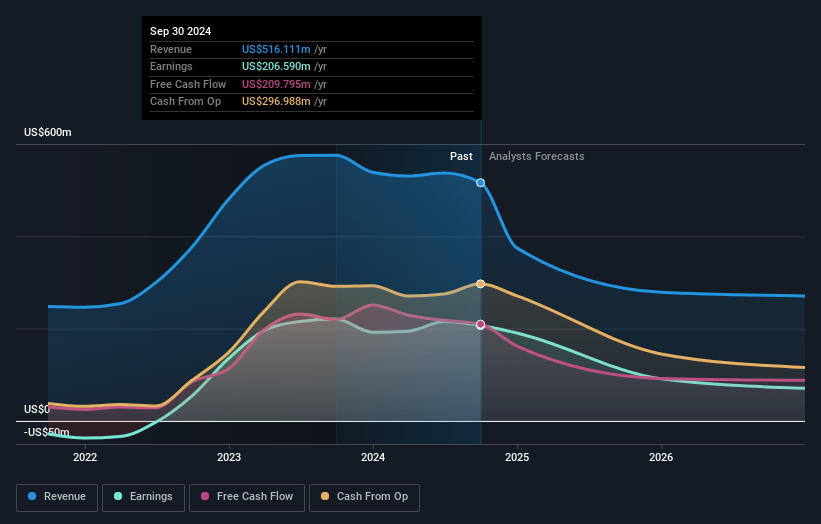

d'Amico International Shipping Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on d'Amico International Shipping compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming d'Amico International Shipping's revenue will decrease by 12.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 34.0% today to 12.8% in 3 years time.

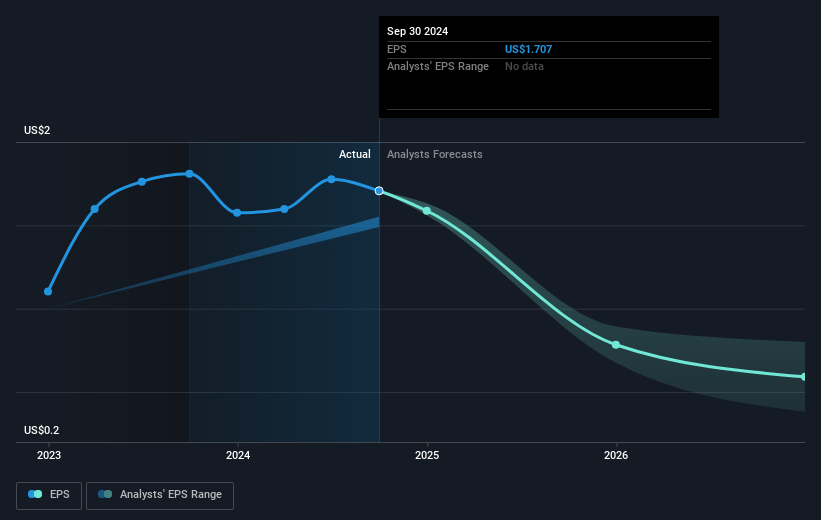

- The bullish analysts expect earnings to reach $38.4 million (and earnings per share of $0.34) by about July 2028, down from $151.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.3x on those 2028 earnings, up from 3.1x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 17.2x.

- Analysts expect the number of shares outstanding to decline by 1.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.94%, as per the Simply Wall St company report.

d'Amico International Shipping Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The long-term global transition towards decarbonization and declining oil demand, as highlighted by the International Energy Agency's downgrades and reduced OECD refined throughput, presents a structural headwind for product tanker utilization rates, potentially leading to lower revenues and EBITDA in the coming years.

- Fleet growth-including anticipated accelerations in MR and LR1 newbuilding deliveries through at least 2027-and persistent sector overcapacity could keep charter rates under pressure, eroding profitability and potentially compressing operating margins and future earnings.

- The company's reliance on spot market exposure for a sizeable portion of vessel days results in significant revenue and earnings volatility during market downturns, as evidenced by the sharp drop in average spot rates compared to the prior year, which threatens bottom-line stability and investor confidence.

- Escalating environmental regulations and stakeholder expectations on emissions and fuel types are increasing the operational and capital cost burden for d'Amico International Shipping, especially as they prepare to renew or upgrade their fleet, which could negatively affect net margins and require substantial capex outlays.

- Ongoing geopolitical risks and regulatory uncertainties-including shifting trade routes, sanctions, and proposed tariffs-create unpredictability in shipping demand and market fundamentals, which could adversely impact future revenues and asset values, particularly in regions or routes on which the company is highly dependent.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for d'Amico International Shipping is €5.78, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of d'Amico International Shipping's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €5.78, and the most bearish reporting a price target of just €3.89.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $300.0 million, earnings will come to $38.4 million, and it would be trading on a PE ratio of 23.3x, assuming you use a discount rate of 6.9%.

- Given the current share price of €3.52, the bullish analyst price target of €5.78 is 39.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.